August 14, 2011; Source: New York Times | In an op-ed that appeared in the Monday New York Times, Warren Buffett, the second-richest man in the U.S., said that he and his colleagues have long been coddled by a “billionaire-friendly Congress” to the detriment of the nation’s overall fiscal health. Buffett says this has resulted in an economy where the super-rich are not paying their fair share in taxes. He knocks down the oft-repeated warning that a higher tax rate for the very rich would dissuade investment and smother job creation. He also writes:

Since 1992, the I.R.S. has compiled data from the returns of the 400 Americans reporting the largest income. In 1992, the top 400 had aggregate taxable income of $16.9 billion and paid federal taxes of 29.2 percent on that sum. In 2008, the aggregate income of the highest 400 had soared to $90.9 billion—a staggering $227.4 million on average—but the rate paid had fallen to 21.5 percent.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

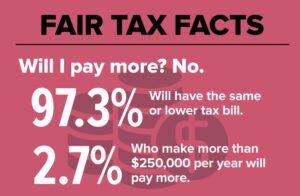

Buffett also addresses the 12 members of the congressional “super committee” who will soon meet to try to reach agreement on $1.5 trillion in deficit reduction over 10 years. He suggests to them that tax rates be raised for any household making more than $1 million per year (there were 236,883 such households in 2009) including on dividends and capital gains. And he suggests an additional rate increase for the 8,274 households with incomes of more than $10 million. NPQ has long promoted the need for nonprofits to get behind a push for fair tax policies. Now seems the right time to make some loud concerted noise in support of Buffett and our communities.—Ruth McCambridge