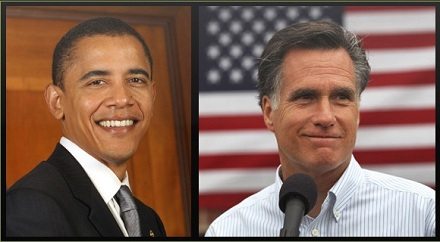

September 26, 2012; Source: Politico

We’re only one day away from the first of three presidential debates between President Barack Obama and former Massachusetts Gov. Mitt Romney. Both have been practicing with their opposing candidate stand-ins. Politico’s James Hohmann suggests a few good questions that moderator Jim Lehrer might ask the two candidates.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Hohmann suggests that Obama explain why he didn’t push for a bigger stimulus package in 2009, as many liberal economists recommended at the time, whether he overestimated his ability to bridge partisan divides in Washington, why he has done so little to help families facing mortgage foreclosure, whether he is talking out of both sides of his mouth when he talks about no changes to entitlements as he puts changes in Social Security on the table for negotiations, and why he hasn’t shown any leadership on gun control even after the Rep. Gabby Giffords and Aurora, Colo. shootings.

For Mitt Romney, Hohmann wants him to name at least one specific tax loophole he would eliminate to help balance the budget, how he would figure out how to keep and pay for the popular but expensive parts of health care reform (such as no preexisting conditions) while getting rid of other pieces of the law, why he made Paul Ryan give him more years of tax returns than he is willing to disclose to voters, how he justifies paying a lower tax rate than most of middle income American taxpayers, and what three things he disagrees with in Ryan’s budget.

All good questions, but what questions would nonprofits stick onto the debate docket? We have several questions we would ask the candidates:

- The Tax Exempt/Government Entities (TEGE) division of the IRS has historically been underfunded and unable to do the kind of monitoring and oversight needed to enforce nonprofit laws and regs. What would you do to ensure that the TEGE division is funded to do the job it is supposed to do?

- Foundations often spend the minimum proportion of their tax-exempt assets required by law and a proportion of that goes for foundation administrative costs. What would you do to get more foundation money into the hands of charities?

- A third or more of nonprofit revenues come from government sources, but government funding for nonprofit service providers is threatened by the across-the-board formula cuts of sequestration. How would you protect nonprofit service providers from the impact of devastating cuts to federal funds and to federal pass-through funds administered by state and local government agencies?

- How do you propose to bolster local community governance and control of nonprofits as they respond to pressures and incentives to “scale up?”

- Moneyed interests armed with the Supreme Court’s Citizens United decision have been using 501(c)(4) social welfare organizations as avenues for secretly funding partisan political campaign activities. Would you—and if so, how would you—compel donor disclosure in 501(c)(4) organizations?

- Even when the Affordable Care Act (ACA) is fully implemented, there will be tens of millions of people in this country without health insurance coverage. What would you do to provide for health care coverage for people who would not be covered by the ACA, those who typically end up being served by nonprofit clinics and other nonprofit health providers?

Through a nonprofit lens, what would you ask of the two presidential debaters if you were in Jim Lehrer’s seat on Wednesday night?—Rick Cohen