March 13, 2015; Time

A recent report from the Federal Reserve finds that the current net worth of American households is up to $83 trillion—a record high. But before you get too excited, it’s likely that your community has not seen any of that post-recession gain.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

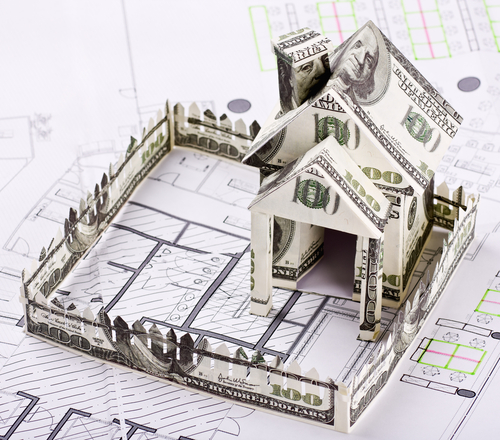

Much of the gain in 2014 was driven by stocks and real estate. In fact, researchers at the University of Michigan found last year that the median wealth of a U.S. household, in inflation-adjusted dollars, dropped 36 percent from 2003 to 2013. In that same period, the richest five percent of households saw their median net worth increase by 12 percent. Where in 2003, the wealthiest five percent of Americans had a net worth 13 times that of the median household, by 2013, those richest five percent of households held 24 times the median.

This article explains, “Not only do the rich have more assets, but they have more of the assets that have performed better. More than half of a typical household’s wealth is in real estate. But a median household in the top 5% keeps only 16% of wealth in home equity. More of their assets are in businesses (49%) and financial investments like stocks and bonds (25%). So these households have gained far more from the recent equity bull market.”

How can our democracy sustain in such an environment? Who in philanthropy is committed to reversing this trend? What have you done today to address asset inequality at its roots? —Ruth McCambridge