April 14, 2016; Center for American Progress

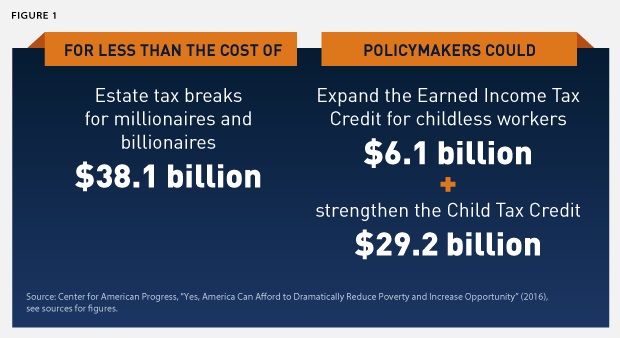

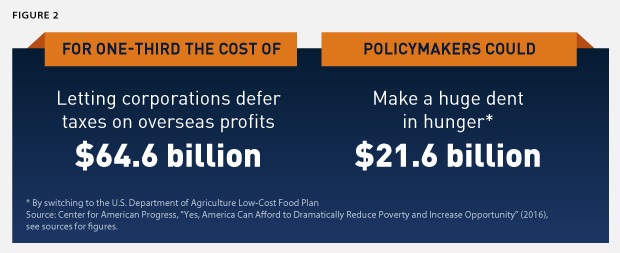

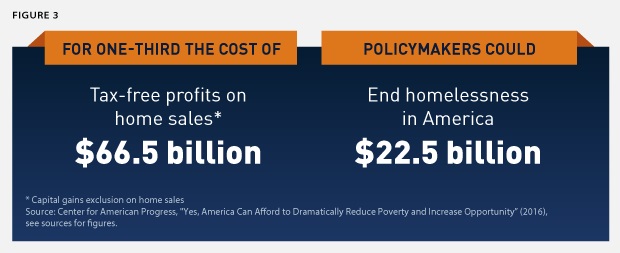

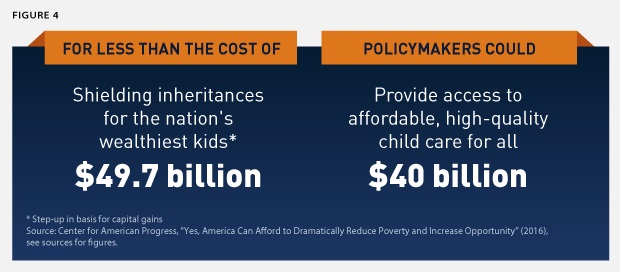

On Tax Day, a report released yesterday from the Center for American Progress may help you consider why tax activism is so important to the work of your nonprofit. The following graphics and notes come directly from the content of that piece.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

You should look back to the report itself for the details of the proposals referred to here, but please remember: Taxes are levied in your name. The design of these is a reflection of your values. Did you mean to support your local billionaire? Will you do so without a peep of protest next year?—Ruth McCambridge