Last month, we at NPQ published an issue of the Nonprofit Quarterly on the shifting landscape of regulatory activity. In it, we spoke with a variety of experts about the changing balance of efforts between the IRS and state offices overseeing charities. In short, the experts we talked to suggested that the IRS would likely be depending more on technology to surface malfeasance, and that the states would potentially be increasing their activities likewise, looking to data to better coordinate interstate regulatory action to stop bad nonprofit behavior.

Now, the Urban Institute has published a new study called State Regulation and Enforcement in the Charitable Sector. This primer looks at the size, shape, and activities of individual states’ charity regulation efforts.

Cindy Lott—now the Program Director of Nonprofit Management Programs at Columbia University, and Senior Fellow at the Urban Institute’s Center in Nonprofits and Philanthropy—observed when we interviewed her that the charity offices differ greatly in resources, dedicated staffing, and cohesiveness. Now, the Urban Institute (along with Lott) has produced a unique publication that studies the structures, activities, and emphases of those state-based offices. We strongly recommend this free, downloadable report to all our readers and their boards, as it contains critical information on your nonprofit’s operating environment.

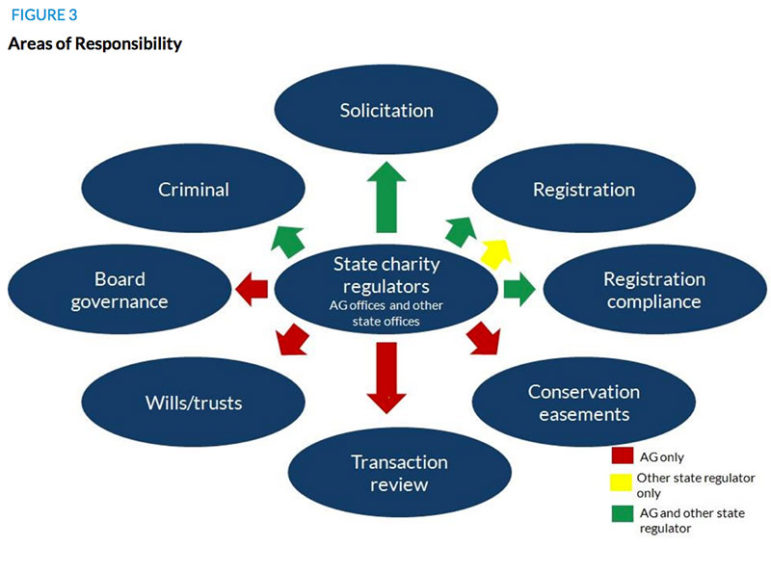

This report reiterates that the organization and staffing of state charity offices varies significantly from one state to another. In 41 percent of states, one office has primary responsibility for monitoring charity, but in the remaining 59 percent responsibility is shared across agencies or offices. The largest proportion of charity offices has dedicated staff comprising between one and 9.9 full-time employees, but 31 percent have fewer than one and 19 percent have ten or more.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Most of the regulatory requirements enforced by the states are a mix of laws particular to each state, with the few exceptions coming in the form of uniform laws and model acts, like the Uniform Prudent Management of Institutional Funds Act, which has been adopted in 49 states, the District of Columbia, and the U.S. Virgin Islands. Fundraising leads the list of enforcement issues taken up by state charity offices, with trust enforcement and governance problems tying for a more distant second place. Nearly all of the offices engage in joint investigations and prosecutions with other agencies at the state and federal level.

As we mentioned, much of the rest of the state-based regulatory activities vary, including the requirements for registration, approval of mergers, dissolutions, and other pivotal moments in the life of a nonprofit.

This systemic review—long needed, well done, and first of its kind—will help your organization figure out the current state of your state’s nonprofit regulation environment, but don’t expect it to stay as it is. As we have mentioned, the landscape is in flux.

For more reading on this topic, including the plans afoot at the IRS, articles from NPQ’s regulatory issue can be accessed here.