May 6, 2019; Deutsche Welle

“Should mainstream American philanthropists fund organizations that promote fear, hate, and conspiracy theories about Muslims and Islam?”

Based on the findings of a newly published report sponsored by the Council on American-Islamic Relations (CAIR), this question is as pertinent as questions about the limits of free speech for Facebook, Twitter, and other social media platforms.

According to Deutsche Welle (DW), Germany’s national public broadcaster, the report, Hijacked by Hate: American Philanthropy and the Islamophobia Network, found that “American philanthropic organizations, including mainstream foundations, have funneled tens of millions of tax-free dollars to anti-Muslim groups influencing public opinion and government policy all the way up to the White House.”

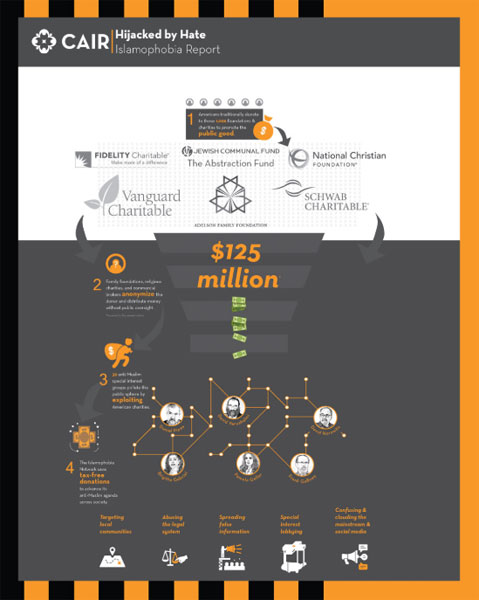

Using publicly available tax data for 2014 through 2016, CAIR’s researchers found that “1,006 charitable foundations provided nearly $125 million…to 39 anti-Muslim groups.” With resources of $1.5 billion, these 39 groups make up what CAIR calls the “Islamophobia Network…organizations and individuals that share an ideology of extreme anti-Muslim animus, and work with one another.”

Among the more than 1,000 tax-exempt organizations that were found to have directed funding to the network of organizations that CAIR characterized as Islamophobic, it is not surprising to find foundations whose founders’ political agendas align with the work of the targeted 39 groups. For example, “Sears Roebuck heiress Nina Rosenwald…has used her tax-exempt Abstraction Fund to funnel $3.2 million to anti-Muslim groups, including nearly $1.9 million to the conspiracy theory-peddling Gatestone Institute, which she founded and for which she serves as president.”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Of greater concern is the finding that “mainstream American philanthropic institutions—ones that typically support organizations such as the Boy Scouts, Salvation Army and Doctors Without Borders—are also financing anti-Muslim groups often unbeknownst to donors, civil society organizations, and the general public [which] are more than likely being exploited or used by donors who seek to anonymize their contributions to anti-Muslim special interest groups.”

Of specific concern is the use of donor-advised funds, a practice NPQ has been following, to provide tax deductibility and anonymity. “Fidelity Charitable and Schwab Charitable have funneled $8.7 million and $5.7 million, respectively, to anti-Muslim groups, while mainstream faith-based DAFs, like the National Christian Foundation and Jewish Communal Funds, have donated $15.7 million and $3.2 million, respectively.”

Each of the 39 organizations characterized as supporters of Islamophobia by CAIR was found to actively “support anti-Muslim legislation and policies, conduct anti-Muslim lobbying, distribute false and defamatory information to mainstream media and on social media, and run public campaigns promoting conspiracy theories.” Many are also characterized as hate groups by the Southern Poverty Law Center. Yet each of these organizations is also deemed to be operating in the public interest and granted tax-exempt status by the federal government.

The report sees knowledge and information as the path to solutions. Educating the philanthropic community so it understands what bigotry looks like and where it is coming from will spur decision-makers to end their support of Islamophobia and other types of bigotry and hatred. Specific recommendations include:

- “Familiarizing staff and stakeholders with major actors and influencers in the Islamophobia Network and the major philanthropic organizations responsible for supporting it.”

- “Conducting audit of funding sources, institutional partners, and programming relationships.”

- “Reviewing funding sources to determine whether those funding organizations and institutions are also supporting the Islamophobia Network.”

- “Implementing policies and procedures to ensure that funds are not diverted to hate groups.”

- “Implementing policies and procedures to ensure that the programs and activities of grantees align with donor interests, stakeholder values, and the public good.”

These are good steps for broad-based organizations that are DAF sponsors. They will help them avoid becoming engaged unwittingly in activities they never wittingly chose to support and keep them better aligned with their communities. But will that be enough?

The harder questions come next. Is continuing the tax-exempt status of groups that practice anti-Muslim—or any other bigotry—a given? Should we be debating, as social media organizations have been asked to debate the limits of free speech, the limits of charitable freedom? Can an organization have a right to advocate for a position but not have the right to tax-exempt status? Unsettling questions like these are easy to consider when asked about positions you disagree with, but harder when you agree with an organization being challenged. The growth of hate speech and action, and the growth of a philanthropic network of organizations tied to it, means we cannot avoid the uncomfortable debate.—Martin Levine