Editors’ note: The data used in this article were taken from over 1,500 claims against nonprofit directors and officers (D&O) insurance policies issued by the Nonprofits Insurance Alliance Group—based in Santa Cruz, California, but serving more than 14,500 nonprofits in 32 states and Washington, D.C.1 The Nonprofits Insurance Alliance Group serves small to midsize nonprofits, and experiences may well differ for very large organizations with complex business relationships: references to employment practices liability (EPL) claims being both the most expensive and most frequent of nonprofit D&O insurance claims must be understood in light of this fact. There are data suggesting that this may be a different case with other insurance carriers, whose insureds include very large nonprofits, such as the Mayo Clinic and Johns Hopkins University, rather than our community-based charitable nonprofits with budgets typically under $10 million—in which case non-EPL D&O claims are showing as less frequent but generally more costly.

Insurance carriers tend to withhold information as a business practice, so the information in this article is something of “breaking news”—offering, as it does, new and more detailed information on nonprofit D&O insurance than is generally known. Our hope is that this article is just the beginning of the Nonprofit Quarterly’s ability to present increasingly open information about how nonprofit insurance actually works.

This article is from NPQ’s summer 2015 edition, “Nimble Nonprofits: The Land of the Frugal Visionary.”

Does a nonprofit organization really need to purchase directors and officers (D&O) liability insurance? The short answer is “yes.” What follows is the longer answer.

D&O insurance covers the organization and its directors, officers, and trustees against actual or alleged wrongful acts in three major areas:

- Governance liability: claims resulting from general governance decisions;

- Fiduciary liability: claims resulting from alleged fraud and improper financial oversight, including oversight of employee benefit plans (Employment Retirement Income Security Act [ERISA]) and use of grant funds and donor contributions; and

- Employment practices liability: claims resulting from employment-related activities.

Of these types of claims, employment practices liability claims are by far the most frequent and, generally, the most costly. Employment-related claims spiked during the recession of 2009, and those of us handling these claims expected them to continue for a few years—when nonprofits were cutting back on their workforces because of dips in funding—and then return to a more normal level once funding improved. However, that appears not to be the case. Employees and their attorneys seem more willing than ever to sue nonprofits (unlike ten years ago, the focus of such lawsuits is no longer on for-profit companies); furthermore, employment law has become more complex, and it is much easier for all employers, including nonprofits, to fail to follow both the spirit and the letter of the law.

The other two areas of coverage relate to governance and fiduciary liability alleging improper governance decisions, or alleged fraud and improper financial oversight or improper use of funds. While these claims may also be large, they are far less frequent than employment-related claims.

D&O and Nonprofits

While the risk of sizable employment claims is present in every state, California seems to produce the most expensive ones—both in cost of defense and in indemnity payments. The average employment practices claim against a nonprofit in California is about 45 percent more expensive than claims against nonprofits in the rest of the United States. This is likely because California has more complex and stringent employment laws that are more protective of employees, and also because in California compensation and cost of living are relatively higher than in many other states, and so the attorney fees tend to be proportionately higher.

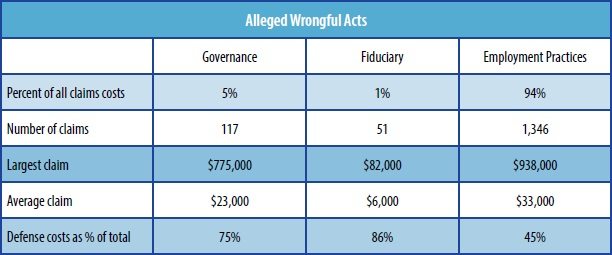

The chart below illustrates the relative risk and cost of these various types of claims gathered over a ten-year period by Nonprofits Insurance Alliance Group. The chart indicates averages for all claims; however, nearly 65 percent of employment practices claims close with only expense payments—and no indemnity payment at all. These are typically claims that do not go any further than a complaint to the U.S. Equal Employment Opportunity Commission or a state-based organization such as California’s Department of Fair Employment and Housing. If these claims, whose average expense to handle is $6,500, are removed from the data, an average employment practices claim that actually has merit will typically cost between $150,000 and $200,000 to ultimately resolve—whether by way of settlement or trial. Unless a nonprofit has these types of discretionary funds available to undertake defending and settling such claims, it behooves every nonprofit to provide D&O insurance protection for their organization and their board of directors.

The Three Major Areas of D&O Insurance Coverage for Nonprofits

Employment Practices Liability

With 94 percent of the claims dollars under a D&O policy emanating from employment practices allegations, that is the area that demands attention. This is also an area where targeted risk management can have the most immediate impact. Specifically, it is critical for organizations to have clear and up-to-date employment handbooks with policies that are strictly followed in both letter and spirit. The most common types of employment practices claims are the following:

- Sexual harassment;

- Racial and gender discrimination;

- Retaliation, including against whistleblowers;

- Defamation;

- Failure to accommodate (as per Americans with Disabilities Act [ADA]); and

- Improper employee classification (exempt/nonexempt and independent contractor/employee).

One of the most frequent claims, particularly over the past several years, has been improper classification of employees. Some D&O insurance policies offer defense of these actions, but none of these policies are going to cover back wages and penalties owed to the employee. Those are the full responsibility of the nonprofit, and they can be substantial. Many nonprofits believe they can be thrifty by classifying employees as exempt so that they don’t have to pay overtime, or by hiring people as contractors or consultants so that they don’t have to pay benefits. There are extensive rules about such distinctions, and if they are not followed carefully, these claims can create serious problems for the nonprofit and its board if an employee or group of employees files a lawsuit. Employees cannot give “permission” to be misclassified; the responsibility for getting this right rests squarely on the shoulders of the management of the nonprofit.

Termination of employment is the action that triggers the majority of employment-related claims against nonprofits. In fact, 80 percent of the total dollars spent on claims in the employment practices area involve either involuntary termination or constructive discharge claims. And most claims have multiple allegations attached to them, such as failure to accommodate, defamation, and retaliation, as well as wrongful termination.

In addition to being expensive in terms of legal costs and indemnity payments, the litigation of employment practices claims can take a significant toll on an organization, even with the very best in legal representation. There are typically voluminous documents that need to be collected and time spent by the human resources department (if the nonprofit is even large enough to have such a department) and other executives preparing for and undergoing depositions. These are time-consuming distractions from the mission of the nonprofit. In most of these cases, plaintiff attorneys have no incentive to encourage plaintiffs to participate in early mediation, because plaintiff attorneys can often recover the majority of their fees as part of the settlement of the claim. At first, nonprofits that believe they have done nothing—or very little—wrong want no part in a negotiated settlement; often, they want their day in court to prove their innocence. However, once nonprofits see how prolonged and difficult these claims can get, most are more than ready to have the insurance company find a way to resolve the claim at the earliest possible opportunity. Fully 31 percent of employment practices claims take more than one year to be resolved, and 7 percent take more than two years.

Governance Liability and Fiduciary Liability

Although governance and fiduciary claims are less frequent, it is worth noting the types of allegations made against nonprofits for which a D&O policy may or may not afford important coverage. Governance claims include the following:

- Breach of contract (those unrelated to employment, such as leases);

- Discrimination in housing access; and

- Improper board elections.

- Fiduciary claims include the following:

- Attorney general investigations;

- Improper fundraising allegations;

- Improper reporting of revenue;

- Mishandling of donations;

- Failure to report payroll taxes; and

- Mismanagement of employee benefit plans.

The Importance of a Good Broker

With any financial service—including insurance—it is critically important to have expert advice. Your insurance agent or broker should be familiar with the various D&O policies that are on the market and be able to help you to understand the coverage details of each policy form. All D&O policies are worded slightly differently and offer different amounts of coverage for various types of allegations. For example, some D&O policies will offer defense for breach of contract and allegations of misclassifying employees, but no D&O policy will actually pay damages related to a non-employment-related breach of contract, or misclassification of employees, or failure to pay payroll taxes. Most D&O policies do not offer coverage for these actions at all. These are nuances that a good broker will be able to explain to a nonprofit client.

Also, just because there is a list of coverages summarized on the declarations page of an insurance policy does not mean one should assume that all of these coverages are included in the D&O policy that is attached. It is not uncommon for insurance companies to list many types of coverage on the front page of the policy but actually only provide the coverage if a specific box is checked and the premium has been paid. An insurance broker or agent with experience can help you to avoid these pitfalls. And, coverages offered in the policy are one thing, but it is also valuable to ask your insurance broker or agent about the insurer’s reputation for defending and appropriately handling these sorts of claims. Are they known for interpreting the coverage on behalf of the insured organization, or do they try to find ways to avoid covering the claim? Are they good communicators? Do they keep you informed on how the claim is going and what their strategy is to get the best result? What is the quality of the defense counsel the insurer will be assigning if you have a claim?

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Insurance brokers are typically compensated by commission from the insurance company. A typical commission rate is 15 percent of the premium, although some brokers get additional, or contingent, commission from insurance companies at the end of the year as a reward for placing a certain amount of business with that carrier. It is important to ask an insurance broker how he or she is compensated and what the commission is on each quote given to you for consideration. Very large nonprofits may choose to work with a broker on a fee-for-service basis, but this practice is fairly uncommon.

When a Case Goes to Trial

Sometimes the contract language in the D&O policy gives the insurance company both the right and the obligation to select the defense attorney and make the final determination about when or even whether to settle a claim. While this may at first be off-putting to a nonprofit executive or to board members who may think they will get a better result if they have more control of the handling of the claim, our experience tells us that this is unlikely. Many policies that allow nonprofits more control also require that the nonprofit fund the cost of the claim up to a prescribed self-insured retention. We find that the best results come when experienced attorneys who specialize in labor law handle the cases impartially. An attorney who has been working with the nonprofit providing advice on a difficult situation and who is then hired to defend that claim can end up in the position of defending his or her own advice. Our experience has shown us that an attorney who was not involved in the advising process is in a better position to objectively handle the defense of the claim.

Risk management for employment practices claims is equivalent to overall good organizational leadership. Many claims result from leadership either not knowing about the law or not caring about following it in a manner that results in an outcome that is respectful to both the employee and the organization. In most cases, the situation causing the claim is not clear-cut. Usually, neither the situation alleged by the employee is as egregious as described nor are the steps taken by the nonprofit as impartial or thoughtful as they might have been. Often, by the time a situation has escalated to termination, emotions are high on both sides and judgment can be clouded. And even when the nonprofit has taken all of the proper steps and is in complete compliance with the law, the outcome at a jury trial is far from certain. A “jury of our peers” typically means a jury comprised of employees, and just about every juror has felt frustrated or wronged at some point by a supervisor. It is far easier for most jurors to sympathize with the employee than to side with the organization. Depending on the judge, the defense may even be prohibited from telling the jury that the defendant organization is a nonprofit one.

While some jurors may be slightly more inclined not to see their local nonprofit as a rapacious corporation and go easier on them in the courtroom, the notion that the law offers protections to nonprofits that it does not offer for-profit corporations is an oft-cited myth. Many states have “volunteer protection” statutes on the books, but these simply do not extend protections to the organization itself. In fact, many of these state statutes try to deflect some of the individual volunteer liability by placing it strictly on the nonprofit itself. And, even if the volunteer seems to have protection under these statutes, no state statute can override federal discrimination or harassment laws. Nonprofits are subject to the exact same employment laws and requirements as for-profit employers. Innocent or not, if a nonprofit or volunteer is sued, there is no alternative but to answer the lawsuit and successfully defend or settle the case. Either path can be quite expensive and time-consuming. As indicated on the earlier “Alleged Wrongful Acts” chart, between 45 percent and 86 percent of any D&O claim is the cost to pay a defense attorney. And even when the nonprofit is found through trial to have done nothing wrong, the financial costs and disruption to the organization often render it a hollow victory.

If You Do Not Do Anything Else, Do This

We insure nearly 15,000 nonprofits, and we know from twenty-six years of experience that nonprofits do great work, but most are stretched thin. The demands on nonprofits seem to grow no matter how hard or long they work. But there are a couple of things that we believe are essential on the governance side that will more than repay the time, energy, and money expended. These are: (1) get good professional advice before taking a significant employment action; and (2) remember that a 501(c)(3) nonprofit is held in trust for the public, and management is accountable to them.

We feel so strongly about the first piece of advice that we have three employed attorneys providing unlimited, free employment risk management advice to our member insureds who have D&O insurance with us. Yes, it is a significant expense, but we know that in the long term it is going to save all of us time and money, and will cut frustration. It is our number one risk-management tool, and we think that every nonprofit ought not to have to think twice about picking up the phone or sending an e-mail and getting free expert advice to avoid the many employment practices pitfalls.

Finally, some of the most expensive and contentious governance and employment claims we see arise from nonprofits who either do not have or do not follow prudent nepotism policies, or seem not to understand that nonprofits are public organizations and, simply, are entrusted to their care. Those in management who treat a nonprofit like a small, personally owned business and hire many relatives as staff and board members usually lack the external controls that result in the best risk management. It is absolutely imperative that we, as nonprofits, operate transparently and always in the best interests of the public we serve.

We cannot promise that you will never be subjected to a lawsuit even if you do practice good risk management; nor can we promise that the time period for the lawsuit will be short, or that the cost to defend and/or indemnify will be small. However, if you have complied with the law and acted with integrity and transparency, your chances before a judge or jury just got a whole lot better.

NOTE:

- All data used in this article are from over 1,500 claims against D&O policies from 2005 through 2014, issued by Nonprofits Insurance Alliance Group. All claims were against 501(c)(3) nonprofits. Insurers in the Nonprofits Insurance Alliance Group are Alliance of Nonprofits for Insurance, Risk Retention Group (ANI), and Nonprofits Insurance Alliance of California (NIAC). Both ANI and NIAC are 501(c)(3) nonprofits themselves, and together they insure 14,500 nonprofits for all types of liability insurance. These data are for only one line of coverage offered by the Nonprofits Insurance Alliance Group: D&O insurance.

Pamela E. Davis is president and CEO of the Nonprofits Insurance Alliance Group.

ADDITIONAL INSURANCE AND RISK MANAGEMENT RESOURCESThe following links to additional resources for nonprofits wanting to know more about insurance were provided by the Nonprofit Risk Management Center, a national nonprofit resource organization that provides risk advice, tools, and consulting help to nonprofits who do not want to leave their missions to chance. The Center’s resources include their weekly RISKeNews, a periodic newsletter (Risk Management Essentials), informative books, and innovative cloud applications. Affiliate members of the center enjoy free risk help and access to a large “vault” of practical webinars. The center’s website includes hundreds of articles on risk and insurance topics, and the forthcoming issue of the center’s newsletter will focus on insurance. In addition, a new book on insurance will be published in fall 2015. To learn more about these resources, visit www.nonprofitrisk.org or call 703-777-3504. Chartered Property Casualty Underwriters (CPCU) Society Insurance Services Office, Inc. (ISO) International Risk Management Institute, Inc. (IRMI) National Association of Insurance Commissioners (NAIC) Public Risk Management Association (PRIMA) Risk and Insurance Management Society (RIMS) Society of Insurance Research (SIR) University Risk Management and Insurance Association (URMIA) |