June 21, 2016; Pittsburgh Post-Gazette and Los Angeles Business Journal

In Pittsburgh and Los Angeles, voters will be asked to approve affordable housing proposals. L.A.’s proposal will be on the November ballot, while Pittsburgh’s initiative is still in the signature-gathering phase. In both cities, the local government, not just housing advocates, has played a key role in promoting solutions for the initiative.

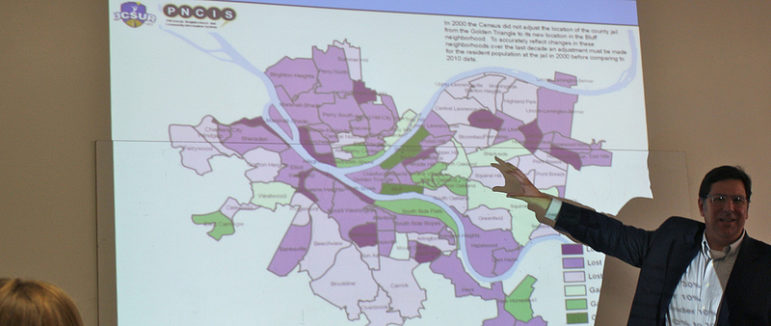

In Pittsburgh, a citizen committee created by the Pittsburgh City Council is proposing the creation of a $10 million housing trust fund that would be supported by a one percent real estate transfer tax. According to the Post-Gazette, “The fund could be used for new affordable housing, rental assistance or rental rehabilitation, and could create as many as 6,840 affordable units over the course of 10 years.”

For civic leaders in the Golden Triangle, the idea of a local housing trust fund is just the latest in a series of efforts to expand affordable housing in the community. Besides arising from a Citizens Advisory Committee, Pittsburgh is relying upon the volunteer efforts of labor and advocacy organizations to bring the proposal to the November ballot and get it passed. Even before hatching the proposal in early June, the Affordable Housing Task Force had been talking to “the public” in ways that would help build the support needed to pass a new tax proposal.

Los Angeles leaped ahead of Pittsburgh with a less ambitious proposal, in part because the L.A. City Council voted to place the “Build Better L.A.” initiative issue on the November ballot. Competing ballot initiatives from labor and housing advocates were brought together into a single compromise plan that would create an inclusive housing ordinance, like many around the country, under which developers would be required to set aside affordable units in new developments or pay into a fund to be used by the city to create affordable units. L.A. Streetsblog provides these details:

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The Build Better L.A. initiative would require to developers who sought a zoning change or general plan amendment to choose between setting aside five percent of the units to be rented to extremely low-income tenants and six percent rented to tenants at who qualify as very low income. Or, developers could opt to set aside five percent of the units for extremely low-income tenants and 15 percent for low-income tenants.

The pros of inclusionary zoning ordinances are that they use regulation, not public funds, to create affordable units and they don’t stifle construction. One downside is that inclusionary zoning does nothing to slow the growth of upper-scale rental development, which can fuel area median rents. Another potential drawback is that permitting developers to pay an “opt out” fee could mean that affordable units may not be integrated into upper-income areas.

Affordable rental housing continues to be a financial burden for low- and middle-income families. WonkBlog’s Emily Badger reports on more findings from the McArthur Study of housing affordability in “All the things Americans sacrifice because housing costs too much“. Households in the survey most often reported that they were taking on additional work in response to high rents. Other frequently reported responses were to stop saving for retirement and an increase in credit card debt. For households with fewer options, the coping choices were more ominous behaviors, like cutting back on medical care or healthy foods or moving to neighborhoods that are less safe or have schools of lower quality. Ms. Badger concludes, “The reality that always hides behind these statistics is that households make hard concessions to keep the one thing they can’t do without. Alongside housing, other things start to look like luxuries: a car, a bottle of medicine, a box of toys for the kids or a bank account for retirement.”

While local initiatives like those envisioned by Pittsburgh and Los Angeles are important, they don’t have the scale to address what is a national problem flowing from the Great Recession. Too many households end up chasing too few rental units because they can’t afford to purchase or qualify for a mortgage…or because they no longer trust home ownership as a good investment. NextCity describes a new study by the Joint Center for Housing Studies (JCHS) that identifies decreased home ownership as a driving force fueling increasing rents. “The report states that ‘rental demand has risen across all age groups, income levels, and household types, with large increases among older renters and families with children.’” The JCHS is not optimistic about local initiatives, either, as “more than 500 local jurisdictions have implemented inclusionary housing policies, but the scale and intensity of these programs vary widely and have yet to reach the scale of federal programs.”

Still, with a lame-duck president and a Congress obsessed with showmanship, game playing, and reelection, taking the issue to the streets may be the only place that renters and their advocates can push for a change.—Spencer Wells