March 4, 2018; WLRN-FM (Miami, FL)

Throughout the United States, low-income communities struggle to access affordable credit and, as a result, build wealth. Certainly, the historical context of disinvestment in these communities is a primary driver, as is the emergence of alternative financial service providers (AFSP) that prey upon these communities by benefiting from the existing credit gap, typically locating their high-interest services in banking deserts.

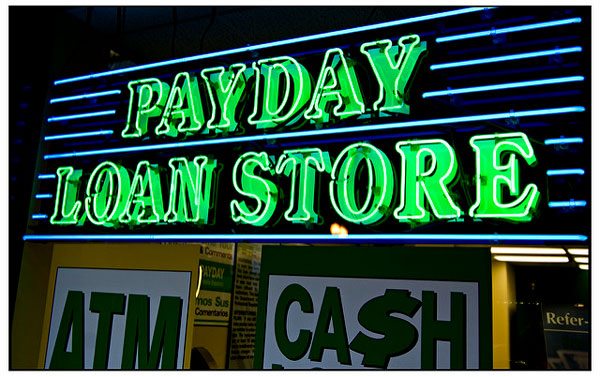

While there are several types of AFSPs, payday lenders have come under scrutiny in recent years for their role in wealth-stripping low-income communities. Specifically, through exorbitantly high interest short-term loans, predatory payday lenders lead people into what is commonly called a “debt trap,” a vicious cycle whereby the borrower takes out a loan they cannot afford, resulting in excessive fees imposed by the lender when the borrower is unable to make an on-time payment. Given that many borrowers cannot access affordable credit from other sources, these borrowers are forced to “flip” their loans, taking out an additional payday loan to cover the costs of the initial loan and the fees. Nationally, this trend has garnered the attention of the Consumer Financial Protection Bureau, which in its Data Point Report on Payday Lending noted that 80 percent of payday loans are rolled over or followed by another loan within 14 days of the original loan. Given that the payday lending market is estimated to be around $38.5 billion annually, and some 75 percent of payday lenders’ total profits come from rollover loans, the issue of predatory lending is paramount to nonprofit organizations and coalitions dedicated to asset building, wealth building, and financial security efforts.

Although some local governments (see NPQ’s previous article on Caddo Parish Commission’s effort to limit predatory lending) and legislatures across the country recognize the detrimental impacts that payday loans have on their constituents, more than 30 states currently allow high-interest payday loans, with the average APR being 391 percent according to the Center for Responsible Lending, the nation’s leading nonprofit dedicated to ensuring a fair, inclusive financial marketplace. Yet even in states with existing payday lending laws, the influence of an increasingly powerful AFSP lobby seeks to reshape existing laws designed to rein in the deleterious effects of predatory lending. In Florida, for example, the state senate held a Saturday session last weekend and passed SB 920 by a vote of 31–5. This legislation would raise the limits for short-term payday loans from $500 to $1,000 and extend the existing repayment term from 31 days to 90 days.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Though proponents of this legislation argue that these revisions will assist low-income communities in accessing much-needed funds, community and consumer protection groups correctly identify this legislation as a concerted effort to exacerbate the effects of wealth-stripping by increasing the number of people ensnared in debt traps while at the same time lining the pockets of payday lenders. Similar payday lending legislation passed in Florida in 2001 and was sold as a measure to prevent debt traps, but had the exact opposite effect: the average APR of a payday loan in Florida is 278 percent, over $2.5 billion in fees alone have been stripped from Florida communities by payday lenders since 2005, and a report in 2015 showed that 83 percent of Florida payday loans were made to Floridians stuck in seven or more loans.

This type of legislative wealth stripping is aggravated by limitations in the ability of federal consumer protection efforts to enforce laws, as well as the budding resurgence of rent-a-bank legislation (HR 3299), which seeks to allow payday and predatory lenders to circumvent existing state rate cap laws by originating their loans through banks. There is also a proliferation of other AFSPs, like merchant cash advance (MCA) providers, which target their debt traps on startup and early-stage small businesses with limited credit access and consequently further restrain the ability of low income people and communities to prosper.

Taken together, nonprofits and community-based initiatives that address economic self-sufficiency and poverty must continue to think about the systems that hinder their efforts. Taking aim at AFSPs is one potential leverage point for local communities to consider, especially as they recognize the aggregated influence of AFSPs on economic mobility. There are some examples of new approaches to building wealth through innovative strategic partnerships with community banks and credit unions and nonprofits must look to these and other emerging models as ways to address the destructive financial devices that have grown from existing credit gaps. By addressing these negative feedback loops and using a critical lens to identify and understand forces that influence the overall system, nonprofits can address the underlying causes and subsequently increase their overall impact.—Derrick Rhayn