February 15, 2019; Next City

In Next City, Oscar Perry Abello notes that an early draft of Rep. Alexandria Ocasio-Cortez’s proposal for a “green new deal” called for financing green infrastructure through a “system of regional and specialized public banks.” The notion of creating such a network of banks may sound fantastic. But it actually already exists. It’s called the Federal Home Loan Bank.

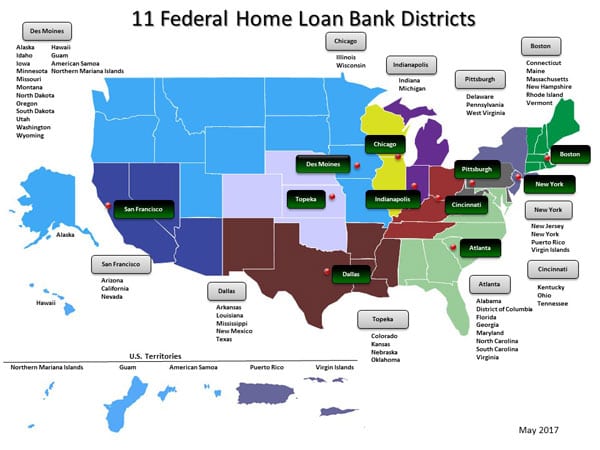

Founded in 1932, the federal home loan bank system consists of eleven regional banks, structured as member-owned cooperatives, with regional banks headquartered in 11 cities across the US: Atlanta, Boston, Chicago, Cincinnati, Dallas, Des Moines, Indianapolis, New York, Pittsburgh, San Francisco, and Topeka.

As Abello explains, this network of 11 banks is a set of government-sponsored enterprises that combined have “a trillion dollars in assets, and while they have the intrinsic backing of the US Government, they operate with zero taxpayer dollars.” They also, despite their name, do far more than back housing loans.

As an individual or organization, however, you cannot just walk in and open your own account at one of these 11 banks. These are bankers’ banks. As Abello points out, “They don’t take deposits; instead, they borrow from global capital markets—and very cheaply, since they have the implicit backing of the US government. Then they turn around and primarily make loans to their members, who are also their shareholders. Loans to members can be for one day or for up to 20 years, and the funds can be wired into members’ accounts in less than an hour.”

Once, the Federal Home Loan Bank network, true to its name, only supported home lending. These banks were founded, after all, to deal with the nation’s collapsed residential real estate market during the Depression. The 1932 date means it was Herbert Hoover who persuaded Congress to invest $125 million ($2.24 billion in present-day dollars) to capitalize a fund that was intended to reduce foreclosures and finance home construction.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

But the scope of the system has greatly expanded since then. As Abello explains, expansion typically follows crises. For instance, credit unions were allowed to become member-owners in Federal Home Loan Bank cooperatives in 1989 and insurance companies in 1992, after the savings and loan crisis wiped out many previous Federal Home Loan Bank member-owners. Prodded by the Great Recession, in 2010, community development financial institutions (CDFIs) also gained member eligibility.

Today, Abello notes, “there are around 7,000 Federal Home Loan Bank members across the United States. About two-thirds of them are banks, along with 1,479 credit unions, 704 savings institutions, 426 insurance companies, and 55 community development loan funds—up from 26 community development loan fund members in 2014.”

Being a Federal Home Loan Bank member-owner does involve some responsibility. Members, notes Abello, must “make an initial purchase of shares and must purchase additional shares with each advance they take out. And they must pledge a certain dollar amount of collateral for every dollar they borrow.”

Still, the support that the Federal Home Loan Bank network provides can be important. At the Chicago bank, the bank’s Community First Fund acts as a $50 million revolving fund that supports loans made for housing and business lending in Wisconsin and Illinois. At the San Francisco bank, a $100 million “quality jobs fund” provides financing for job creation, small business expansion, and job training in Arizona, California, and Nevada. And surely a few NPQ readers will recall that over 40 years ago the Federal Home Loan Bank of Pittsburgh helped a fledgling Neighborhood Housing Services to expand its efforts. That organization, now called NeighborWorks America, has grown to 245 members in all 50 states and to date has invested a total of $70 billion.

The role the Federal Home Loan Bank network would play in Green New Deal financing depends on the shape and scope of what Congress approves—approval that surely would only come with political change in Washington. Still, as Abello argues, the “expansion and growing activity of CDFI membership among Federal Home Loan Banks hint at what could someday become a direct or explicit source of financing for activities that fall under the umbrella of a Green New Deal.”—Steve Dubb