December 7, 2017; Politico

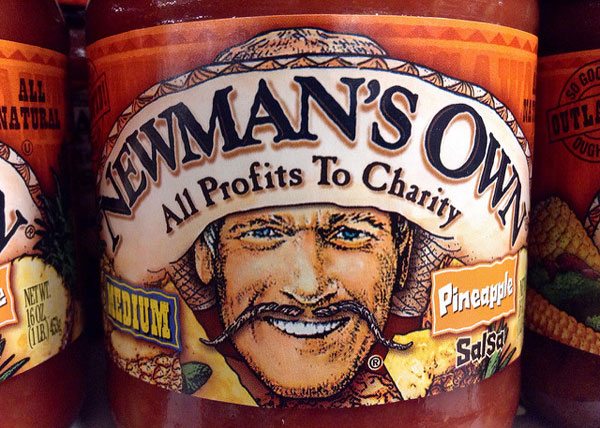

Newman’s Own Foundation is facing a very stiff tax penalty that could cause it to sell off its ownership in the food conglomerate that shares its name or even disband altogether if a provision in the tax reform bill currently being deliberated is not included. According to reports, the IRS has issued a deadline of November 2018 before a severe penalty of 200 percent will be enforced.

There are two issues at play here. One is that foundations face stringent limits to the amount of ownership they can have in for-profit businesses. IRS regulation states a private foundation can generally only own up to 20 percent of the voting stock of a for-profit corporation. It keeps business owners from creating a foundation and then transferring ownership of their business to that foundation as a tax dodge. When Paul Newman died in 2008, he left ownership of the food empire named for him to the Foundation, which since then has been giving away the profits derived from the sales of salad dressing, pet food, chocolate, popcorn, and other items.

Leaders of the Newman’s Own Foundation have been working with legislators in Washington in order to be given an exemption to this rule. They thought they had hit a home run when both the House and the Senate versions of the tax reform bill included the exemption, since if the exemption were not included, it is likely Newman’s Own would have to break itself up by divesting of its holdings.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The other issue at play, however, is that Senate parliamentarian Elizabeth MacDonough has determined the provision providing the exemption is in violation of the Byrd Rule. The rule, named after former US Senator Robert Byrd (D-WV), sets limits and guidelines for the kinds of provisions that can be included in a reconciliation bill, which is the once-a-year legislative procedure the Republican-controlled Congress is using to push through their tax reform bill. The parliamentarian, who is responsible for making sure all legislation abides by rules and regulations, has removed the Newman’s Own exemption from the tax reform bill being given final consideration. Although the report does not indicate why the provision is in violation, it’s probably because it can be considered “extraneous” to the bill’s intent.

Ms. MacDonough has removed closed to a dozen provisions in the tax reform bill for similar violations of a variety of Senate rules and regulations. One is a provision advocated by Sen. Bob Corker (R-TN) that would have forced tax increases in the future if the tax bill does not help the economy to the level that is currently being projected. This is a failsafe provision the Republican leadership had been counting on to help build trust in and support for the legislation.

So, who knew? Who knew there was a “parliamentarian” who has the power to remove portions of legislation that might go against the rules? Obviously, the senators in Washington do, because they are currently scrambling to figure out how to rewrite the dozen or so provisions Ms. MacDonough has nixed. Apparently, there is very little precedent for overruling a parliamentarian’s decision. Conversely, who knew there was an IRS regulation limiting how much a foundation can own of a private, for-profit corporation? Obviously, the people who wrote Paul Newman’s will missed it.—Rob Meiksins