December 10, 2018; WKMS (Murray State Public Radio)

NPQ has this year been highlighting alternatives to traditional methods of economic development or jobs creation. At the same time, we have been particularly critical of the high profile one-off corporate tax deals that promise jobs in return for public support for the company. In the end, it has been proven time and again, much of the wealth built from such strategies is funneled to corporate tax giants not to local residents. It can also destabilize regions by creating economic overdependence upon a corporation which is often either national or multinational. But, even at the most basic level, many of these deals are based on promises that go unfulfilled from the corporate side and plans that disrupt local housing, transportation, and business.

Now, a December report from Kentucky Center for Economic Policy throws a wet blanket on the state’s highly touted, “job-creating” investment from large companies like Toyota. When one dives into the numbers, it becomes apparent that the reported $9.2 billion is not all it is claimed to be.

A closer look at the details reveals a substantial share of these announcements are not connected to any new jobs, and the total includes investments that may never occur. In addition, the vast majority of projected new investments are from companies that were already operating in Kentucky prior to 2017, as opposed to outside companies choosing to invest in Kentucky for the first time, raising serious doubts about claims the investments result from recent policy changes.

The report estimates that at least 9.6 percent of the $9.2 billion of potential investments in Kentucky will not result in any new jobs. Toyota received a tax subsidy for job retention, and indeed the $1.33 billion investment reportedly adds no new jobs. The Kentucky Cabinet for Economic Development granted $43.5 million in tax subsidies to Toyota for their troubles. Ford’s announced $900 million investment will merely retain jobs, not add to the stock of jobs in Kentucky.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Furthermore, when the Cabinet for Economic Development announced these billions of dollars of investments, not all of them are guaranteed to materialize. These are only potential investments. Take, for example, Braidy Industries—an aluminum products manufacturer—which announced a $1.3 billion investment projected to create 550 jobs. The report notes,

As of fall 2018, Braidy Industries lacked the financing to get the project off the ground. As the [Louisville] Courier-Journal reported, the company is far from raising the funds needed to build the $1.68 billion facility. As of September 2018, Braidy was seeking a $1 billion federal loan, $500 million in credit from the government of Germany and $400 million from a crowdfunded sale of stock. Braidy “claims it has pre-sold twice the capacity of the mills for its first seven years of operation, but the company told the SEC: ‘None of the prospective customers who have indicated a desire to purchase aluminum from Braidy are contractually committed to do so.’” Another Courier-Journal investigation found that the CEO of the company, Craig Bouchard, has a history in which “past ventures show frequent predictions of spectacular success followed by financial problems and notable failures.”

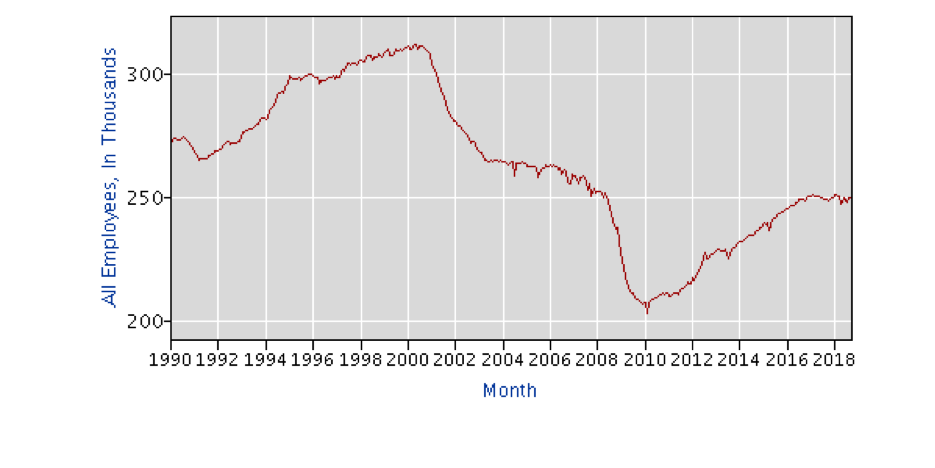

All of this comes, as Kentucky finds itself falling behind most of the nation in employment statistics. The Bureau of Labor Statistics ranks Kentucky 43rd in unemployment rate as of October 2018. While manufacturing employment in Kentucky is higher than its Great Recession trough, the gains in the sector are beginning to level off and remain far below their recent peak in the early 2000s and is leveling off.

This is a lesson we just learned with the Amazon HQ2 competition. The outside savior promising jobs and growth can lead policymakers to compete by offering tax incentives to chosen companies in exchange for the hope of employment. And although these decisions are politically splashy and make for great headlines, there is scant evidence that they are cost effective. As the article notes, a report from 2012 finds that a whopping “35 percent of jobs associated with tax incentives would have to be created solely as a result of the state’s tax breaks—and not other factors.”

The problem with these sorts of tax incentives, besides the advantage they bestow upon chosen companies, lies in the opportunity costs of decreased tax revenue. These programs are one-offs, a single opportunity for Kentucky to sweeten the financial benefits of setting up shop in the state. Those revenues could be used elsewhere to improve the quality of Kentucky’s employees. The state ranks in the bottom half in education and access to internet, according to US News and World Reports. Long-term growth will depend on have a high-quality labor force that entices outside investment and in-state policies that encourage business growth. As noted in the article, “more than 80 percent of the jobs created in a state in any given year are from new business start-ups and expansions of existing companies already located in the state.”

As difficult as it may be, politicians and policy makers need to avoid playing the special tax incentives game. It tends to be a losing proposition, since taxes are only part of company decisions of where to produce their goods. Companies look at the costs of moving their goods to market, the quality of the employees in the area, and many other things beyond a state’s control. The best policies will recognize this and avoid self-defeating moves chasing headlines in the short-term. Tax breaks, in many cases, only stave off the inevitable. Taking a look at the policies that work to build shared wealth, and avoiding those that don’t, is what Kentucky and economic growth advocates need to focus on now.—Sean Watterson