July 7, 2020; Houston Chronicle and Indian Country Today

It has been a difficult week for oil companies. Courts have ruled against several pipeline projects, and jobs and stocks can’t seem to quite jumpstart the highly speculative economy from the coronavirus pandemic. Delayed projects are proving to be just bad business for oil. How long can they keep this up?

On Monday, June 6, 2020, the Supreme Court upheld a federal ruling that blocked the construction of TC Energy Corp’s Keystone XL pipeline, one of the largest on the planet that would have transported extra heavy crude from tar sand reserves in Alberta, Canada, through the state of Nebraska, all the way to the Gulf of Mexico. After a major mobilization from civil society, Obama blocked the pipeline as a last act of his presidential legacy, just to be overturned by Trump a couple months later. A lower court had ruled in April that the Army Corps of Engineers should have not approved the construction project, crossing 20 miles of waterways, which violates the Endangered Species Act.

This comes as a big blow when, back in March, TC Energy had reached a $7.5-billion financing agreement with the Alberta government. The deal was thought of as a “boost” to the Canadian economy.

“We cannot wait for the end of the pandemic and the global recession to act,” said Alberta Premier Jason Kenney in a press conference. “After construction is complete, we will be able to sell our shares at profit.” Now TC Energy will have to delay its work until 2021, and Biden already promised he would cancel the permit if elected.

The oil industry seems to be, speculatively, barely hanging from a cliff, as the industry began laying off workers as early as April when it saw prices for barrels of oil fall below effectively below zero. A London-based think tank called Carbon Tracker characterized the industry as being on “Terminal Decline” as governments begin to abandon the oil industry for greener renewable technologies. According to their analysis, demand for oil peaked in 2019 and the coronavirus pandemic is only accelerating a process of higher costs vs. lower profits.

Mass layoffs—26,300 in Texas in April alone—have led college students to rethink their careers. One of the laid-off workers was quoted by the Houston Chronicle as saying, “I definitely won’t work for an oil-field service company again…if there are downturns every two years, how are you supposed to build a career or start a family?” He switched careers and is now studying for an MBA at Texas A&M.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Never has the industry seen a downturn so quickly at this scale, and the workforce seems to be just getting older. Baby Boomers make up 21 percent of the well-paid oil industry jobs. Meanwhile, recruiting the younger generation has become a challenge, as they “have a sharper sense of corporate mission and accountability to sustainability,” according to David Foster of the Energy Futures Initiative, speaking to the Chronicle.

To keep up appearances, oilfield services companies applied for and received as many as 1,261 PPP loans of $5–10 million in Texas alone. It was the third-highest number of loans received, just after restaurants (2,714) and physicians’ offices (1,941).

It’s a short-lived love affair, experts say, as coronavirus continues to bring the industry down. “The forecast remains gloomy,” writes Keith Goldberg for Law360, “Oil and gas bankruptcies were already on the rise before the COVID-19 pandemic cratered energy demand, as a multibillion-dollar mountain of industry debt comes due and investors refuse to sink any more cash into new drilling activities.”

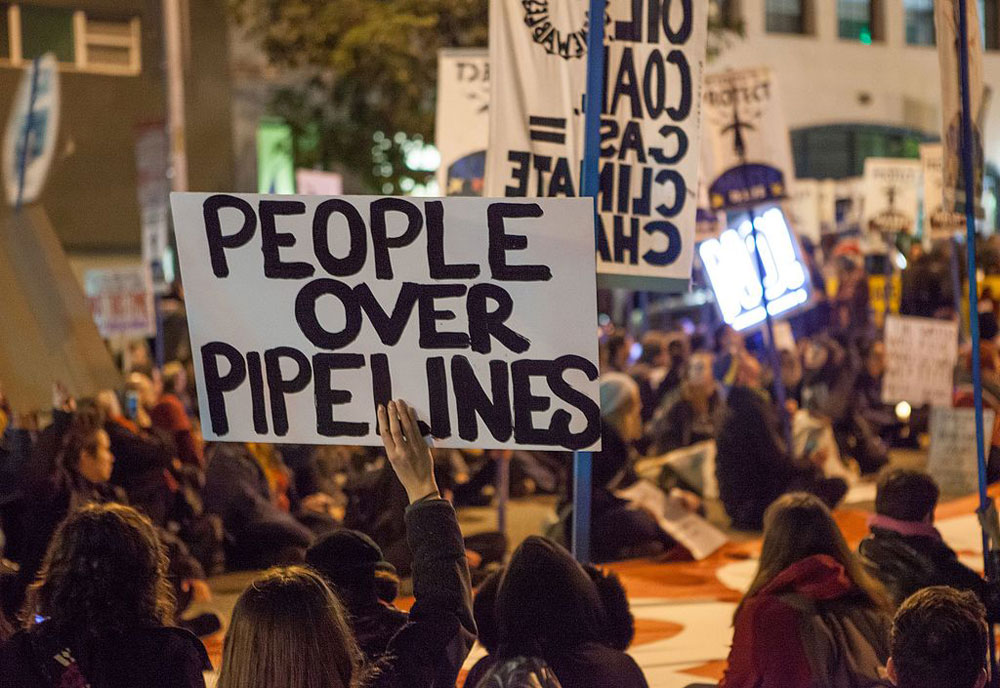

The other two defeats for the gas and oil industry in the courts this week—the shutdown of the Dakota Access Pipeline and the fracked gas Atlantic Coast Pipeline—were seen as huge victories by the environmental movement. Mark Trahant at Indian Country News wisely points out that the DAPL court decision of shutting down the pipeline by August 5th raised the risk of “potentially disruptive effects” on the tribes that depend on Lake Oahe. That is, the court weighed the risks of economic impact vs. social and environmental risks and concluded the latter was of utmost importance.

A paper published by First People’s Worldwide showed back in November of 2018 that Energy Transfer Partnership was reporting lower economic risks to their investors that didn’t include social risks, which could amount to $7.5 billion.

“The costs of protests speak for themselves,” the researchers wrote. “The delay in placing the pipeline into operation can be directly attributed to the protests, social unrest, and legal challenges.” With losses of up at least 25 percent in the first half of 2020, the oil industry seems to be the last place to invest.—Sofia Jarrin-Thomas