Editors’ note: This article is featured in NPQ’s new, winter 2014 edition, “Births and Deaths in the Nonprofit Sector.”

Everyone agrees that the number of registered nonprofits at any given time is a very rough—bordering on meaningless—proxy for the number of nonprofits that exist. But these are the figures advanced whenever anyone attempts to describe the parameters of the sector. This article outlines the numbers and some of the issues and questions that they raise.

Between December 2004 and September 2014, there were 1,904,769 IRS-approved tax-exempt organizations that appeared on the IRS Exempt Organizations Master File (EOMF) for at least one month. Yet, by September 2014, there were only 1,459,813 organizations that the IRS still believed were viable. For various reasons, any analysis of the ebbs and flows in the numbers and types of nonprofits that thrived and perished during this period is inherently flawed, but the analysis here presents a rough sketch of what happened during the period.

The Great IRS Purge

Using the EOMF, we can get some idea of the births and deaths of organizations from 2005 through 2014. One of the difficulties in pinning this down with precision jumps out after a quick look at table 1.1

Prior to 2006, the IRS had no legal standing to revoke the tax-exempt status of an organization for failing to file the required Form 990 series return, and organizations with gross revenues of $25,000 or less were not required to file at all. The Pension Protection Act of 2006 provided for the creation of a new online form (subsequently named the 990-N) that these smaller organizations were required to file starting in 2008. The legislation further allowed the IRS to begin revoking the tax-exempt status of organizations that failed to file for three consecutive years.

The first round of these automatic revocations began in June 2011. Based on the anomalous number of deaths for that year (and, to a lesser degree, in 2012 and 2013), the actual number of deaths in the years preceding 2011 are understated. For example, 154,214 of the organizations appearing on the December 2004 EOMF would have qualified for automatic revocation had the law been in effect at that time, but they did not lose their tax-exempt status until June 2011. It is also worth noting in passing that death is a simpler but somewhat misleading way of describing the loss of taxexempt status. One of these “dead” organizations is happily operating as a public charity seven miles from where I sit writing this, ignorant of the fact that it has been doing so illegally since June 2011. I suspect that there are thousands of small, volunteer- only organizations in similar circumstances.

The Demographics by Field

In general, there appears to be no trend suggesting that specific program types of organizations are waxing or waning. For the most part, organization types were born and died in proportion to their overall representation in the EOMF (see table 2).

One notable exception were human services organizations, which were created at 23 percent more than the expected rate and died at 28 percent more than the expected rate. The other exception were religious organizations, which died at about half the expected rate. One possible explanation for this is simply that because most religious organizations are not required to file even a 990-N they are not subject to automatic revocation. The IRS does not know that an organization has gone out of business unless it notifies the IRS that it is ceasing operations (a requirement usually observed in the breach). (Note: for various reasons, nearly half of the organizations in the current EOMF, mostly small ones, are not classified by program type. Those organizations are not included in table 2.)

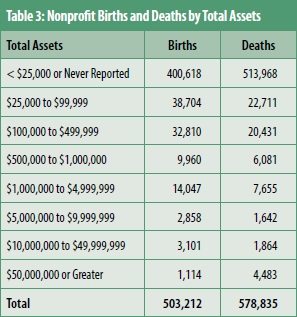

The Demographics by Size of Assets

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

It is probably not surprising that small organizations dominate both births and deaths in the EOMF. Organizations with total assets of less than $25,000, or those never required to report assets because their revenue was less than $25,000, accounted for 80 percent of the births and 89 percent of the deaths (see table 3).

One surprising finding was that, besides the very smallest organizations, the only other assets group where deaths exceeded births was the very largest organizations.

Upon further investigation, we found what you might expect—that the disproportionate number of organizational deaths among mega-organizations were rarely deaths but rather morphings. For instance, the Jamie and Steve Tisch Foundation came apart when the founders underwent a divorce. This death resulted in two births: the Jamie Tisch Foundation and the Steve Tisch Foundation. Another interesting example is Oxford University Press, Inc., which reported net assets of $93,204,848 on its 2011 Form 990. It was allowed to transition to become Oxford University Press, LLC, in Delaware, and become a “disregarded entity” of Oxford University, itself a 501(c)(3)—which essentially means that for tax purposes it will be treated as part of the university. And so it goes—these larger nonprofits do not die at all but rather merge, split, or otherwise change form. This provides just a small window into the fallacy of using the numbers without plenty of caveats.

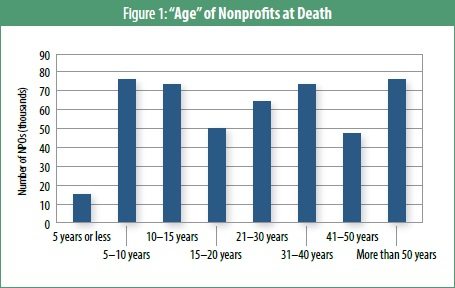

Life Expectancy

When speaking of the age of nonprofits at death, the EOMF provides us with only the proxy of the IRS ruling year. In most cases, this will track the founding year fairly closely, but there can be some odd exceptions. For example, the American Diabetes Association (ADA), which has been around since 1940, received a new IRS ruling in 1992 because of changes to its corporate structure. So, for the purposes of talking about age using the EOMF, we have no choice but to treat the ADA as if it were twenty-two years old. This kind of situation is unusual, though, and with the hundreds of thousands of organizations in this analysis, it is unlikely to change the numbers significantly.

The most likely age of organization death is between six and fifteen years (see figure 1). That decade accounted for 31 percent of all deaths. The most “dangerous” age was nine, with 18,955 deaths, about 6 percent more than age ten, the second-highest age for deaths.

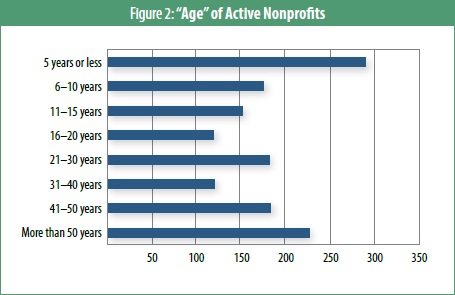

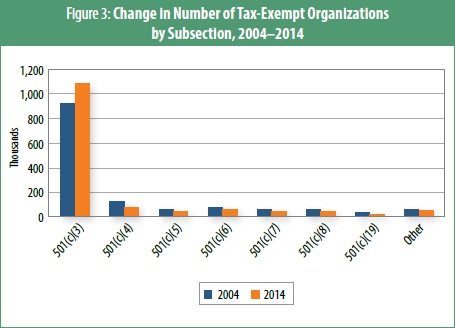

The age distribution of nonprofits active in the September 2014 EOMF skews young (see figure 2). Organizations five years old or younger make up 20 percent of the organizations. The median age is twenty years. These young organizations are overwhelmingly public charities, and their proportion of the total tax-exempt universe is increasing. Overall, 69 percent of the organizations in the September 2014 EOMF are public charities; 82 percent of the organizations age five or younger are public charities. In fact, from 2004 to 2014, all subsections under which the IRS provides tax exemption saw a net decline, except for 501(c)(3) organizations (see figure 3).

In light of this, one thing that bears close attention is the advent of the Form 1023-EZ. The purpose of this new form is to make it easier for small organizations to receive tax-exempt status as public charities. Although it is much too early to come to a definitive conclusion about the impact this new form will have, consider this: of the 67,321 organizations created in 2014 through the end of August, 28,807 (43 percent) received their tax-exempt status in the two months since it became possible to file Form 1023-EZ, and 62 percent fit the profile of organizations that would be eligible to use that form rather than the full Form 1023.

• • •

Readers should use these numbers at their own risk, and only to provide the most general and fuzzy estimates of the parameters of the sector. Although automatic revocations mean that, going forward, the EOMF will give us a fairly accurate understanding of the numbers and types of organizations that are active and have formally applied for and received tax-exempt status, this leaves much of the sector unaccounted for. For instance, the Association of Statisticians of American Religious Bodies reported 344,894 religious congregations in its 2010 census. A vast majority of these congregations do not apply for tax-exempt status, and we know very little about their birth and death patterns. The IRS does not release information on how many and what types of organizations file one of the Form 990 series returns on a regular basis without ever actually applying for tax-exempt status—only organizations operating under IRC sections 501(c)(3), 501(c)(9), or 501(c)(17) are compelled to formally apply. I can find no reliable numbers on how many of these so-called “self-declarers” are currently operating. Likewise, as I have suggested above, there are probably many small organizations, important in their communities if not in the grand scheme of things, that operate as if the IRS did not exist.

Note

- The tables and figures in this article were generated by GuideStar using datasets created or downloaded from the IRS.