A significant share of NPQ readers have roles that involve management of some sort. But what is management? Judging by the syllabi of most resource management courses, a reasonable surmise might be that management is about how to deal with money, cash flow, and organizational sustainability.

Certainly, that is part of what managers do. But what if educators thought of management as also involving people, nature, trust, and cooperation? If they did, they might teach management courses differently.

This is my story. I am a professor at Arizona State University. A couple of years ago, I was invited to teach a management course on resource allocation. But I was appalled by the standard way that course had been taught. Our students, you see, were being educated to focus on financial resources nearly exclusively.

I knew the course needed to be redesigned, so I did so, employing a multiple capitals framework to help students consider a range of financial and nonfinancial (e.g., social, human, natural, cultural) resources. In this course, students learned about two dozen tangible and intangible resources they can strategically develop to create prosocial business models and to apply an integrative approach to think intentionally about what they value and how to enact and account for those values.

The resulting course won a 2020 Aspen Institute Ideas Worth Teaching award for innovation that transforms business education. While it’s an honor to be recognized, what’s more important is for the field to respond and update management education to reflect the world we live in, and more importantly, the world we want to create. Our economy is in part a product of the mental maps we bring to it. If future managers learn to focus on monetary assets while making social, human, natural, and cultural factors secondary, we should not be surprised if our businesses in their decision-making give non-financial considerations little thought. The key, then, is to model our organizations to value both financial and non-financial resources.

Resources, Values, and Power: Mapping Their Relationships

Management courses at most universities today focus their curriculum on the resources included on a balance sheet—namely land, buildings, and money. Seldom are the criteria used to determine what counts as a resource questioned. To be recognized as an asset in financial and managerial accounting, a resource must be in the control of the organization (i.e., owned); likely to generate future economic benefits; and measurable, such as through price or cost. This results in ignoring many things we value, including non-financial and intangible assets essential to social and long-term value creation. Examples include volunteers, employees, relationships, reputation, and governance. To make matters worse, these non-financial resources are frequently labeled as expenses rather than being recognized as assets, leading to underinvestment in them.

The unexamined assumptions about what counts as a resource overlook an even more fundamental question: what makes something valuable in the first place? What makes something valuable is a function of our values and aspirations (what we hold dear, what we want to create); context (our circumstances and cultural norms); and the availability or scarcity of the resource. Resources can be either a service or a material good. Material resources are tangible—you can feel and touch them. Services and resources without a physical form are called intangible.

Expanding our conception of resources to include both tangible and intangible assets is a way to recognize and account for what we value. Resources are not just financial. They are anything we deem to have worth and that help us achieve our goals. For example, resources for building a house include raw materials like wood and concrete; the land on which the house is built; the design and blueprint for construction; and the human knowledge, effort, and teamwork that transform the raw materials into the finished product. One could also include the trees and rocks that sourced the raw materials, the roads needed to transport the materials to the site, the electricity that powers the tools, and the livelihoods that enable buyers to purchase the home. Generally, we value resources because they help people, organizations, and societies to survive and achieve their goals.

Resources are integrally related to power. This is because people with resources have more agency—the ability to exert control to achieve what they want out of life. Besides the ability to acquire things they want, control creates greater capacity to structure operating contexts (e.g., policies, rules, processes, and who is included in decision-making) and determine what social and political goals should be pursued. People who possess resources also have a greater capacity to obtain even more resources in the future, a dynamic known as increasing returns (the tendency of gains to produce more gains).

Resource allocation is usually defined as the process of managing and distributing assets strategically to achieve a larger goal. Yet it’s critical to recognize that resource distribution decisions always have ethical implications—everyone needs resources to survive, yet allocation typically benefits some more than others. To achieve equity requires acting to ensure distributive justice for those who receive fewer resources, since receiving fewer resources decreases their prospects in the future for power and control. It’s also important to make explicit who gets to decide how scarce resources should be distributed and to make transparent the processes for selecting these people.

Sustainable resource allocation also requires accountability—taking responsibility for decisions and actions, and the results these produce. This is because exchange systems, to be viable over time, must ensure reciprocity (mutual benefit) so people believe in and support the systems on an ongoing basis. Without reciprocity, people eventually lose faith in the system. Accountability also promotes legitimacy—the right to exert control over others with their consent due to the expectation of mutual benefit. While democratic governments establish legitimacy through a chartering process like a constitution, organizations get their legitimacy from stakeholders—people who influence and are affected by an organization’s actions. The basis for individual accountability to society is known as the social contract. In business, it is often referred to as social license to operate.

Expanding Our Resource Conceptual Toolbox

Let’s step back into the classroom. Once students come to understand the connection between resources, power, values, ethics, accountability, and legitimacy, they are next introduced to social accounting to make visible what we value. Social accounting expands the criteria for what counts. It includes environmental, human, economic, social, and cultural resources—the ingredients that go into creating value for people and society. It measures impacts in the past, present, and future. Social accounting promotes legitimacy by communicating the positive and negative impacts a firm has on its stakeholders. It employs a combination of financial measures such as revenue and costs, quantitative metrics (for things that can be counted or measured), and qualitative elements such as stories, pictures, analytical descriptions, and ratings. Together, these data provide a more robust view of the organization’s value creation performance and stakeholder impacts.

For social accounting to be effective, there must be clarity on what is being measured. What I call a “multiple capitals” framework is a technique for gaining this clarity systematically. Capital in this schema is broadly defined as resources that endure and can produce more resources. This expansive definition enables capital to serve as a proxy for capacity and capabilities. Six leading types of capital are financial, natural, human, relational, symbolic, and structural capital. Each category has a few subtypes; for example, human capital includes moral, psychological, physiological, creative, and rational aspects. The subtypes are important because they make it easier for managers to create strategic interventions to develop the capitals. For example, students learn that Google’s Project Aristotle identified psychological safety as the hallmark of effective teams and learn how to develop and measure psychological safety and team effectiveness in their own organizations.

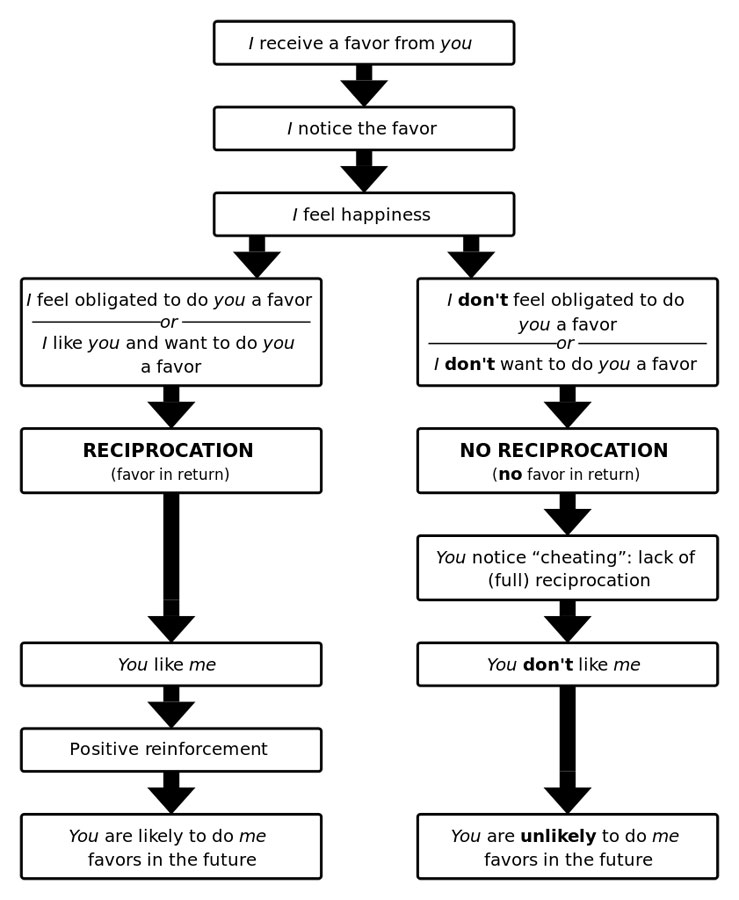

In the course, I broke this down into units, with each covering a category of capital and its subtypes. Students learned to identify those various resources, how they create value, and how they can be developed and measured. Case studies bring the capitals to life, showing what they look like in practice and the difference they make to organizations and society. While these examples are from the for-profit sector, the principles are equally applicable to the nonprofit and public sectors as well. One of the students’ favorite cases comes from Harvard research on how independent bookstores reinvented themselves as they faced competition from Amazon. The research identified three “Cs”—community, curation, and convening—as key store-based strategies, as well as coordination and communication at the macro level by the American Booksellers Association. Framing these activities as the development of social and intellectual capital provides additional explanatory power. Students learn the mechanisms for how social capital creates value at both the micro and macro levels. In organizations, developing social capital expands access to and promotes flow of information, increases trust and influence, promotes shared identity, and enhances reputation. At the macro level, it promotes social cohesion and provides dynamic stability through reciprocity. Students also learn about how non-reciprocal exchange erodes trust and leads to social polarization, as illustrated in Figure 1.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Figure 1.

Another favorite case is “Working across multiple cultures at Western Union.” This McKinsey interview with Western Union’s CEO explains how learning, diversity, and stakeholder orientation are integral to Western Union’s value creation strategy. These intangible resources enabled the firm to survive numerous technological challenges in its 170-year history. For example, understanding the cultural contexts, norms, and needs of customers in diverse communities around the world has enabled it to remain responsive to changing consumer needs. Multicultural competence and leadership diversity have also enabled the firm to understand and better serve its diverse global customer base. From a business model perspective, these strategies and values reflect a combination of social capital (stakeholder orientation), cultural capital (multicultural competence, valuing diversity), and process capital (learning, adapting).

Learning to Measure What We Treasure

Accountability mechanisms that promote legitimacy include governance, identity and culture, and performance metrics and reporting.1 Social accounting makes these elements visible and measurable. Governance consists of the processes and people that decide how power is exercised. Indicators of good governance include transparency, inclusivity, and fairness. These aspirational qualities can be assessed as rule-of-law capital.2 Identity (one’s sense of self) shapes how we relate with others and the degree to which we feel connected to and responsible for them. People’s individual identities influence and inform shared identity or culture, the informal collective norms and behavioral rules of an organization. Cultural capital can be assessed using indicators such as diversity, adaptability, and values congruence.3

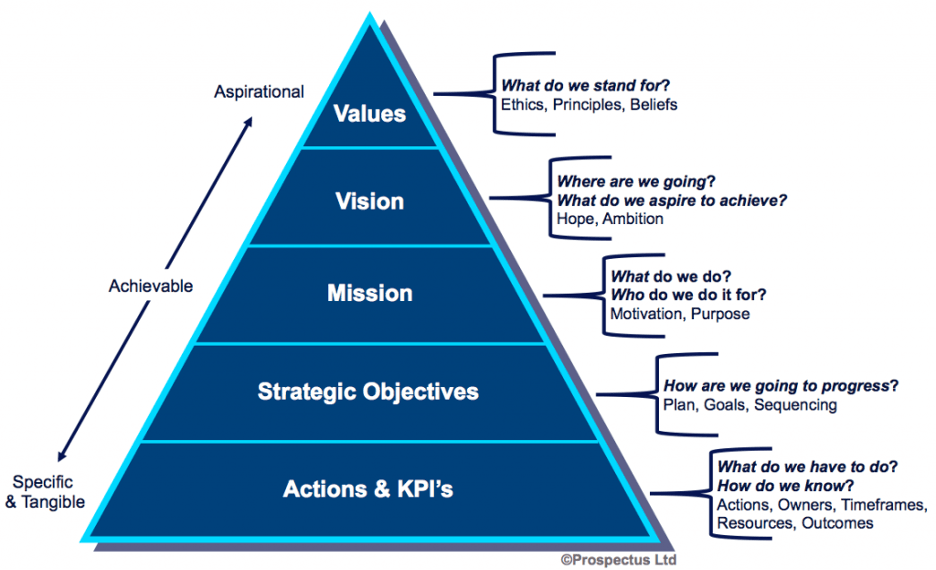

Budgets and resource allocation choices at their heart are expressions of our values. Using multiple capitals makes these intangible assets visible while providing explanatory power for their efficacy. For example, the rule of law, social capital, and cultural capital reflect shared values and beliefs about how people should treat each other and their stakeholders. Metrics enable comparison between stated goals and outcomes. When allocating resources, the essential starting point is to make our guiding values and purpose explicit. From there, we can specify the goals the organization wants to accomplish, along with supporting objectives, actions, and key performance indicators (KPIs). This integrative approach ensures alignment and clarity so that the organization is constantly advancing its values and mission.

Goals are often quantified into objectives and achieved by developing key performance indicators (KPIs)—strategic actions that must happen to achieve the goal and its supporting objectives. Reporting centers on sharing information with stakeholders about what outcomes were achieved. This enables everyone to determine if expectations in key areas such as legal compliance and service delivery have been met. Ensuring alignment between values, goals, and actions requires intentional integration of these elements, as illustrated in Figure 2. Social accounting provides a systematic framework to ensure this integration.

Figure 2.

Integration of values, goals, and actions

Examples of organizations adopting integrative thinking and reporting include the nonprofit Indiana CPA Society and B corps like Tillamook Cheese (page 13 of their 2020 stewardship report has metrics examples). Municipal initiatives such as smart cities,4 resilience,5 and sustainability programs6 similarly entail integrative approaches that recognize both financial and nonfinancial resources, often connecting local community well-being indicators to global metrics such as the United Nations Sustainable Development Goals (SDGs).

Adopting this more expansive view of resources helps groups ask key questions, such as: How do proposed goals and resource allocations promote (or conflict with) organizational values? How can the group make the best use of its limited resources? Which resource investments will generate new and more options? How is equity ensured for internal and external stakeholders and future generations? It also invites thinking about first-, second-, and third-order effects, e.g., what are the likely short-, medium-, and long-term impacts of a potential resource allocation? What are cascade effects and potential unintended consequences?

Conceptual Shifts

Besides learning to recognize, develop, and account for intangible resources, additional conceptual shifts are needed to achieve integrative thinking. These include shifting from seeing the economy as a standalone entity to recognizing its embeddedness—that economic activity takes place within natural, social, symbolic, and geopolitical contexts that enable or constrain developmental potential. If organizations are to enact their values, they must account for the constitutive role worldviews, choices, and values play in creating enabling or limiting structures.

A second shift is to stop thinking in terms of reductionism—that the individual parts automatically constitute the whole. Instead, managers need to learn complexity science principles. These include emergence (a qualitative state change at a higher scale that arises through lower level interactions, such as individual interpersonal relationships that in the aggregate produce social cohesion or social polarization); self-organization (order does not need to be imposed; it can arise spontaneously through the interaction of individual agents, as seen in ant colonies, birds flocking, and networked activism); and interdependence (how parts of a system are interconnected and dependent on each other, both in obvious and non-obvious ways, creating feedback loops that can exponentially amplify effects of an action and make systems unpredictable). By understanding such principles, leaders are positioned to develop sensemaking organizations that are designed for complexity and facilitate emergence of social change. A multiple capitals approach provides a framework to understand and work effectively with complexity, such as community development and disaster recovery.

Student Reactions

How have students reacted to this new way of thinking about resources? The opening exercise in my course asks students to name things they value most. They generally list family, friends, nature, and physical and mental health. I then ask how many of their chosen items show up on a balance sheet. They are usually shocked to see none, recognizing the disconnect between what we feel is important and what we account for.

By the end of the course, their comments generally fall into four categories. The first is anger—how did they get to be this age (most are in their thirties), yet were never taught about the relationship between resources and values before? Some are quite irked to only now be finding out how trust and reciprocal relationships expand capabilities and produce emergent social effects like cooperation and social cohesion. A second reaction is hope. With their expanded understanding, they feel heartened they have many more resources in their leadership toolbox than they realized. A third reaction is a greater sense of integrity, both in understanding the ethical dimensions of resources and how leaders can strategically synergize resources to produce outcomes greater than the sum of the parts for the common good.

A fourth reaction is clarity. At the organizational level, they provide new insight into companies’ operating practices and decision-making. At the personal level, they make it clearer both how and why leaders must be intentional about values—since all decisions and actions either advance or impede these. Nonprofit leaders would be wise to strive for such clarity and intentionality. Making the values that guide decisions collectively visible and actionable is an essential step to bring about the flourishing and equitable world so many of us desire.

Notes

- Lenn, D.J. (2008). “Accountability.” In S.R. Clegg & J.R. Bailey (Eds.), International Encyclopedia of Organization Studies (pp. 5-8). Thousand Oaks: SAGE Publications, Inc.

- United States Council for International Business (2015). Good Governance & the Rule of Law.

- Corritore, Matthew, Goldberg, Amir, & Srivastava, Sameer B. “The new analytics of culture.” Harvard Business Review, 98(1).

- Chourabi, Hafedh, Taewoo Nam, Shawn Walker, J. Ramon Gil-Garcia, Sehl Mellouli, Karine Nahon, Theresa A. Pardo, and Hans Jochen Scholl. “Understanding smart cities: An integrative framework.” In 2012 45th Hawaii international conference on system sciences, pp. 2289-2297. IEEE, 2012.

- Mark Roseland, Elizabeth Castillo, Melanie Gall, & Nerrissa Pinto (2020). Maryvale community capital dashboard.

- Yılmaz Argüden, Pınar Ilgaz, & Erkin Erimez (2019 April 3). Municipality Integrated Reporting model: The Famous Istanbul District, Kadıköy adopts integrated reporting.