Click here to download this article as it appears in the magazine, with accompanying artwork.

Editors’ note: This article is from the Summer 2022 issue of the Nonprofit Quarterly, “Owning Our Economy, Owning Our Future,” and was excerpted from Mutualism: Building the Next Economy from the Ground Up, by Sara Horowitz (Random House, 2021). Reprinted with permission.

A healthy mutualist organization must try to plan for at least two generations in the future. How? The organization can’t rely on the leadership of a single charismatic, intelligent, or innovative founder. It must, instead, create a self-reliant institution that is bigger than any one person. It can do this by creating offices (president, treasurer, and so on) that outlive the people who occupy them, or by creating a board of directors (made up of the organization’s members), which confers decision-making authority to a group. Some mutualist organizations, especially cooperatives, even adopt a set of principles to guide them; a founder may die or move on, but the principles that define the institution live on.

Decoupling an institution from a single founding individual doesn’t mean doing away with leadership. To the contrary, a mutualist organization must get comfortable with the idea of leadership if it is to survive, whether the leadership is in the form of an elected president, a board, a set of guiding principles, or some combination of all these. Why is leadership so important? One of the key aspects of a mutualist organization is its ability to self-determine. Without leadership, it’s impossible for the organization to make adult decisions about where its money does or doesn’t go. A mutualist organization’s leader or leaders should be held accountable by the community of interest, and structures should be put in place to allow the transmission of knowledge from one generation to the next. Hierarchy in a mutualist organization exists not only to facilitate decision-making but also to provide a path toward leadership—and a way to transmit the organization’s core values and missions— for a new generation.

To plan for the long term, mutualist organizations also need to take a long-range financial view by making investments that ensure they will continue to exist to serve future generations. When I started building the Freelancers Union, I was surprised by just how hard this is to do. Mutualist organizations today are starved for capital that can help them build or expand, because they need a kind of investment—an investment of patient capital—that just doesn’t exist.

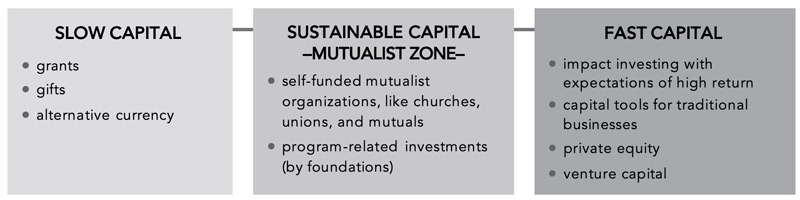

What do I mean by “patient capital”? All monetary exchanges, from financial gifts (investments made with an expectation of a zero-percent return over an indefinite time period) to usury (predatory loans made with interest rates so high that the borrower will be in debt indefinitely), exist on a spectrum along which the variable that changes is the rate of return. Between these two extremes is every form of economic activity that you can imagine—from foundation grants and Section 8 public housing to your neighborhood check-cashing place and the aggressive investments of Fortune 500 companies and venture capitalists.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Mutualist organizations . . . plan for the future by investing in themselves. They do this by recycling excess capital generated by their economic mechanism back into the organization.

We call these categories of monetary exchange capital markets, which is just another way of talking about where the money comes from. If you want to do something that requires capital, who is going to loan you a big chunk of money to do it, and what are they going to expect in return? Most of capitalism occurs toward the right side of this graph: fast capital and investments expected to produce huge returns in a few years (as is the case of a Silicon Valley start-up). Most charity occurs toward the left side. In the middle is a section that is curiously empty in the twenty-first century—sustainable capital: investments that will reliably make money but aren’t going to make anyone obscenely rich over a short period of time. This is the mutualist zone. One of the only forms of patient lending available in today’s capital markets is mortgages, which is why one of the first things many sophisticated mutualist organizations do is get a loan to buy a building. Otherwise, progressive markets—where investing meets social purpose—are almost impossible to find.

So mutualist organizations also plan for the future by investing in themselves. They do this by recycling excess capital generated by their economic mechanism back into the organization. One type of organization that recycles excess capital all the time is an endowment—an organization that makes investments and then reinvests a certain portion of the returns back into the endowment, growing it over time. But you don’t have to have a billion-dollar endowment, as many universities do, to recycle capital effectively. You just need to recognize that any extra money in a mutualist organization is for the community the organization serves, and the best way the community can use that money is in ways that will perpetuate the organization’s continued existence. This could be through traditional investments, as in the case of a university’s endowment, or it could be through a more general investment in the future, such as saving up to purchase a building for the organization, investing in relevant training for members, or putting the money in a pot set aside for members to use in case of emergency. What matters most is that when you have more money than you expect to, you use it to plan for the community’s future.

A mutualist organization is always planting saplings that its founders will never see grow into mature trees. The shade of those trees is for the next generation.