August 13, 2020; Star Tribune (Minneapolis, MN) and Duluth News Tribune

The three trustees of a private foundation increased their salaries by approximately 300 percent over the course of just a few years. They built out lavish new offices—so lavish that the trustees considered they might be embarrassing if a meeting with local representatives like former Senator Al Franken and present Senator Amy Klobuchar were held there. One of the trustees expressed concern that “the display of wealth would be off-putting and would cause them to investigate or inquire more serious[ly] about how we are spending our money.” At least one of the trustees ran for-profit businesses out of the nonprofit offices. The trustees had the Trust make grants to organizations outside its geographic mission area, and to projects that fall outside of the guidelines. One, a half-million-dollar grant, reportedly went for the purposes of advancing the political career of an acquaintance of one of the trustees. Now they are trying to sell of the single most profitable asset the foundation has, with the goal of lining their own pockets.

These are among the accusations levied against trustees of the Otto Bremer Trust, based in St. Paul, Minnesota, by the state attorney general, Keith Ellison. According to reports in the Star Tribune and the Duluth News Tribune, Ellison is asking the Ramsey County Probate Court to remove the three trustees currently running the Trust, replacing them with interim trustees.

Over the past few years, staff at the foundation have also expressed concern about the ethics of the trustees, as have other foundations in the area.

Trust staff, currently composed of 22 employees, questioned $3.8 million in grants to nine charities that the trustees were personally affiliated with, either by serving on their boards or having close family on them.

“We have sworn affidavits and testimonies from current and former employees that are being filed in the form of exhibits,” said John Stiles, a spokesman for Ellison’s office. “We have 238 exhibits.”

This is the second time in recent days that a state attorney general has filed significant charges against a nonprofit. Earlier, NPQ shared the news about the attorney general in New York filing to dissolve the NRA and have its CEO barred from being involved in any nonprofit in the state. As with this case, a significant portion of the argument is that the leaders of the nonprofit took undue personal gain and therefore fell afoul of the state’s nonprofit law.

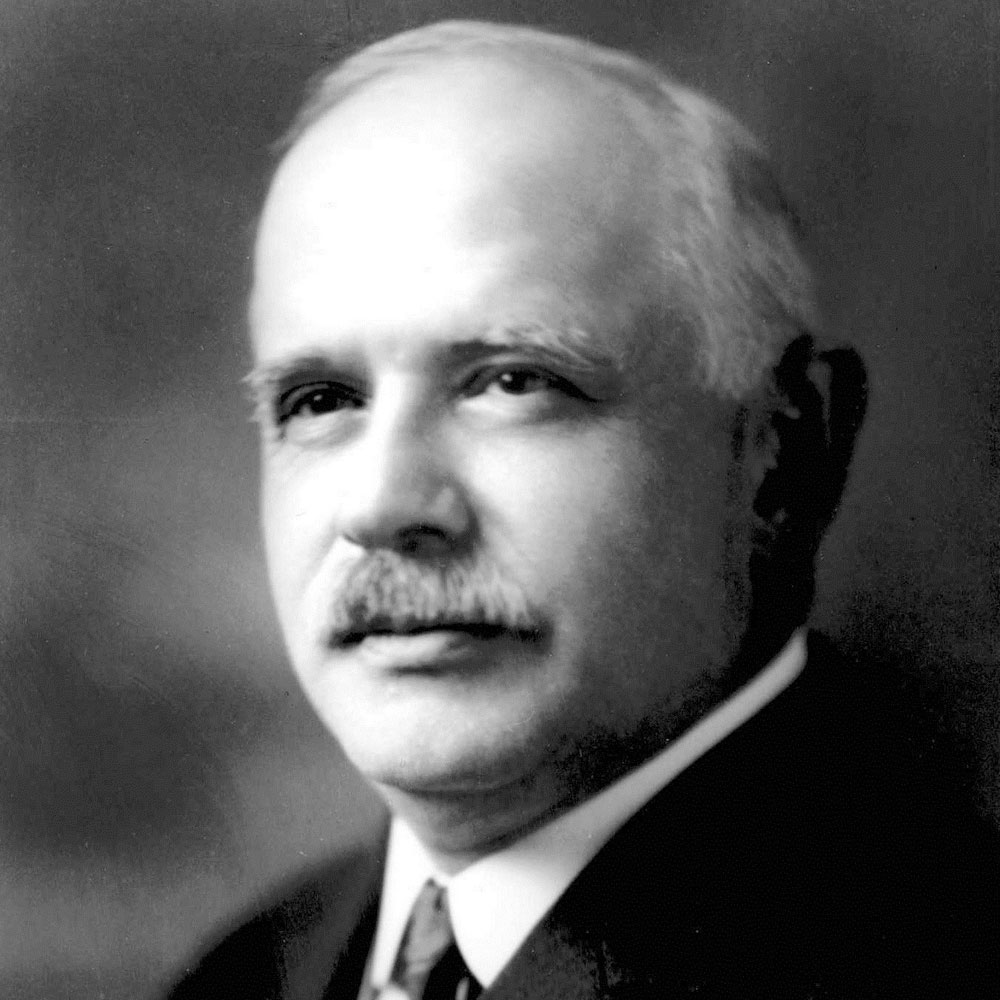

The case of the Bremer Trust is an interesting one, with a corporate structure that is very unusual. Otto Bremer immigrated to the US from Germany in 1886. Otto had taken some classes in banking back in Germany, and after a brief period working in wholesale, he joined the National German-American Bank as a bookkeeper and rose through the ranks. Eventually, in 1924, Otto gained a controlling interest in the American National Bank in St. Paul.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Otto quickly made a commitment to rural communities, and American National formed partnerships with several country banks in Minnesota, Wisconsin, and North Dakota. With challenges after World War I, Otto had controlling interest in 55 banks in those states and Montana.

Otto created the Otto Bremer Company in 1943 as a bank holding company to consolidate holdings in the country banks. A year later, he created the Otto Bremer Trust, which was to make charitable contributions to causes in areas served by the country banks. In 1949, ownership of the Otto Bremer Company was transferred to the trust.

The Otto Bremer Trust ended up with 92 percent ownership of what remains of those country banks, which have been consolidated into Bremer Financial and the Bremer Bank. That makes the Bremer Bank the only bank owned by a nonprofit. The remaining portion of the Bank is owned by its employees.

In its 2019 IRS Form 990-PF, Bremer Trust listed more than $1.1 billion in assets, and contributions totaling more than $45 million. It also shares that the three trustees cumulatively were paid more than $1.4 million and documents that more than $2.1 million in legal fees were paid.

When the foundation was created, the intent was for it to own the bank holding company which would serve as an ongoing source of income so the foundation could build its assets and the funds that it could give away. In recent years, the three trustees have made a series of moves designed to sell off the Bremer Bank. Their argument is that this would significantly increase, perhaps even double, the trust’s assets and increase what it could give in the shorter term.

Because of some changes in the law, the Trust is only allowed to have a minority voice on the board of Bremer Financial, and the trustees of that entity have been fighting against the sale. They argue that the original intent of Otto Bremer was for the bank to remain independent and continue to have a commitment to rural, agricultural communities. Lawsuits and legal filings have been flying. As part of the battle, trustees of the Trust have transferred some of their voting stock to 19 out-of-state hedge funds with the goal of replacing the Bremer Financial board of trustees and then putting the bank up for sale.

In his written statement, Attorney General Ellison essentially sides with Bremer Financial executives, accusing the trustees of the Otto Bremer Trust of “serious breaches of fiduciary duty.” Ellison has asked for all pending litigation to be put on hold while his charges are considered. He calls for the trustees to be ousted and replaced with a former District Court judge, a former executive at the Minnesota Council on Nonprofits (and erstwhile NPQ author and supporter) Marcia Avner, and a former President of the St. Paul Foundation and the Minnesota Community Foundation.—Rob Meiksins