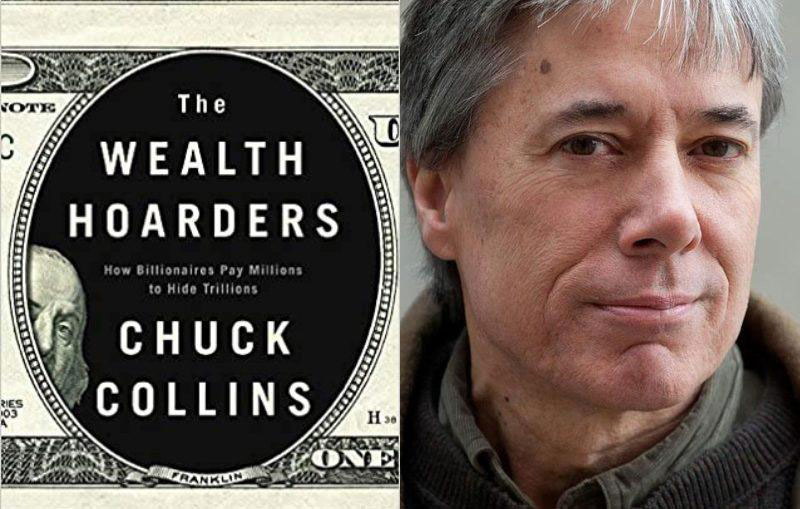

This section is excerpted from pp. 118-121 of The Wealth Hoarders: How Billionaires Pay Millions to Hide Trillions (Polity Books). Republished with publisher permission. For more information, see www.wealthhoarders.com.

A significant portion of hidden wealth touches down to earth in the form of real property and luxury real estate. Across the world, skyscrapers and mansions are rising in globalized super-cities, a form of “wealth storage” for the world’s wealthy who are seeking to diversify their asset holdings. These are not people looking for homes so much as wealth parking spots.

This is leading not just to gentrification, but to a “plutocratization” of urban neighborhoods. As Richard Florida observes in The New Urban Crisis, “Some of the most vibrant, innovative urban neighborhoods are being turned into deadened trophy districts, where the global super-rich park their money in high-end housing investments as opposed to places in which to live.”1

Perhaps the original super city for buying shell real estate was London. Entire neighborhoods—such as Kensington and Mayfair—were transformed into ghost towns of absentee-owned properties, many of them empty.

As the UK cracked down on anonymous ownership by announcing the creation of a beneficial ownership registry, global investors looked elsewhere. US and Canadian luxury real estate markets became more and more attractive. Vancouver suffered such an influx of global investors buying real estate that the city and later the province of British Columbia enacted strict restrictions on foreign buyers.2

New York City was an obvious first destination in the US for global capital. In 2015, The New York Times published a rigorous work of investigative journalism, “Towers of Secrecy.” The series documented the impact of anonymous buyers on Manhattan’s luxury market.3 They traced multiple shell company owners to criminal activity and money laundering by foreign buyers.

In 2014, 54 percent of real estate purchased in New York for more than $5 million was acquired in the name of anonymous shell companies. In the 6 most expensive condo projects in the city, the owners in a majority of units were hidden by shell companies, including 77 percent of the units in One57 and 69 percent of the units at The Plaza. The value of the 900 condominiums in these 6 buildings was equal to the value of 20,000 average American homes.4

Many US cities, especially coastal markets, are experiencing similar trends, with thousands of new luxury residential and rental units in different stages of development. A decade from now, the skylines and population demographics of many US cities will be transformed by decisions being made today for the benefit of the ultra-rich, not the residents of those cities.

As cranes rise up over many cities, it is clear that the luxury construction boom does have benefits. These projects provide jobs in the building trades and increase property tax revenue for the city. And there are additional jobs in the “service-rich lifestyle” sector that accompanies luxury development.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

But the boom poses perils for US cities, many of which are experiencing affordable housing emergencies. It is hard for city policy makers to look past the construction boom hype and ask critical questions about the disruptive impact of their city’s luxury real estate boom.

The affordable housing crisis is not driven primarily by foreign investment. Both domestic and foreign capital are surging back into cities, as wealthy people have a renewed interest in living in center cities or holding a pied-a-terre apartment. As Richard Florida observes, “Gentrification and inequality are the direct outgrowths of the recolonization of the city by the affluent and the advantaged.”5 Florida writes,

It’s not so much an incursion of super-rich plutocrats that is transforming many of the world’s great cities as an incursion of the much larger numbers of merely well-off people, including the growing ranks of startup entrepreneurs, venture capitalists, and well-paid techies who are trading in their houses in the suburbs for condos, apartments, and townhouses in superstar cities.6

Wealthy workers moving into central and walk able neighborhoods are more classic forces of gentrification. But global capital is supercharging these gentrification dynamics by injecting additional cash and disruption into the market.

In my hometown of Boston, thousands of units of luxury housing are rising around the central city, with over 5,000 high-end units in the permitting and construction pipeline. High-end rental and luxury condos have transformed the Seaport area into a neoliberal neighborhood, with virtually no public space, coastal access, or services such as schools and libraries. In an analysis of eight luxury buildings, with condos starting at $2 million, over 35 percent were owned by shell companies or anonymous trust entities. In one building, Millennium Tower, anonymous ownership makes up closer to 80 percent of the units.7

Miami has historically been a magnet for foreign investment from all over Latin America and the Caribbean. “Foreign investors have driven home prices out of whack with local incomes,” wrote Miami Herald reporter Nicholas Nehamas. Between August 2015 and July 2016, foreign nationals accounted for 39 percent of total residential real estate purchases in South Florida, over $6.2 billion.8

Los Angeles is experiencing an empty homes crisis alongside acute homelessness. One report found more than 103,000 vacant units in Los Angeles with over 41,000 not on the market. There are an estimated 36,000 homeless families in the city. Tens of thousands of housing units are being withheld from the market by speculators and anonymous ownership entities (including trusts, LLCs and shell corporations) that are simultaneously overproducing luxury housing and fueling displacement, homelessness and a crisis in housing affordability. Of the 25 luxury condominium buildings profiled in the report, 2,399 of 3,244 units, or 71 percent on average, are sitting effectively vacant—they are not anyone’s primary residence.9

“Knowing that our city is failing so dramatically to house people, it’s shocking to find tens of thousands of units are sitting empty, many just to fill the pockets of investors. People deserve to know who owns their city and who benefits from this injustice,” says Alex Ferrer, with Strategic Action for a Just Economy in Los Angeles.10

Seattle is experiencing a luxury boom, with thousands of new luxury units in the pipeline. In a 2019 report that I coauthored, we sampled eight new luxury building projects containing 1,635 units, all costing $2 million or more. Limited liability companies or trusts that masked the real owners and beneficiaries owned over 12 percent of units. In one luxury tower, the percent of anonymous ownership was as high as 47 percent—with only 19 percent of all owners registered to vote there. In all of the 1,635 units, only 39 percent of owners are registered to vote at the property, a figure nearly 40 percent lower than that of Washington State as a whole.11

Notes

- Richard Florida, The New Urban Crisis (Basic Books, 2017), p. 6.

- Paul Roberts, “Is Your City Being Sold Off to Global Elites,” Mother Jones, May/June 2017. Also see: City of Vancouver. “Empty Homes Tax.” City of Vancouver, RedDot CMS, 6 June 2018.

- Louise Story and Stephanie Saul, “Stream of Foreign Wealth Flows to Elite New York Real Estate,” The New York Times, February 7, 2015.

- As part of the “Towers of Secrecy” series, published by The New York Times, see this short video overview of absentee owned buildings.

- Florida, 2017, p. 4.

- Florida, 2017, p. 42.

- Chuck Collins and Emma de Goede, Towering Excess: The Perils of the Luxury Real Estate Boom for Bostonians (Institute for Policy Studies, September 2018).

- Reporting on data from the Miami Association of Realtors. Nicholas Nehamas, “Buying a home in Miami-Dade is so expensive, it could hurt the economy,” Miami Herald, February 9, 2017.

- Alex Ferrer, et. al., “Who’s Buying Los Angeles? How Speculative Finance Keeps Houses Vacant and People Unhoused,” Strategic Actions for a Just Economy (SAJE) and the Alliance of Californians for Community Empowerment (ACCE), April 2020.

- Ferrer, 2020.

- Chuck Collins, “Who is Buying Seattle? The Perils of the Luxury Real Estate Boom for Seattle,” Institute for Policy Studies, (October 2019)