This is the second part of a two-article series. As NPQ readers surely know, ten years is quite a long time, with the potential for great change both legislatively and culturally. As we run this piece, remember that it was written before the 2016 presidential election, with no eye toward the changes that may come with a Trump presidency.

The burden of student debt can make choosing a nonprofit career—and sticking with it—hard to do. Earlier this month, we wrote about the serious negative impact of student debt in “Student Debt Is Hurting the Nonprofit Workforce—and You Can Do Something about It,” and a recent survey conducted by CalNonprofits confirms that student debt is hurting recruitment, retention, and diversity in the nonprofit workforce.

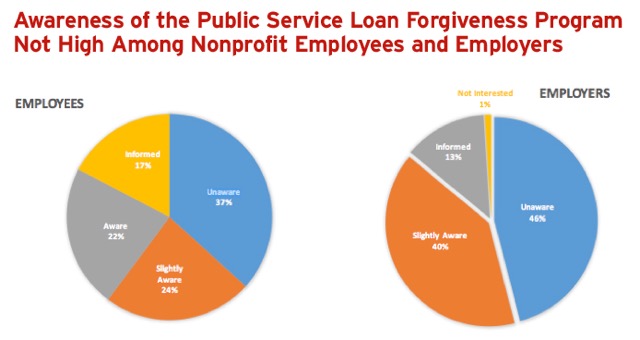

But there’s good news! The federal government offers a program that makes staying in the public sector easier: Public Service Loan Forgiveness. PSLF eliminates your debt after 10 years of payments. Shockingly few people know about this program (see the chart below) but it can bring life-changing debt relief to thousands of nonprofit employees—and it’s also a great recruiting tool for nonprofit executive directors and HR managers.

I think the PSLF program is the best thing since sliced bread! Not only does it allow nonprofits to build their capacity with qualified graduates, but it allows me the graduate to make a reasonable payment each month, and will forgive some of my debt.

In a nutshell, the PSLF is a federal program from the Department of Education that helps nonprofit staff with student debt stay in the sector by forgiving the balance of their student loans after 10 years of payments. Since 120 qualifying payments must be made on eligible federal student loans after October 1, 2007, the first applications for debt relief will be accepted in October of 2017.

For an overview of the program, necessary forms, and to find out if you’re eligible, go here.

I paid on my loans for five years before I started working toward my 120 PSLF payments, so I’ll have paid on my loans for 15 years before my debt gets wiped out. And that’s a bummer. But it means that I’ll be debt free by the time I’m 45, not 60. And that’s huge!

Got debt? Here’s what to do NOW:

First, figure out if you are eligible for Public Service Loan Forgiveness. Do you have qualifying loans and are you on a qualifying repayment plan? Qualifying repayment plans are income-driven: your monthly payments are tied to your income level.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Second, be sure you work for a qualified employer. Any job—program staff, receptionist, CFO—is eligible, as long as it is with one of the following:

- 501(c)(3) nonprofit organization

- Government agency

- Public child or family service agency

- Tribal college or university

- Peace Corps or AmeriCorps

- Others detailed in Section 4 of the Employment Certification Form

Third, track your progress by submitting Employment Certification Forms from your nonprofit employers to FedLoan Servicing, the agency contracted with the Department of Education to manage this program. Get one form from each organization certifying the dates you were employed and the average number of hours you worked each week. Your current employer can check the “currently employed” box.

Fourth, submit an Employment Certification Form every year going forward, even if you’re with the same employer. This is a new program, so mistakes may happen. Check your FedLoan account frequently to make sure your loan payments count toward the magic 120.

Finally, once you reach that number, complete the Application for Loan Forgiveness. It hasn’t been written yet, but will be available at MyFedLoan.org by October 2017.

Want to support staff with student debt? Here’s what nonprofit executive directors and HR managers can do now:

First, check that you are a qualified employer (see the list above). If your organization does not fit those categories, you may still be qualified—check the definition in Section 4 of the Employment Certification Form. Unfortunately, labor unions, partisan political organizations, 501(c)(4)s, and foreign nonprofits not operating in the U.S. are not qualified employers right now.

Then, familiarize yourself with Public Service Loan Forgiveness and create a support program for your employees with student debt. Promoting PSLF can help boost staff morale, retain employees, and recruit the best and most diverse candidates by offering something that for-profits can’t—appealing to their hearts (their desire to work for the community) and their heads (their desire to be debt-free in a reasonable amount of time).

And we need to be advocates, too. The PSLF program has faced opposition in Congress, so it’s important to be aware that who and what we vote for will impact the future of the Public Service Loan Forgiveness Program and other student debt alleviation programs.

Please visit the CalNonprofits Nonprofit Student Debt Project website for updates and resources for both employees and employers, including an Employer Toolkit that we are currently developing to increase awareness and education about PSLF. Nonprofit Student Debt Project manager Christina Dragonetti is spearheading the development of the toolkit—contact her for more details.

Get the facts and spread the word about Public Service Loan Forgiveness! The time for alleviating the burden of student debt and keeping nonprofit employees committed, talented and diverse—and happy—starts now.