Editor’s Note: Many nonprofits know that they should be building reserves over time, but find it hard to do so without hobbling their work. Perhaps with a better understanding of full costs, we should all be educating funders about their responsibilities in that regard. Here’s a way for readers to approach the endeavor. This article is from the Nonprofit Quarterly’s spring 2016 edition, “Strategic Nonprofit Management: Frameworks and Scaffolding.” Its original online publication date was May 2, 2016.

Recent years have seen a gradual but marked shift in philanthropy, from a traditional emphasis on program- or project-focused restricted grantmaking to more flexible funding that enables organizations to build their management infrastructure in addition to (and in support of) delivering programs. This trend parallels the growing awareness within the nonprofit sector of the critical role management capacity plays in an effective and sustainable organization, as publicized by campaigns such as the Overhead Myth,1 essays like “The Nonprofit Starvation Cycle,2” and Dan Pallotta’s now-famous TED talk.3

While the demonization of overhead and reluctance among many institutional and individual donors to support nonprogrammatic functions certainly still exist, we now have the first stirrings of a potential critical mass of grantmakers, nonprofit leaders, and other sector stakeholders dedicated to breaking the association of overhead with waste and forging a new association of overhead with sustainability and effectiveness.

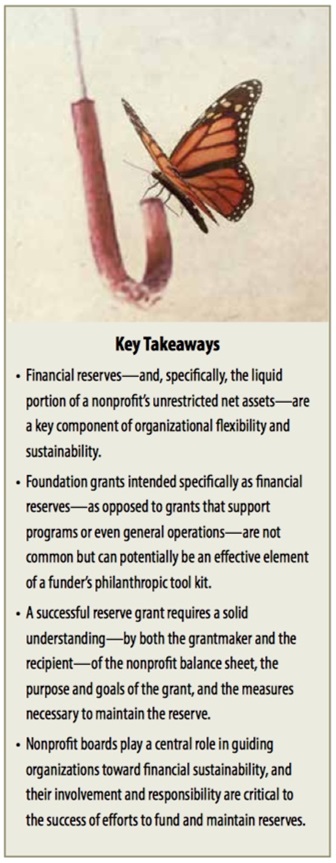

So, having only just gained some collective traction around the value of grants for general operations, it may seem premature to make a case for a type of grantmaking that, if anything, departs even further from the traditional program-focused model. Nonetheless, that is the case we will be making in this article: to highlight another potential item in the philanthropic tool kit for supporting and strengthening grantees. This is grantmaking that bypasses operations altogether and instead looks to strengthen the financial position of grantees by providing funding for financial reserves and liquidity.

Of course, there’s probably nothing less sexy in philanthropy than writing a check to build a grantee’s reserves. By design, it doesn’t translate to a number of meals served, performances presented, or children taught to read. “We made twenty grantees’ balance sheets look better” isn’t the kind of outcome statement that gets trumpeted in a foundation’s annual report. But, given the financial constraints and revenue volatility within which many nonprofits operate, reserves can be a critical source of financial security for organizational leaders and, for some, literally the difference between sustainability and collapse.

The practice of building grantees’ reserves is still so uncommon that there is no single term for it (for grants that are not program specific, we have general operating support). Names we have encountered for this type of funding include reserve grants, liquidity grants, or even balance sheet grants (all accurate, but none particularly inspiring). This type of funding is also different, at least in spirit, from the growth capital or equity-like investments promoted by more progressive nonprofit funders and stakeholders such as the Nonprofit Finance Fund and the F.B. Heron Foundation. Those kinds of investments seek to imitate for-profit equity stakes, with a particular focus on creating the capital structure necessary for scale. Our focus here is on grants made primarily for purposes of establishing (or bolstering) an operating reserve as a hedge against real or potential cash-flow challenges.4

In this article, we will examine a few examples of reserve grantmaking by funders who have experimented with the practice, sharing lessons of what to do—and not to do—to make these grants effective in supporting nonprofit sustainability. Above all, the key to a successful reserve grant is ensuring that the grant recipient has the appropriate knowledge, understanding, and—most critically—buy-in as to the nature of the support and its purpose of building financial resilience and sustainability over the long term.

What Reserves Are and Are Not

In the past, those foundations seeking specifically to support long-term financial health and sustainability among grantees have mostly done so through contributions to endowments and endowment campaigns, which tend to be limited to major cultural institutions and other nonprofits with long time horizons. But as Clara Miller, president of the F.B. Heron Foundation, and others have noted, a permanently restricted endowment, especially one that commits an organization to particular future activities, may not always be an advantageous form of capital for every organization.5 In any case, every nonprofit still needs access to a stable financial base that will allow for meeting day-to-day cash needs, weathering financial downturns, and investing in new opportunities—accessible, relatively liquid resources that can be tapped as needed to strategically support organizations’ execution of their missions.

On the nonprofit balance sheet, such resources are represented as unrestricted net assets (available for use at the discretion of organizational leaders), unlike temporarily restricted net assets (which are designated by a funder to be used for a specified purpose or within a particular time frame) or permanently restricted net assets (endowments from which organizations can typically only use income derived from their investment).6 But even unrestricted net assets have limitations, because this figure includes whatever value an organization holds in the form of buildings, property, equipment, furniture, and other illiquid assets. (While a well-furnished office is a good and valuable thing, try convincing an employee or a vendor to accept the conference room table in lieu of a check.)

At FMA, we use the term LUNA to refer to an organization’s liquid unrestricted net asset balance—that portion of an organization’s net assets that exists in a liquid form and can be used at management’s and/or the board’s discretion.7 LUNA represents an organization’s true financial reserve position: resources that are neither committed to specific uses (or, in the case of endowments, committed to not be used at all) nor tied up in fixed assets or other illiquid investments. Organizations examining their balance sheets through this lens often come to the realization that their financial reserve position is, in fact, very tenuous; indeed, it is not uncommon for an organization to have a negative LUNA balance, indicating that funds are in essence being borrowed from other asset categories (or from other sources) to cover this deficit.8 Organizations with a negative or only narrowly positive LUNA metric have very little financial cushion to pursue opportunities or mitigate risks.

The foundations discussed below have focused on their grantees’ financial resilience and sustainability by paying attention to this liquid unrestricted net asset metric as well as targeting grants and other support, toward improving that key indicator of financial health and flexibility.

Shoring Up a Shaky Balance Sheet

For most nonprofits, having an unrestricted net asset balance of zero sounds like a nightmare, but for some it is a goal (or at least a step in the right direction). Due to accumulated operating deficits over the years, some organizations find themselves in a negative unrestricted net asset position, facing both the cash-flow challenges and financing costs of carrying debt on an ongoing basis. This also proves to be one of the most difficult situations for nonprofits to fundraise their way out of, because very few funders want to give money to make up for the financial shortfalls of activities long past. In such situations, however, some foundations have been willing to take the long view by providing funding that shores up a grantee’s shaky balance sheet, in order to provide a more stable foundation for the future.

One such example comes from Tipping Point Community, a grantmaker in the San Francisco Bay area committed to providing unrestricted funding as well as management assistance and expertise to its grantees. In the wake of the 2008 financial crisis and subsequent fundraising challenges, a community-based social service agency and long-time grantee of Tipping Point had fallen into a negative (unrestricted) net asset position. The organization was able to stabilize its operations at a basically break-even level, so while its accumulated deficit of around $80,000 was not worsening, it also was not improving. The time and money required to finance debt, manage credit, and juggle payables were draining the organization’s financial and management resources. The executive director of this grantee described the situation as “a scary time for the organization—we almost ran out of cash. We came into the economic slowdown without realistic projections about how hard it would hit us, and got into a hole we had to work ourselves out of.” He was transparent with Tipping Point about the financial situation the organization was facing, and, in turn, the foundation immediately looked for ways to offer support. “At the time, they didn’t have the internal capacity for good financial forecasting and were being too optimistic in their projections,” explained Elena Chavez Quezada, then a senior program officer at Tipping Point. “We got them support to build the internal systems they needed, hire the right CFO, and begin to turn things around. We also wanted to take a longer-term view and help them think about building something they had never had before: a reserve.”

Based on its close collaborative relationship with this organization and its commitment to nonprofit capacity building, Tipping Point was willing to make what it describes as a “targeted investment” to help the organization begin to break out of its debilitating cycle of financial vulnerability. As Quezada described it, the intention was to create a “culture shift and mind shift” by providing the beginnings of a reserve fund that would allow the organization to reduce its dependence on costly external credit and wipe much of the net asset deficit from its balance sheet, while at the same time building a mindset of financial saving and thinking beyond the current year’s programs.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The form of the grant itself supported this reorientation toward financial sustainability, because it consisted of a $20,000 matching grant, offered if the organization’s board could raise $20,000 of its own—bringing the total potential fund to $40,000. (Tipping Point maintained its funding for the organization’s operations, as well.) The new CFO of the organization pointed to the matching component as helping to create “much more momentum than just a one-shot grant for a reserve. It got us into the rhythm of setting money aside on a monthly basis.” The board was able to meet its match requirement easily, even ahead of schedule.

At the same time, “We seriously rightsized the organization,” said the executive director. “We took a realistic look at revenues and expenses and rethought how we deliver services in a way that was supportable, given our revenues. It’s hard to build a reserve, because we all want to give more service—but this process included coming to the realization that in order to give that service, you have to be in a financially secure position.” Without this structural adjustment, of course, the reserve would have quickly disappeared, and both sides noted that the foundation’s support in terms of providing resources for financial planning and management was just as important as the cash itself.9 “There was a whole set of support to us beyond just the dollars,” the executive director continued, “in terms of help in thinking about how we do reporting, planning, and projections, and tell our financial story.” Quezada concurred: “We liked the idea of a targeted investment for reserves, but without the right systems in place it wouldn’t be effective. It was the financial investment but also the overall support, in terms of how to forecast what are your full costs, what is your realistic revenue, and how do you get those in line in a sustainable way.”

The result of this investment and support has been, in a word used by both the funder and the organization, transformational. From the initial seed of $40,000, the organization’s cash reserve has grown to over $300,000. Reflecting the organization’s new attention to operating reserves and financial stability, the CFO noted that this amount was “halfway to where we want to be”—ultimately working toward a goal of six months of operating expenses available in reserve.

Attempting to Address Working Capital Challenges

What the Tipping Point example shows is that the monetary award itself is only one element of a successful reserve grant. Also necessary is an organizational understanding of and commitment to the importance of a financial reserve and the sometimes difficult decisions that may be required to ensure that new funds don’t simply get swallowed up into underfunded operations.

Yancy R. Garrido, senior program officer at the Clark Foundation, echoes the point of ensuring this commitment from a grant recipient’s full leadership team—executive staff and the board of directors—as essential for a reserve grant to achieve its intended purposes. The funder learned this lesson from a less successful strategy intended to build upon its traditional general operating support dollars (87 percent of the foundation’s grants are unrestricted). The Clark Foundation had some historical experience with making grants for endowment campaigns, but following the 2008 financial crisis, Clark identified working capital as a much more critical need for the nonprofits in its portfolio. These organizations, many of which were key social service providers and heavily reliant on government contracts, were pushed to the financial brink as public funding retrenched and payments slowed down. The need for (and absence of) reserves just to manage day-to-day cash flow became overwhelmingly apparent among several of the foundation’s grantees.

In response, Clark made significantly larger general-support grants to important community-based organizations to address their needs for working capital. The grants were intended to function as reserves to remedy cash-flow timing challenges in the short term but then be replenished from operating revenue and maintained as financial reserves for the long term. Unfortunately, the grants did not achieve these goals. While the results differed in the details and particulars, none of the recipients were able to make the adjustments necessary at that time to preserve the funds as a source of financial reserve and working capital. This was particularly frustrating for the foundation, because most of the organizations had, in fact, developed practical financial action plans through the use of outside consultants. However, buy-in to those plans from both executive staff and board members was lukewarm, and the consultants were not retained for what would have been a challenging implementation phase requiring difficult decisions to make operating budgets sustainable. Within the ongoing urgency of program and service delivery, the organizations directed their unrestricted resources toward operating expenses. In the absence of strategies to make the structural changes necessary to bring overall expenses in line with available revenues, the funds were quickly exhausted.

This example helps illustrate a significant lesson for this type of grantmaking: few nonprofit organizations are accustomed to receiving grants meant to be saved rather than spent. Particularly when facing a significant revenue shortfall, it can seem counterintuitive to hold funds in reserve while reducing services and making structural expense-side cuts needed to bring the budget into balance. But if a recipient treats a reserve grant as just another source to cover operating costs, then the entire point of the grant (and the financial stability it is meant to support) is lost. Garrido noted that organizations need the knowledge and the discipline, at both the management and board levels, to understand the importance and appropriate use of reserves and to keep operating revenues and expenses in balance such that the reserves can be maintained (and ideally increased) over time.

As Garrido described it, a lesson the Clark Foundation took from this experience is the critical importance of board members being deeply aware of their organizations’ financial situation and their role in ensuring long-term sustainability, and that they participate in planning and accountability around the implementation of financial strategies. (As part of Clark’s standard due-diligence practice, a grantee’s key board officers are now required to be present at site visits and meetings when the grantee is under consideration for funding.) The good news is that most of Clark’s grant recipients participating in this experiment did finally get their boards involved and were able to achieve the original goals, albeit several years later. Another recipient was saved through a merger into a larger entity, and yet another, unfortunately, eventually closed due to its lack of financial and leadership capacity. The foundation’s ongoing efforts in this area focus particularly on board governance and achieving appropriate oversight between board and staff leadership.

Reserves as a Component of Operating Grants

The examples highlighted earlier illustrate funders attempting to address operating reserves and working capital in the context of rather urgent financial need, if not outright crisis. Ideally, however, reserves are built during times of relative calm so that they are there to draw upon when needed.

The Los Angeles, California–based Weingart Foundation has been experimenting with reserve funding in a limited way since 2011, by including a contribution to reserves as a component of a small number of its general operating-support grants. For example, explained Joanna Jackson, Weingart’s director of grant operations, a $175,000 grant over a two-year period may consist of general operating support of $150,000 and a $25,000 contribution to reserves. Jackson noted that this openness to funding operating reserves was itself an “organic” evolution of the foundation’s shift from program-specific grants toward more general operating support (what the foundation calls its core grant program), developed in response to grantee needs for flexible funding during (again) the 2008 financial crisis and subsequent recession. As the foundation saw how critical unrestricted funding can be to nonprofits trying to plug financial holes across their operations, it also began to appreciate the importance of setting something aside for the next crisis (or, more optimistically, the next opportunity). Thus, the reserve component of grants can serve the same function over the long term that unrestricted operating support does for the current budget year—namely, to provide the financial flexibility that nonprofits need to best advance their missions.

When asked what makes for a successful reserve grant, Jackson sounded a common theme with the other examples highlighted here: keying in on grantee alignment with the grant’s purposes and expectations. “Never make the operating reserve gift unless the organization’s leadership has bought in,” she opined. The foundation’s approach to these grants puts that philosophy into practice by, for instance, including the reserve component of grants when an intention to build financial reserves is an element of the grantee’s own long-term strategy rather than something imposed as a condition of the grant. (Again, in the majority of cases, Weingart’s grants do not include the reserve component.) While the foundation does expect that recipients will have a board-level policy addressing management of the reserve, Weingart doesn’t dictate the terms of the policy or set restrictions as to the use of the funds. Because there is no additional financial benefit to having the reserve element to the grant (it is a carve-out from the overall grant amount, rather than an add-on), Weingart sees it as a way of supporting those organizations that are truly thinking proactively about their financial health and sustainability.10 The foundation has also provided training on capitalization, liquidity, and financial health as a way of encouraging this mindset among its grantees.

Conclusions

Conclusions

While not yet a widespread philanthropic practice, grantmaking that promotes nonprofit financial health and sustainability by explicitly strengthening reserves can be just as impactful as grantmaking to support programs. Indeed, strategically targeted grants of this kind can have a transformative effect on organizations, allowing them to break the cycle of cash-crisis management and spend more time and energy focused on long-term planning and program delivery. Based on the experiences of the funders and foundations discussed in this article, grantmakers interested in exploring reserve grants should keep the following lessons in mind:

- Nonprofit executives and board members need to understand the significance of the balance sheet and commit to strengthening financial reserves as a key part of their long-term financial strategy. That understanding and buy-in have to be present for a reserve grant to serve as the basis for long-term financial stability rather than just plugging short-term funding gaps.

- Combining monetary grants with financial-management education can be an effective one-two punch for improving nonprofit financial resilience.

- Reserve grants can be an effective way of stimulating additional board involvement in fund raising while also building financial strength by creating a match program to increase the amount of the grant.

- Nonprofit boards should carefully govern reserves and set appropriate policies for their use and replenishment. This includes approving and monitoring a budget that allows for the preservation (and, ideally, accumulation) of reserves over time.

Grants to support nonprofit programs and operations are and will remain philanthropy’s primary focus—and rightly so. The funding that foundations and donors provide to nonprofits is the lifeblood that fuels social change, services to communities, and artistic excellence. At the same time, financial security can provide those organizations with the stability they need to deliver their programs without the constant distraction (and cost) of deciding which expense can wait another month or how much credit will be needed to meet payroll. For this reason, we believe that grants intended solely as financial reserves can be a very important part of the philanthropic tool kit, helping to maximize the impact of programmatic dollars themselves.

Notes

- GuideStar, BBB Wise Giving Alliance, and Charity Navigator, “The Overhead Myth: Moving toward an Overhead Solution,” open letter to U.S. donors, June 2013.

- Ann Goggins Gregory and Don Howard, “The Nonprofit Starvation Cycle,” Stanford Social Innovation Review, Fall 2009.

- Dan Pallotta, “The way we think about charity is dead wrong,” TED Talk, March 2013.

- In accounting terms, reserve grants and growth capital are generally identical in being unrestricted assets on the balance sheet; thus, the distinction here is more in the spirit than the letter of the law. While there are a number of foundations and intermediaries that are active in the emerging equity/growth capital field, we have found very few that have an explicit practice of grantmaking to support financial reserves.

- See Clara Miller, “Hidden in Plain Sight: Understanding Nonprofit Capital Structure,” Nonprofit Quarterly, Spring 2003.

- Note that in some cases nonprofits may refer to an unrestricted, board-designated fund as an endowment, if it is being used for long-term investing and income-producing purposes.

- See Hilda Polanco, “The Key to Long Term Financial Health: Liquid Unrestricted Net Assets (LUNA)” (reprinted from New York Nonprofit Press, June 2012). (An executive director at one of our trainings commented that LUNA sounds like the name of an insomnia medication, and then noted that having LUNA would, indeed, help him sleep better at night.)

- A negative LUNA balance is itself the result of accumulated operating deficits over time.

- Disclosure: FMA provided financial consulting services to the grantee organization during this period.

- As in the Tipping Point example, one way in which Weingart’s reserve grants have provided an additional financial benefit to recipients is by sometimes including a board match as a condition of the reserve component, thereby engaging the board in additional fundraising.