July 11, 2018; NBC News

According to a report authored by the Urban Institute, and funded by the Better Mortgage Corporation, the homeownership rate of Americans aged 25 to 34 is a full eight percentage points less than that of Americans born between 1946 and 1980. The result is that there are 3.4 million more people who are renting rather than owning than there would have been the case had the home ownership rate stayed the same. In fact, “almost half of 18- to 34-year-olds spend more than 30 percent of their income on rent.” Why is this decline so important? One reason, as Nicole Acevedo reports for NBC News, “Lower homeownership numbers at this rate will exacerbate wealth disparities among white millennials compared to their black and [Latinx] counterparts.”

Some key findings of the report include:

- Households of color have homeownership rates almost 15 percentage points lower than white households.

- Even among the highly educated, homeownership has fallen five percentage points compared with the prior two generations.

- Even for white households married with children and with substantial household income, the homeownership rate is two-to-three percentage points lower than for similar households in the previous two generations.

These numbers are reflected in the demographic results. Homeownership rates are down for people of all racial and ethnic groups, but the gap among groups remains large and in some cases is growing. For people aged 25 to 34, 39.6 percent of whites are homeowners, compared to 26.6 percent for Asian Americans, 24.6 for Latinx and a dismal 13.7 percent for Blacks. The decline in the Black homeownership rate was greatest, a full 9.7 percentage-point decline from 2000 to 2015.

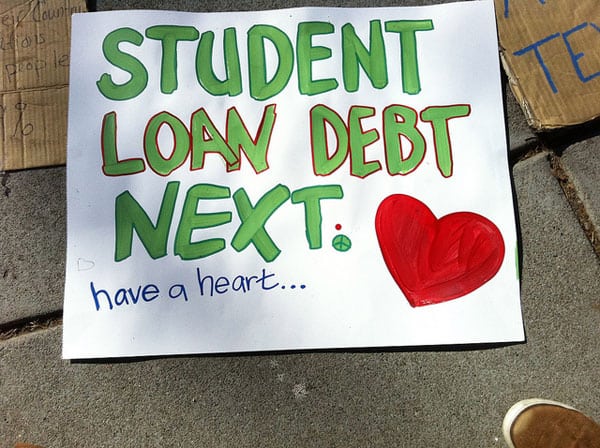

High student debt topped the report’s list of “external factors” driving lower home ownership. As Acevedo explains, a one percent increase in student loans lowers the likelihood of owning a home by 0.15 percentage points. Put differently, this means that students with double the debt of their peers can be expected to have a homeownership rate that is a full 15 percentage points less.

According to NeighborWorks, 52 percent reported that student loan debt is at least somewhat of an obstacle to buying a home and nearly three in ten said that they knew personally of someone who delayed buying a home due to student loan debt.

Of course, debt is not the only driver. Other external factors listed include high rental costs that make it difficult save for a down payment, stricter credit rules in the wake of the Great Recession, and the decline of available affordable housing, particularly in urban areas. “Life factors” such as a generational shift of the age in which people get married and have children has also led fewer people under the age of 35 to buy homes.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

One strategy for encouraging greater home ownership promoted in the report is financial education. Financial literacy classes that begin in high school can lead to a stronger foundation in personal finances, according to Vishal Garg, CEO of Better Mortgage. “Although millennials have a higher level of educational attainment, they do not have a higher level of financial knowledge.” The Survey of Consumer Finances asks three questions on saving, borrowing, and investing, and of 25 million millennials, only 9 million or 36 percent answered all three questions correctly, compared to 43 percent of Generation X and 47 percent of Baby Boomers. Garg also believes that rethinking credit standards is another solution. Garg sees the current guidelines for what makes someone creditworthy as “too inflexible” and suggests the inclusion of other factors, like paying rent and cellphone bills on time.

However, it’s important to remember the role that factors other than education play. Wage stagnation hinders millennials’ ability to afford down-payments. Fifty-three percent of renters responded that they couldn’t afford a down payment on the Federal Reserve’s Survey of Household Economics and Decisionmaking. Another major element is parental wealth and homeownership; as per the Better/UI report:

White parents have an 83.7 percent homeownership rate, [Latinx] parents have a 64.4 percent rate, and Black parents have a 47.7 percent rate, suggesting an intergenerational association.… A young adult’s homeownership is highly correlated with parental homeownership. The homeownership rate for young adults whose parents were renters is 14.4 percent, whereas the homeownership rate for young adults whose parents were homeowners is 31.7 percent.

The challenges are immense. As Acevedo writes, “many millennials have had no other choice but to rely on a gig-to-gig type of income to support themselves. Not having a steady income, makes it harder to save towards a down payment to own a home while paying other financial obligations like student debt.”

Still, financial education efforts can make a difference. Acevedo portrays Christian Padilla and her wife, who were able to buy their own home after “one year of real strict budgeting.”

“We wouldn’t eat out. We would literally save every penny. It started getting easier when we saw the savings account going up,” Padilla says.—Diandria Barber and Steve Dubb