September 11, 2018; Next City

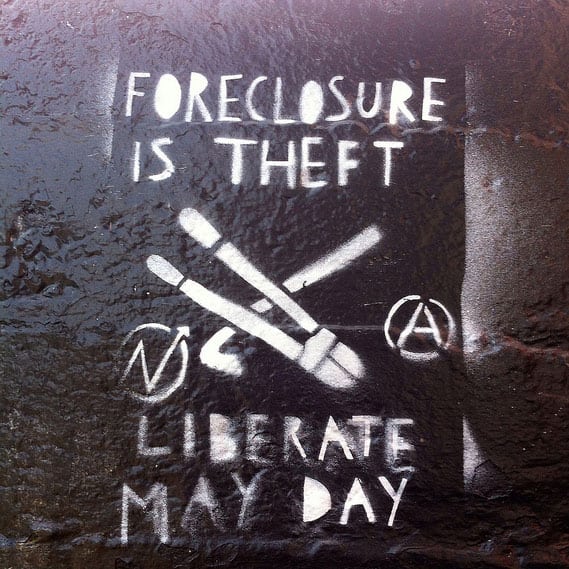

Housing advocacy has been making strides to keep families in their homes—particularly in Boston. As Zoe Sullivan details in Next City, the sad reality for many in Boston’s lower-income areas is that investors prey on those struggling to make mortgage payments, seeking to purchase their houses and flip them for profit. The Coalition for Occupied Homes in Foreclosure (COHIF) aims to help families facing foreclosure, an issue that disproportionately affects communities of color.

COHIF comprises “some 25 tenant, community, nonprofit, legal and government agencies and organizations.” It was founded in 2008, in the face of “foreclosures increasing in Boston, particularly in neighborhoods with high percentages of lower income and Black and [Latinx] households.” It’s this collaboration that makes COHIF unique; here, a way has been found to navigate differences between organizational stances to craft solutions for those who need it most.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Right now, Boston is seeing a boom in luxury buildings. According to the Institute for Policy Studies, 12 luxury projects in Boston, “totaling 1,805 units, have an average condominium price of $3.02 million, a price 50 times higher than Boston’s median household income.” Foreclosure and sky-high rent issues are by no means limited to Boston, either. NPQ has covered Boston Community Capital and City Life/Vida Urbana (a member of COHIF) in the past, as well as churches that faced foreclosure or demolition. Baltimore has also dealt with higher foreclosure rates for African Americans.

As nonprofits look to face increasingly complicated problems in communities, COHIF is a great example of how comprehensive collaboration can drive adaptation.—Kelly Phipps