December 11, 2018; Slate

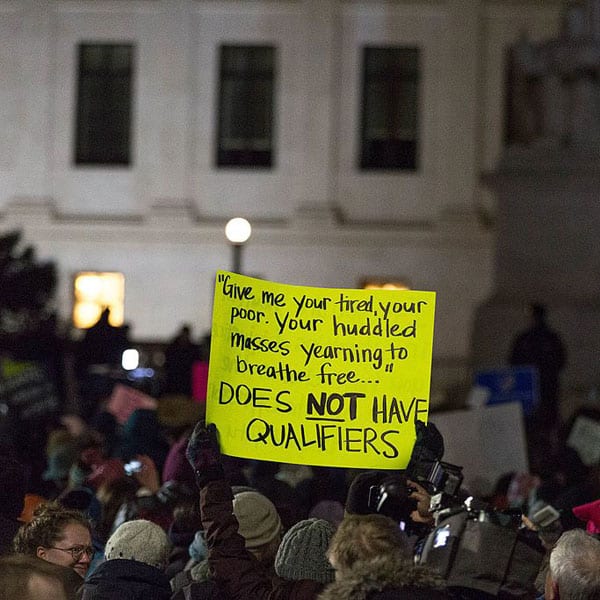

A decent credit score, which dictates so much of what we are allowed to acquire in modern-day America, is hard for many people to achieve in this unequal country. But now, the US Department of Homeland Security wants to require immigrants to demonstrate they have one before being considered “admissible.”

The purpose of the proposed rule is to stop immigrants from becoming legal residents if they might become a “public charge,” meaning dependent on government assistance. The proposal, which now is open for public comment, would also apply to immigrants seeking an extension of stay or change of status. The rule defines a “good” credit (commonly referred to as FICO) score as “generally near or slightly above the average for US consumers.” (Credit scores range between 300 and 850, and lenders consider those between 670 and 739 to be “good.”)

Credit scores and the reports in which they are documented originally were designed for a single purpose: to help lenders evaluate whether a would-be borrower is a good risk. They are determined by analyzing consumers’ debt-repayment history. Thus, writes Amy Traub in Slate, “Credit reports contain no information about a consumer’s income or earnings and have no applicability to whether an immigrant, or prospective immigrant, is likely to become a public charge.”

Rather than playing a helpful role, the proposed rule could have a very negative effect by discouraging immigrants from seeking public aid. “Requiring an immigration officer to pull someone’s FICO before a final decision will take us bad places—quickly,” Matt Cameron, an immigration law attorney in Boston, told Slate. For example, immigrants may decide against receiving WIC (women, infants and children) benefits to avoid trouble with immigration agents.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

“I grew up on WIC and public housing; I don’t know what my parents would have done without it,” Cameron said. “To make immigrants choose between a green card in the future and taking care of their kids right now is really cruel.”

In the past, immigrants have simply been required to have a financial sponsor and assure they will have enough money to live above 125 percent of the poverty line. (For a family of three, that would be $25,975, according to the Department of Health and Human Services.) Adding credit scores into the mix is bad because they are based in part on the number of years a person has used credit in the United States. According to the National Consumer Law Center (NCLC), this automatically puts immigrants at a disadvantage. Under this standard, immigrants also would be penalized for avoiding debt.

Fortunately for immigrants, it is possible, even without any credit history at all in the United States, to build it fairly quickly, says Tara Robinson, communications director for the Mission Asset Fund, a California-based nonprofit organization that helps consumers build credit through social lending. The Mission Asset Fund helps participants lend small amounts of money to each other with zero interest and no fees. The nonprofit services and guarantees the loans, and it reports payment history to the credit bureaus—thus building a positive score.

However, that sidesteps the many downsides of American society’s reliance on credit scores, which is fueled in part by a decades-long drive by the reporting industry to market and profit from the sale of its data. Today, credit information is used by insurance companies, landlords, employers, utilities, and hospitals for a variety of decisions. And immigrants are only the newest category of resident that suffers as a result. For the past two decades, says the NCLC, numerous studies have found that African American and Latinx communities have lower credit scores as a group than whites (and Asians, when the data is available). This can be traced in large part to the racial wealth gap. For example, a study by investigative journalists at ProPublica found that, even when taking average income into account, court judgements related to debt collection are twice as likely in mostly black communities as in mostly white ones. The racial wealth gap makes it far more difficult for African Americans to recover from a financial setback or come up with a few hundred dollars to pay an emergency bill. And because credit reports judge humans based on past behavior, they perpetuate past inequality.

There is another problem with credit scores: A 2012 study by the Federal Trade Commission found that one in five American consumers had at least one error on their credit report—and there is little reason to believe that has changed. And the process of trying to correct credit-reporting errors has been described as “a nightmare,” “a Kafkaesque no man’s land“ and “a horror story worthy of Hitchcock.” Imagine how much worse it is for plight of an immigrant with limited English language skill.—Pam Bailey