April 5, 2020; New York Times

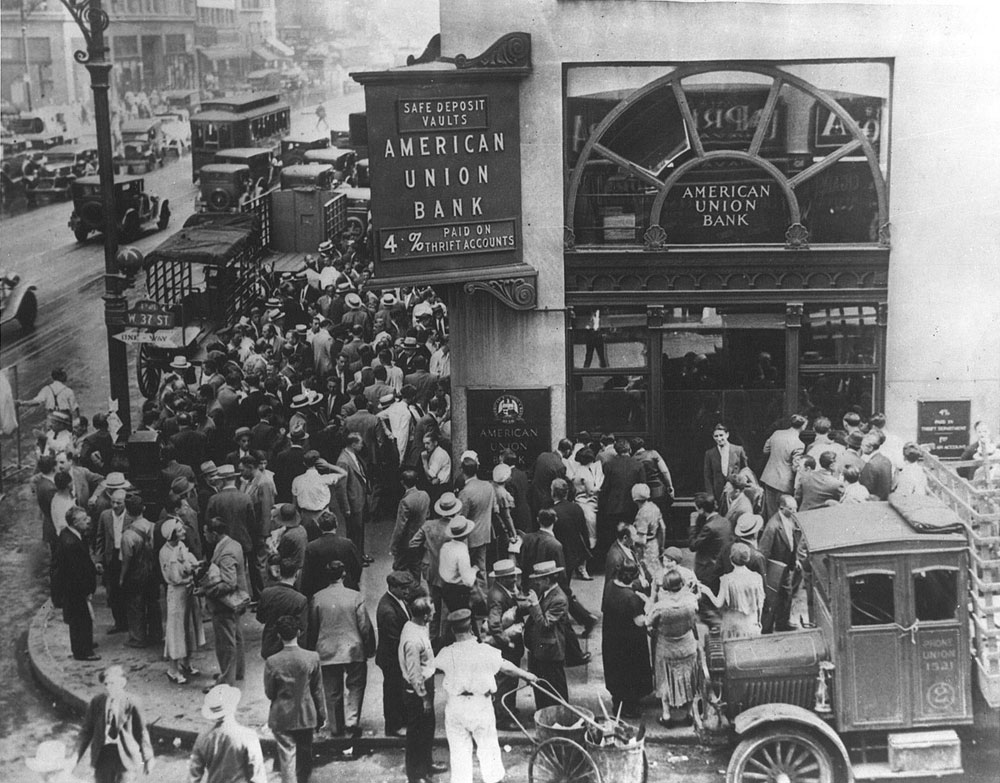

By the close of business on Friday, April 3, 2020, small businesses and nonprofits had reportedly applied for billions in paycheck protection loans made available through the federal government’s CARES stimulus legislation. The $349 billion program, which makes loans that become forgivable (i.e., converted into grants) if used to cover payroll, is seen as a lifeline to keep many small businesses and nonprofits open during the pandemic. But chaos reigned at many banks that were supposed to have helped process the load, leaving many nonprofits and small businesses hanging.

The program was advertised as first-come, first-served. Applicants were promised a preposterous one-day turnaround. But the banks did not get the Treasury Department’s regulations or the final application document until Thursday night. Between unprepared lenders, borrowers trying to follow a nonexistent trail of breadcrumbs, and variations among the bank requirements, many spent a frustrating day stalking their lenders.

The New York Times details some of the bigger banks’ unexpected requirements:

JPMorgan Chase said it would take applications only from people who had a business checking account with the bank as of February 15. A notice on Wells Fargo’s website said it, too, required an existing business checking account. Citi has not yet announced its rules; a spokesman said it was reviewing the program’s rules and planned to start accepting applications “as soon as possible.”

Meanwhile, the first-come, first-served frame is causing panic among those who cannot see a way back to solvency without the loan/grant. The desperation is there, but the ventilators—we mean loan approvals—are not. These loans are absolutely essential to the future of a multitude of nonprofits and small businesses, and lender confusion just added to the angst of the moment.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

At Huntington Bank in Columbus, Ohio, staff worked all night Thursday to get their website ready to accept applications on Friday afternoon. Chase’s site gave error messages to potential logins until 1:00 pm. Wells Fargo did not put its site up until Saturday.

Jointly administered by the US Treasury Department and the US Small Business Administration (SBA), the program is suffering, say many, from failure to launch. Even when the banks get their act together, the problems aren’t likely to end. While President Donald Trump claims that the SBA processed over 28,000 loans in 24 hours, we must keep in mind that the SBA generally only handles 60,000 loans annually. Relatively to its normal case load, then, 28,000 in one day sounds great, until one realizes that hundreds of thousands, if not millions, of applications will need to be processed. Indeed, Bank of America alone reportedly received 85,000 applications seeking $22 billion on the program’s first day.

NBC News reports that “an email from the Small Business Administration to lenders Saturday morning apologized for ‘ongoing technical issues,’ which included slowness and the inability of ‘many’ lenders to create new logins or reset passwords.” (The SBA did not immediately respond to an NBC News request for comment.)

Community banks were reported by some media to have managed the process more successfully. However, even so, as the Independent Community Bankers of America wrote in a letter on Saturday, thousands of small banks are “experiencing massive delays and (an) inability to process loans or even access the SBA.”

“Community bankers are frustrated with failed technology links and portals,” says the ICBA, “Even those banks with access to the (SBA) system have shared their experiences of significant challenges with user access and latency in application processing.”

NPQ would like to hear from our readers about their successes and failures in submitting and actually receiving one of these essential loans. Your advice may be pivotal to someone else.—Ruth McCambridge