March 18, 2019; CalNonprofits

Yesterday, in an unusual move, the California Association of Nonprofits (CalNonprofits) announced it would back a new bill, AB 1712, to regulate donor-advised funds. The bill is co-sponsored by NextGen California and philanthropist Kat Taylor and authored by Assemblymember Buffy Wicks. The bill would mandate greater transparency and accountability through annual reporting requirements, promoting best practices, and requiring minimum annual distributions.

NPQ, of course, also recently took a position on donor-advised funds, suggesting that they need to quickly invest in a robust form of self-regulation and transparency around some of the same issues identified by CalNonprofits or get ready to be regulated from the outside. CalNonprofits and the bill’s other sponsors are trying to invite community foundation DAF sponsors into a planning process for the regulation, at least, and it may be wise for them to accept the invitation, gracefully and enthusiastically bringing their wisdom to the effort.

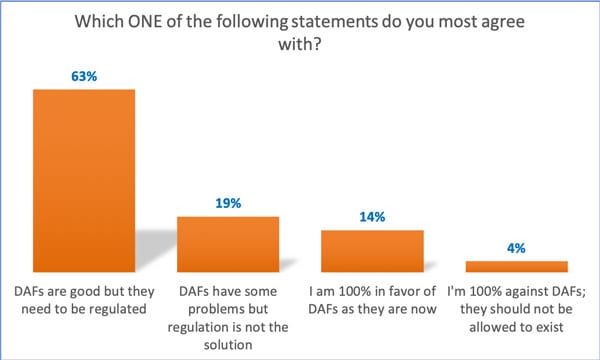

But, kudos to CalNonprofits. In NPQ’s experience, it’s very unusual for an association of nonprofits to back a call for regulation of a funding source, but CalNonprofits has done its homework in terms of gauging the interest of its constituency on the issue. A recent survey of 424 California nonprofits indicates that its membership, 70 percent of which have themselves received gifts through a DAF, overwhelmingly believe DAFs are “good but need to be regulated.” (See the bar chart above.)

Assemblywoman Wicks says,

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

I introduced AB 1712 because we must ensure that tax incentives meant to encourage charitable contributions are being used as they were intended: to directly benefit the people and causes of service providers. They should not be used as a vehicle to benefit a few wealthy individuals, while depriving the general public of the benefits that result from direct gifts to charitable service providers.”

I want to bring stakeholders together so we can explore options to increase transparency. Let’s move to bring more sunlight to DAFs and unlock these much-needed funds by passing AB 1712.

One of the issues flagged by CalNonprofits is the fact that “DAF sponsors (whether a commercially affiliated fund or a community foundation) can make anonymous gifts to nonprofits without reporting any activity for individual funds. An unintended consequence of these aspects has made DAFs attractive vehicles for…huge gifts to 501c4s—including partisan political organizations…made without being traceable to the donor.”

Kat Taylor, who advises her own DAF, added, “As owners of donor-advised funds ourselves, we adhere to best practices to ensure the funds get out into the community. We are also committed to working with Assemblymember Wicks, our nonprofit allies, and other stakeholders to explore better reporting and transparency options.”

It is interesting to see that in the comments section under the article on CalNonprofits’ site the response from at least one local community foundation president is defensive, accusing CalNonprofits of vilifying DAFs. The time for this kind of overreaction is long past. DAFs are an ever-increasing portion of the giving landscape and their transparency issues can be handled with some goodwill. Acting as if half of the nonprofit sector is showing up with pitchforks when rational regulations are being suggested is worse than a bad look in a sector which the public depends upon for transparency.—Ruth McCambridge