May 16, 2017; Washington Post

Over the years, any number of management theories have been trotted out as the answer to the problem of sector-agnostic organizational misfire—performance management among them. We wish there were more debriefs of the aftermath of these attempts at reform, some of which have had profound effects on the lives of organizational constituents.

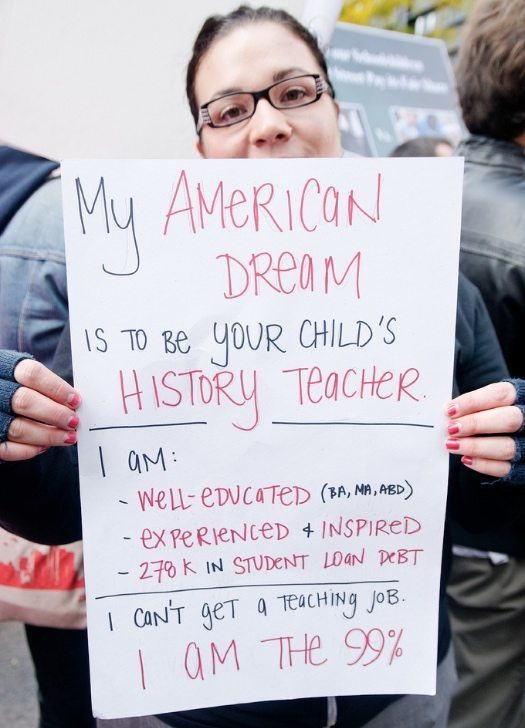

The U.S. Department of Education manages a college loan portfolio that exceeds $1 trillion. If its Financial Student Aid office were a bank, it would rank among the nation’s largest. The effectiveness of the Department’s oversight of FSA’s operations is now facing criticism from the National Association of Student Financial Aid Administrators in a recently published report.

The FSA was restructured in 1998 as a performance-based organization as an outcome of the Clinton administration’s effort to make parts of the federal bureaucracy more “businesslike”. As a PBO, FSA would become “a results-driven organization created to deliver the best possible services—a new way of getting things done in the public sector setting incentives for high performance and accountability for results…allowing more flexibility to promote innovation and increased efficiency.” The expectations were that the FSA would be able to improve its service effectiveness, reduce its costs, and create a more accountable system for managing the federal government’s student loan portfolio.

The Washington Post’s described the NASFAA’s report as calling for “Congress to review whether the Federal Student Aid office is subject to enough supervision by the education secretary, and whether the unit has been granted too much autonomy in setting goals, assessing its own success and awarding financial bonuses to employees. It is calling for the creation of an independent, seven-member oversight board at FSA that reports directly to the public, the secretary, and Congress.”

From NASFAA’s perspective, there is insufficient accountability built into the present structure. The association’s president, Justin Draeger, told the Post,

We feel most people at FSA are in it for the right reasons and are trying to do the right thing. Structurally, there is no real entity holding the organization’s feet to the fire when it comes to developing strategic plans, operational objectives that align with those plans and assessing whether they’ve completed them.

So, is the answer it to complete the hierarchy? While conceived to mirror the practices of effective for-profit businesses, FSA has no board of directors. While its COO does report directly to the Secretary of Education, the level of oversight is limited by the Secretary’s being a political appointee who may or may not have any expertise relevant to the work of FSA.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

FSA’s performance has been a concern. Benchmarks that have been established have not been met. The current public controversy about the practices of firms contracted by FSA to service portions of its portfolio is a problem that was identified in several GAO audits. In a 2015 report, GAO noted that FSA’s inability to provide clear direction was creating a risk of failure. “Without improved guidance and instructions to servicers, borrower finances or the integrity of the Direct Loan program could be negatively affected.” FSA was also found to be ineffective in ensuring that delinquent borrowers were being properly serviced and helped to rehabilitate their account status.

The association’s report noted that while FSA had the responsibility to establish mechanisms for getting stakeholder input and feedback, it was not doing so. Studies and reports are being written before the required comment period closes. Rather than asking for comment as new procedures are developed, FSA often provides an early copy of a new publication and asks for reactions.

As an example, NASFAA pointed to FSA efforts to improve oversight. To eliminate possible cheating, applications from families who earned too little would require completed income tax forms. No comment was requested before the changes were promulgated, and the result was a requirement that schools and families found hard to meet. According to Draeger, the eventual process was “burdensome.”

It’s a manual process that requires the family to mail something in, then we have to wait up to 10 business days to get something back. And if you don’t get something back, this can turn into federal bureaucracy times 10…It’s a real a real barrier for students who are just trying to complete their financial aid form.

The association’s report concluded, “A better FSA is possible, but like any organization, structural evolution must be part of the solution.”

Congress is in the best position to jumpstart that organizational advancement. While there are often many layers in between, ensuring that FSA is a strong, accountable, transparent organization will ultimately provide the most benefit to the millions of students across the country who utilize and rely upon federal student aid each year. NASFAA looks forward to working together to find ways to strengthen this important component of the U.S. Department of Education.

To accomplish this, they suggest that a new structure with a board of directors could provide “corporate-like” accountability for the COO and his/her staff – perhaps so we can experience some of the brilliant results of the banks (leaving aside damage to their power income constituents) but we might suggest that it could be more useful to engage some of those committed and dedicated staff in developing the goals and systems that will work.

With $1 trillion under management, millions of borrowers, and thousands of colleges in the mix, it will be interesting if Congress can address this need for reform in a nonpartisan manner.—Martin Levine