November 29, 2018; Next City

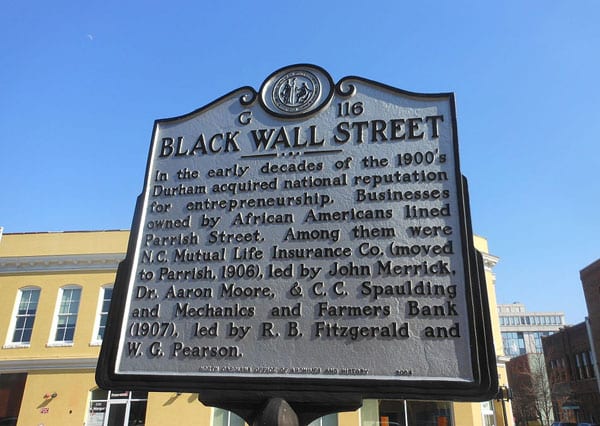

As Sandra Larson writes in Next City, Durham, North Carolina was once home to many “Black-owned financial institutions and businesses that sprang up around Parrish Street during the Jim Crow era.” This included firms such as Mechanics and Farmers Bank and North Carolina Mutual Life Insurance Company. But, as in many cities, highway construction in the 1960s led to the Black business district’s demise.

That said, Durham, a city of 311,000 people which is about 38 percent Black, still boasts a large number of Black-owned businesses. Now, the city is looking to employee ownership as a possible strategy for preserving Black-owned companies for the next generation.

Andre Pettigrew, who directs Durham’s office of economic and workforce development, tells Larson that many of the city’s Black-owned companies are old and have uncertain futures. “Restaurants, funeral homes, auto repair shops, the gamut,” Pettigrew says. “The owners are ready to transfer. [But] in their families, many of the kids have gone on to college and middle-class professional lives. They’re not interested in running the businesses. So, succession planning is a big part of what we’re talking about.”

Pettigrew, Larson notes, “is one of three city employees serving as fellows in the Shared Equity in Economic Development (SEED) Fellowship, developed by the National League of Cities and the Democracy at Work Institute (DAWI).” The fellowship is a year-long program, designed “to equip a cohort of cities with expertise, resources and tools to explore employee ownership as a means of retaining businesses and the jobs and wealth they create.”

Durham, is one of four cities selected for the inaugural cohort, along with Atlanta, Miami (which NPQ recently profiled), and Philadelphia. Each SEED city includes three fellows from city departments and a community fellow. Durham’s community fellow is LaTasha Best-Gaddy, a business counselor with the Small Business and Technology Development Center at North Carolina Central University, a historically black college.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The fellowship, notes DAWI Executive Director Melissa Hoover, aims to promote peer-to-peer learning, with fellows traveling to each other’s cities to share ideas and best practices and learn from an advisory panel made up of community stakeholders and local and outside experts.

Pettigrew acknowledges that many longtime business owners are reluctant to transition ownership to their employees. Still, employee ownership has many advantages. “It’s one way to mitigate the fact that there aren’t a lot of individuals with enough assets to [purchase a business],” Pettigrew says. “For one person, it’s highly risky. You need partners. So, in this case, you know the others and you know the business. In some ways, it’s the most-informed choice of starting a business. You already know its strengths.”

After the SEED fellowship ends in the summer of 2019, Pettigrew hopes Durham will have deeper connections with local businesses and a better understanding of succession planning. “This is not about doing 50 deals by the end of this year. It’s determining if it’s a viable option and [having a plan in place],” Pettigrew says. “It’s not a panacea, but it’s one oar in the water.”

As NPQ has covered, passage last August by Congress of the Main Street Employee Ownership Act makes employee purchases of firms eligible for Small Business Administration (SBA)-guaranteed loans of up to $5 million, which could facilitate ownership transition. But it requires willing owners and willing employee buyers to make that work.

Pettigrew sees employee ownership as a way to reduce the racial wealth divide. “After the recession, a lot of individual wealth was wiped out, especially in the African American community, where most of the wealth was in our homes,” notes Pettigrew. “They say the first path to increasing wealth is home ownership—and right after that is being a business owner. So, to put employees on the path to business ownership is an important part of this model.”

But Pettigrew recognizes that the transition won’t just happen on its own. “If you don’t have an intentional exit strategy, that wealth doesn’t get passed on,” Pettigrew observes.—Steve Dubb