Just a few hours after the newly inaugurated President Biden signed his first 17 executive orders, one of those appeared as a change on the Federal Student Loan website: “On Jan. 20, 2021, the COVID-19 emergency relief measures were extended on [US Education Department]-owned federal student loans through Sept. 30, 2021.”

That brings the total to 18 months that federal student loan holders will not have been charged interest and are given the opportunity of taking that time as forbearance, meaning they do not have to make any payments. In October 2020, it was reported that only 11 percent of borrowers continued to make payments on their federal student loans, taking advantage of the zero-interest to apply their payments in total to the principal.

President Biden is considering forgiving up to $10,000 across the board for every federal student loan borrower, which was part of his campaign platform. (This forgiveness does not apply to those who have private loans.) Biden is also proposing a change to the Public Service Loan Forgiveness Program (PSLF), replacing the forgiveness of the students’ debt for public and nonprofit employees after 120 payments with $10,000 forgiveness a year of steady payments for a five-year period. While those in the existing program don’t see the benefit for 10 years, there is no maximum for the amount forgiven; the proposed plan would cap at $50,000.

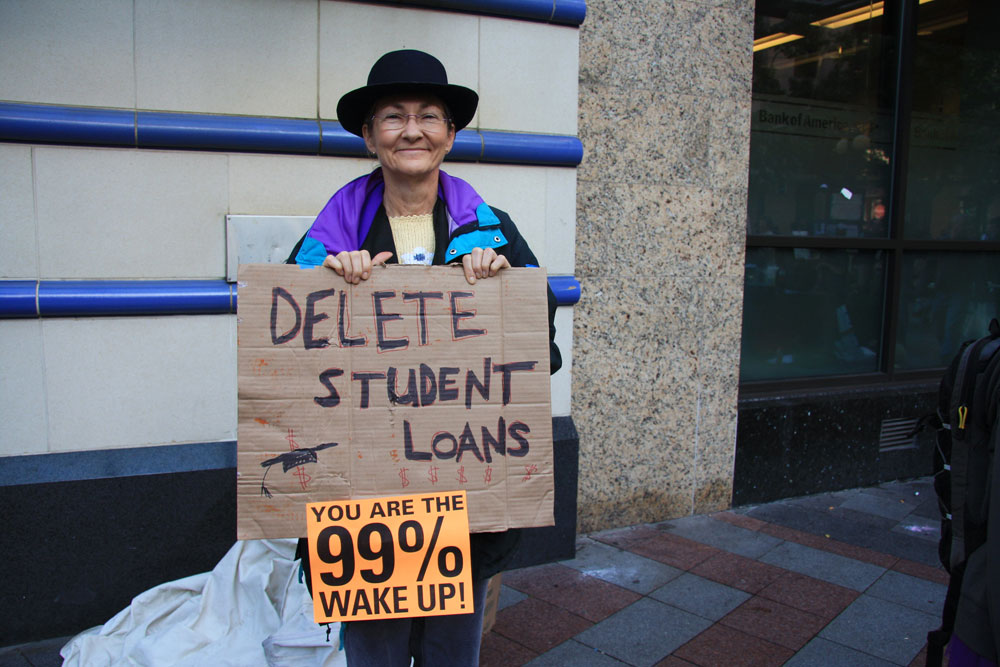

There have been calls to cancel all federal education debt; the burden on individuals affects their spending and the US economy in general by postponing home purchases, hindering small business growth, and reducing saving. A bill, H.R.3448, introduced in the previous session of Congress by Representative Ilhan Omar, (D-MN), called for debt cancellation of all outstanding federal student loans. The bill, which has yet to be reintroduced into the current session of Congress, would instruct the US Secretary of Education to forgive the balance and interest of loans by the student or by a parent or borrower on behalf of the student 180 days after the bill’s passage.

A $50,000 debt forgiveness option has bounced around as well. In the previous Congress last December, Omar and representatives Ayanna Pressley (D-MA), Maxine Waters (D-CA), and Alma Adams (D-NC) introduced a resolution that outlines the path for now-President Biden to utilize executive authority to forgive $50,000 and ensure that cancellation of debt does not create an income tax liability for the borrower. A companion measure, Senate Resolution 711, was also introduced in the last session by Senate Majority Leader Chuck Schumer (D-NY) and Senator Elizabeth Warren (D-MA).

In November, NPQ reported on an open letter by 238 organizations that called on Biden after his inauguration to forgive all student loans, due to the drag the growing student debt has become to the economy, particularly in communities of color, even before the COVID-19 pandemic. The letter points out that the federal student loan forgiveness of their parents would minimize harm to the next generation.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

It would help older borrowers too. It is not just 25- to 35-year-old borrowers who hold student loans; there are retired individuals, some living on Social Security, who are still paying back federal loans—which can have an interest rate of six percent. Schumer and Senator Elizabeth Warren (D-MA) issued an op-ed that was published by CNBC last Friday, making their case to support the government’s forgiveness of $50,000 in federal school loans. They point out that there are senior citizens holding student debt for themselves or a loved one.

The student loan debt load across the US is $1.68 trillion, and not all student loan borrowers are young. Data from the US Department of Education on the $1.566 billion held by the federal government (there is another $100 billion-plus held by private lenders) show that 18.6 percent of borrowers holding 22 percent of all debt are over the age of 50. The average debt for those between the ages of 50 and 61 is over $42,000, and for those over the age of 62, it’s still over $38,000.

The number of older Americans with student debt has grown. The American Association of Retired Persons (AARP) reports that in 2004 adults aged 50 and older held $47 billion in student loan debt; just 14 years later, that figure ballooned to $289.5 billion. And today, the federal government reports that number has increased to $349 billion. That includes non-traditional adult learners who went back to school, and parents and grandparents who borrowed to send dependents to college.

If retired individuals collecting Social Security default on those student loans, their benefits can be garnished, reducing their income significantly. In 2016, Warren and former Missouri senator Claire McCaskill issued a report that found that more than 70 percent of those garnished payments were still going to interest and fees and not putting a dent in the loan principal.

It appears that those who would benefit from any amount of federal student loan forgiveness includes all ages—from children, whose parents may be squeezed by school loans that can affect housing and other needs of the entire family, to seniors on a fixed income. Loan forgiveness would benefit those who must pay student loans even though they did not complete their degrees, and it would benefit people who attended college later in life when it fit with their employment and now cannot retire because of the debt.—Marian Conway

Disclosure: The writer has a federal student loan, is in the Public Service Loan Forgiveness Program, and is 65 years old.