April 18, 2017; Monterey County Weekly

California Attorney General Xavier Becerra is suing the Carmel-based Gregory Family for their misuse of two nonprofits: the Wounded Warrior Support Group (WWSG) and Central Coast Equine Rescue and Retirement. Becerra is seeking in Alameda County Superior Court to have the family barred from any further nonprofit work and to collect penalties, damages, and around $500,000 in funds he alleges were raised fraudulently.

The suit claims that monies raised through raffles at car shows were then used on personal pursuits and on the family business, Gregory Motorsports. “Although WWSG advertised that raffle proceeds would support veterans through a therapeutic equestrian program, no such program has ever existed…Instead, virtually all of the money that donors gave to help injured veterans was used by members of the Gregory family for personal expenses, hobbies and for their for-profit business.” One of those hobbies, by the way, is the Gregory daughters’ own dressage pursuits, which naturally require horses.

The family’s apparent assumption that the cause of aiding injured veterans would be the more likely of their two nonprofits to attract donations was accurate, because its 2015 Form 990 reports $772,000 in revenue and $438,517 in expenses. One expense was a grant of more than $108,000 to Central Coast Equine Rescue and Retirement, which was the entirety of that linked organization’s budget. That grant was to care for horses and not, in the end, used in any veteran’s program.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

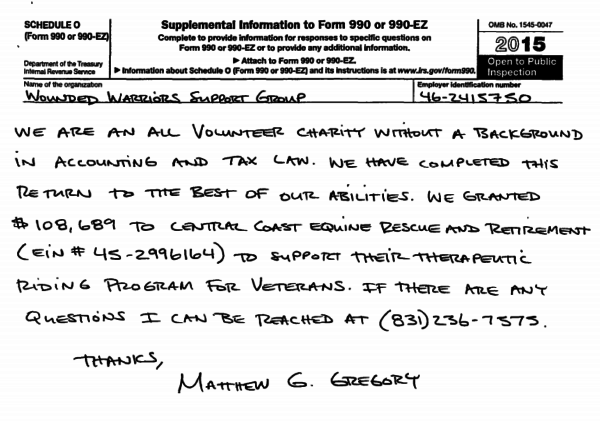

Matthew G. Gregory, the head of the family who signed both organizations’ forms, responded when contacted by Monterey County Weekly that he knew nothing of the suit. “I never intended to break any law, and never used a CPA, or any attorney,” he said. “This has just been a family winging it, the way it should be.” This seems to be a well-rehearsed talking point drawn straight from the Schedule O of WWSG’s 2015 IRS Form 990-EZ (shown above), so if they have operated in ignorance, we can see they have done so for a while.

Is this trend toward fake nonprofits the start of a new trend, one possibly related to the annual 990-EZ and the new 1023-EZ application forms? What is the legitimate nonprofit sector to do?—Ruth McCambridge