May 11, 2015; Center for Budget and Policy Priorities

In light of NPQ’s coverage of nonprofit community development corporations producing thousands of units of affordable housing, this report from the Center for Budget and Policy Priorities is both interesting and disturbing.

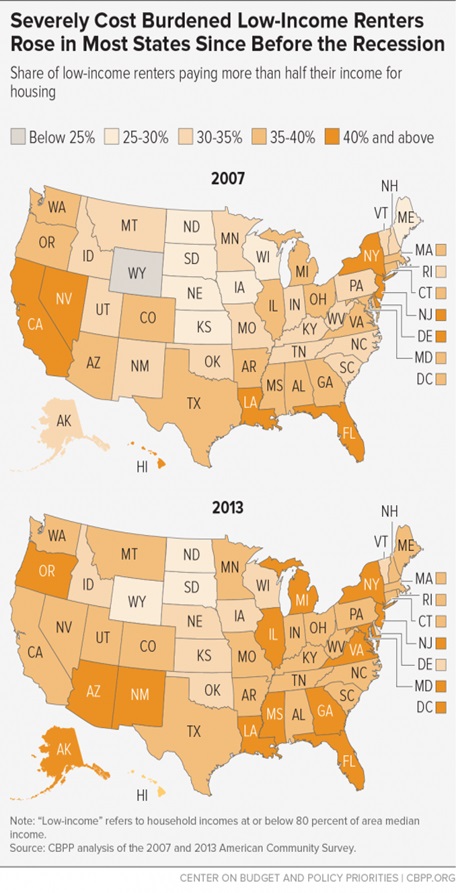

CBPP’s Alicia Mazzara examined the changes in the numbers of renters in every state who pay more than 50 percent of their income for housing. Between 2007 and 2013, the number of such cost-burdened renters increased in every state of the union except for Delaware, and the proportion of renters who pay more than half of their incomes for rent rose in 45 states and the District of Columbia. The following data map tells the story:

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

That’s 11.25 million renter households paying more than half of their incomes for rent, according to Enterprise Community Partners—more than one fourth of all renters in the U.S. The reality is that when paying half or more of income for rent, other family expenses don’t get covered. “It means making really difficult trade-offs,” said Angela Boyd, a vice president at Enterprise Community Partners. “There are daily financial dilemmas about making their rent or buying groceries.”

The proportion of American households that rent has gone up (to around 36 percent), in part because the options to buy are so difficult in many states. According to the Corporation for Enterprise Development, the ten states (including the District of Columbia) with the least affordable homes are, in rank order, Rhode Island tied with Vermont at #9 and 10, Washington, New Jersey, Oregon, New York, Massachusetts, California, D.C., and, as the least affordable state in the nation, Hawaii.

There’s a shortage of millions of units of affordable rentals, and since the recession, even with the job market coming back, incomes are much lower than they used to be, making home-buying difficult for even moderate and middle income families. Are there solutions? Localities are crafting their own strategies:

- In Spokane, Washington, where Gonzaga law student Matthew Cardinale drafted a strategy on behalf of Councilwoman Candace Mumm calling for affordable housing impact statements for legislation passed in Spokane, inclusionary zoning and density bonuses for developers of complexes larger than 25 units, and better income targeting of the city’s multi-family property tax exemption.

- In New York, Mayor Bill de Blasio has called for ending tax breaks for residential developers unless they commit to produce or preserve 25 to 30 percent of the units as affordable. De Blasio is also calling for a special “mansion tax” on homes and condominiums that sell for more than $1.7 million.

- Because of the huge run-up in housing costs in San Francisco, San Francisco Supervisor Dave Campos introduced an emergency ordinance to halt market-rate housing development in the city’s Mission District to stop, at least for a moment, the displacement of lower income renters, but the San Francisco Housing Action Coalition opposed that move, saying that market-rate housing development is the now the city’s prime mechanism of producing affordable units.

The missing partner in all of these actions and strategies? The federal government. Now that a new election is underway for the White House with a bevy of candidates, it might be nice to see if any of them make affordable housing more than a passing reference in their campaign platforms, and if they do, whether they have anything substantive to propose to address the nation’s housing crisis.—Rick Cohen