This article is the fourth in a series of articles that NPQ, in partnership with First Nations Development Institute (First Nations), will publish in the coming weeks. The series will highlight leading economic justice work in Indian Country and identify ways that philanthropy might more effectively support these efforts.

As mothers, business leaders, and community advocates, we’ve spent the last six years advocating for and raising capital for Indigenous-women-led ventures. In tandem, we’ve grown Roanhorse Consulting LLC & co-founded Native Women Lead with six other indigenous women to build a movement. Here, we share our experience partnering with a credit union to develop a new loan product that is beginning to show how changing the rules can have transformative effects in Indigenous communities.

Vanessa’s Story

In 2017, I received a simple but thoughtful email asking to take me out for coffee to talk about access to capital in Indian Country. My company, Roanhorse Consulting, had just begun working with the city of Albuquerque and several partners to better understand New Mexico’s ecosystem of Native American businesses, with the goal of creating resources and a more equitable environment for small business owners.

Just like that, over a single cup of coffee, the stars aligned. Jaime Gloshay shared with me her work developing a Native American lending platform for a regional community development financial institution (CDFI) that would create a new waterway (pipeline) for business owners. And, she had already done a lot of the mapping of the ecosystem.

We immediately started talking about the multiple challenges we’d both seen up close, and the opportunities we saw to push at the boundaries of what was possible and of what needed to happen to create more just and equitable access to capital for Native businesses. What we did not know is that this collision would change both of our lives and trajectory as individuals, and then as a team and as sisters, to push the conversation forward on the power of the Indigenous worldview and how we define value and risk.

Jaime’s Story

I was fresh out of graduate school when I landed my first job at a CDFI, with no prior experience in either the banking or nonprofit world. As I started to conduct outreach and look for ways to support Native entrepreneurs through lending, one of the greatest joys of my job was learning about entrepreneurs, their passion for their businesses, and then advocating to underwriters about why I believed in them. Even more exciting was being able to hand over checks to these entrepreneurs and see them launch or grow.

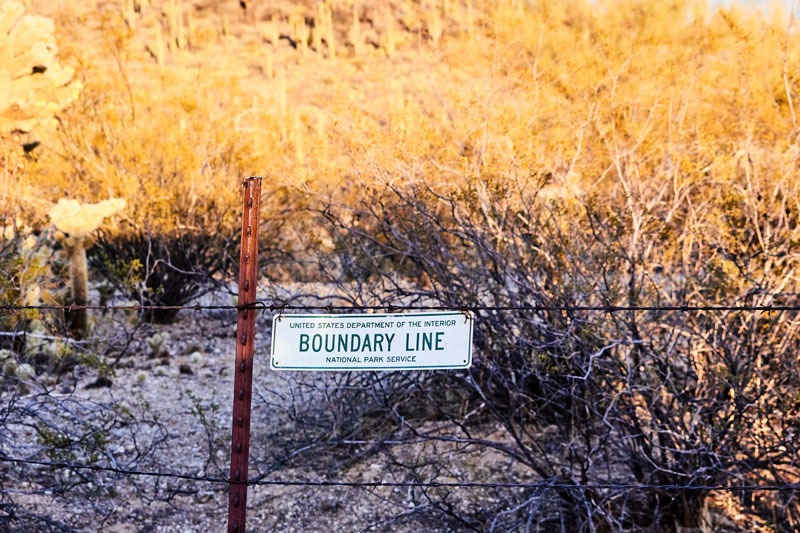

But I also saw my expectations and hopes limited by reality, too. I began to unpeel the layers of how incredibly hard accessing capital is for Native people because of how the economic system has excluded Indigenous people essentially since the onset of colonization and the theft of our homelands. I thought I could connect with Native communities and say, “Got a business? Great! Let’s get you funded!” But I quickly saw the challenges—for example, many banks will not do business on Native lands because they cannot utilize collateral like a home or property, since that would mean dealing with a sovereign nation to collect in the event of default. Another barrier is that many Native people are wary of taking on debt due to predatory lending practices that have plagued our community and the ongoing trauma that has been inflicted by capitalism.

I remember someone told me it took her three months to work up the nerve to come over to ask because she was ashamed of her credit score; she had been judged and turned down multiple times by people who don’t look like us. While I could advocate and provide lending dollars, I could only do so much to get entrepreneurs ready for funding and work within the boundaries of the CDFIs’ risk tolerance to build a strong case. No matter how much I believed in them, I’d have to demonstrate through “the five C’s of credit”—for the uninitiated, these are capacity, capital, collateral, (market) conditions, and character—that they were worth the “risk.” Alongside all of that, I was also trying to find my place in an institution and sector that did not have representation of folx who looked like me or knew what it meant to be an Indigenous person in this country.

Developing a Relationship-based Lending Approach

As we talked with each other about the boundaries we ran up against, we kept returning to a key truth: The traditional 5C system does not account for systemic oppression and economic exclusion. In doing so, it rates people’s abilities to navigate a broken system never meant for them. Many Black and Brown folx do not have access to intergenerational wealth nor access to banking tools and education in or near their communities that make it easy to leverage credit, compound interest, and continue to build wealth in a cycle that allows them to “make their money work” for them.

Let’s be candid: Prior to colonization and the slave trade, our peoples had economies of scales and trade and barter systems that crossed thousands of cultures and miles. We honor the truth that many of our ancestors built this country, and that those who hold the wealth do so through stolen bodies, land, and labor. Oftentimes, we wonder, “Where’s our ROI [return on investment]? Where’s the interest paid for what we’ve already given—or rather, had stolen?”

Holding our lived and professional experience, we dreamed what finance would be like if someone believed in us and gave us a chance, unlike traditional funding mechanisms that exclude not just Indigenous communities, but also immigrants, people of color, and other marginalized people. So, we locked arms and worked to advance the development of a new relationship-based lending pilot that aims to take a different approach and deliberately not use the 5 C’s in underwriting in order to demonstrate that those left out of finance are, in fact, not risky.

The work built on many conversations with Nusenda Credit Union, a New Mexico-based institution whose founding is built on education and educators. Nusenda had an existing microfinance product, called Co-op Capital, which partnered with organizations seeking to serve their networks, such as a grocery cooperative looking to increase production for their stores via small farmers. In this next iteration of Co-op Capital, we advocated for lending to Native business owners, with Roanhorse Consulting advising on program design and Native Women Lead working with borrowers.

The Co-op Capital product consists of personal microloans that range from $500 to $10,000 with a five percent interest rate. As part of the pilot, there was a shift in decision-making authority and power—from the credit union to community organizations, nonprofits, and institutions based on character, goals, and determination. With the support of Living Cities and W.K. Kellogg Foundation, partners like Native Women Lead, Change Labs, and Native Community Capital were included in the program design to develop their own underwriting process. This key differentiator acknowledges the relationships that organizations hold with the people they serve and honors their collective lived experience, insight, and expertise. This model also uplifts partners to design programming to provide wraparound support for borrowers, such as financial education, repayment planning, and technical assistance. We have intentionally shifted power to position those closest to the solutions as the experts to address the unique challenges their constituents face, while providing critical infrastructure, funding, and a community of practice to lean into.

For example, as a Co-op Capital partner, Native Women Lead, a project of Roanhorse Consulting that we both participate in, took this unique model a step further. First, at the onset of the pandemic, community members were asked what they needed. Based on this, our group outlined uses for the loans to include housing, utilities, food, and business pivots for Native women entrepreneurs significantly impacted. Then, we developed underwriting criteria that reflect core community values. A final piece was to co-create a review committee whose members are Native women entrepreneurs and entrepreneurial support representatives whom we serve. Nearly half of the entrepreneurs who applied got funded at a zero-percent interest rate with a 90-day repayment period.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Before the launch, we did not feel comfortable providing our community with just debt capital and had received a grant from NDN Collective. In turn, we decided to use that grant to offer 50-percent loan forgiveness to all our borrowers so long as they paid off the first half. This has resulted in faster repayment compared to counterparts in the program.

Lastly, a key component is how we weave in wraparound support. We partnered with New Mexico Community Capital to provide business technical assistance, loan repayment planning, and financial literacy. This critical partnership has resulted in them developing a program within our “circle of support” to address digital literacy and equity in business technical assistance, as many of our borrowers had to pivot online. The stories we hear from entrepreneurs are unique and challenging. Many experienced significant hardships. Our loan gave them breathing room as they sought additional support. Many have developed and strengthened their relationship with Nusenda; some have even accessed additional capital through them based on their repayment history and increase in credit score.

While evaluation is still in process, we have learned that many borrowers feel incredibly cared for, seen, supported, and surprised that there is an organization that is “sharing responsibility in my repayment success”—something never experienced by any of them. It is rare to see strong institutions give up power and simultaneously build power by putting the decision-making into the hands of those who are often not invited to begin with.

The Impact and Learning from the Co-op Capital Model

Since its launch, Co-op Capital has provided approximately $1 million in loans to over 200 individuals, along the way supporting diverse entrepreneurs and their families in building their safety nets as well as addressing emergent needs and opportunities for themselves and their companies. Half the borrowers identify as Native American, and 70 percent identify as women. Also notable: Co-op Capital has a lower default rate than the vast majority of microlenders.

While there is much to still learn and develop, this pilot has demonstrated the importance of moving at the speed of trust and co-creating solutions to ensure the impact sought is not just traditional metrics (e.g., jobs created, revenue generated, percent of low-to-moderate income people served), but culturally aligned and relevant to the needs and measures of success according to Native communities.

The pilot is ongoing, but the insights and data are already creating new opportunities. Native Women Lead will begin launching innovative funding products for Native women-owned businesses later this year. While microloans up to $10,000 are a good place to start, the demand for larger integrated capital requires intentional and equitable design to build a strong Indigenous-led economy.

Four Action Steps to Support Indigenous Entrepreneurs

The learnings during this process have been multiple. We validated that the 5 C’s are only one way of assessing risk, and that while this type of underwriting keeps most Indigenous and marginalized peoples locked out, it’s possible to create finance mechanisms that build on existing relationships while centering people and their lived experiences. The mismatched product design and lack of direct relationships with Indigenous businesses will continue, however, to be a barrier until we build our own pathways, guided by our culture and values. Here are some action steps that people outside of Indigenous communities can take to help remove these barriers:

1) Invest in Native-led infrastructure building efforts. Learn about Native-led organizations and the challenges we face, then provide unrestricted capital that helps us build our staffing, operations, and business model. By doing so, you support people who are deeply invested, understand the nuances, and have built the resilience to overcome significant challenges through their own lived experience while walking a path forward. Your investment goes beyond a traditional impact or ROI; you are supporting economic sovereignty, equity, justice, and inclusion.

2) Leverage your power to build new power in place. One thing that we are learning from this program is that long-term patient lending and grant capital can be effective if the programs are led and designed by Indigenous people. However, we need partners who are willing to leverage their power and infrastructure to help us build and grow future entities that can serve our communities more effectively. Let’s redefine what we mean when we talk about risk, especially how we define who must bear the brunt of it and what we mean by return on the investment.

3) Educate yourself on the racial wealth gap of Indigenous people in both the historical context and current state. Funders and investors need to be aware not just of what’s needed going forward, but also why and how the economic system was intentionally designed to exclude Indigenous business owners and communities.

4) Reimagine the 5 C’s of credit. The 5 C’s are not inclusive or supportive of diverse communities that have been marginalized and kept out of finance. Developing a more equitable pathway to capital requires dismantling the structures that keep everyone out.

A Final Word

As our society regroups from the impacts of the pandemic, the lessons learned provide an opportunity for those of us working in and around finance and access to capital to do things differently. Indigenous people are not a monolith. We hold similar and diverse worldviews. What holds true in one community may be different in another. We intersect in many places and spaces of work focused on racial equity.

As matriarchs, we embody and activate our intrinsic matrilineal ways coupled with Indigenous ways of knowing and being. Thus, our work is molded with a gender and cultural lens. This means focusing on the interconnectedness and reciprocity and acknowledging that Native women are the backbone of our communities.

One of the things we see time and again is that matriarchs are not just entrepreneurs; we are parents, caregivers, and champions for responsive local and tribal government. These roles are interconnected with business formation and growth. In short, we believe that a new model of finance and economic justice is possible when Indigenous women lead the way.