March 27, 2018; WealthManagement.com

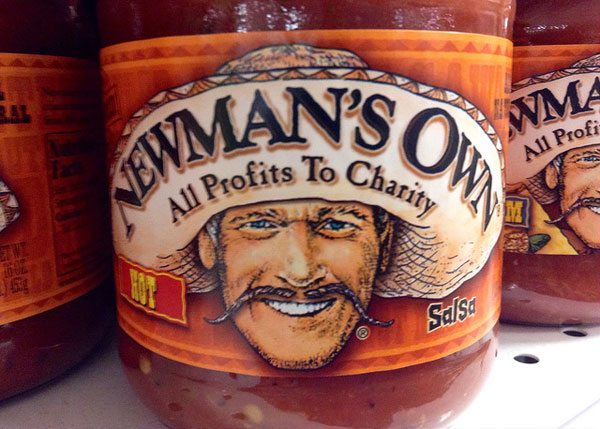

February was a good month for the Newman’s Own Foundation. On February 1st, the foundation announced with some fanfare the milestone of having donated $500 million to charities over 35 years. A few days later, February 9th, President Trump signed into law, as part of the Bipartisan Budget Act of 2018, the Philanthropic Enterprise Act of 2017, also known as the Newman’s Own Exception, ending a long struggle to avoid what would have amounted to a 200-percent tax hit.

Readers will recall that in December of 2017, NPQ ran an article about the dilemma being faced by the Foundation. In essence, the issue was that the foundation had been given ownership of the Newman’s Own corporation in the actor’s will. Unfortunately, there has been a longstanding IRS regulation that private foundations cannot own more than 20 percent of any for-profit business. Newman’s Own Foundation had until November of this year to either divest or have new legislation passed.

After much lobbying, the Newman’s Own Exemption had been included in the tax overhaul bill proposed at the end of 2017. However, it wasn’t in the final bill; the Senate Parliamentarian cited it as one of several elements of the proposed tax bill that were not allowable. In this case, the exemption ran afoul of what is known as the Byrd Rule which prohibits consideration of matters extraneous to the budgeting reconciliation process.

When President Trump signed the Bipartisan Budget Act of 2018 on February 9th, it included the Philanthropic Enterprise Act of 2017. Introduced in June of 2017, the act amends the Revenue Code to allow private foundations to take complete ownership of a for-profit corporation under certain circumstances:

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

- The business must be owned by the private foundation through 100 percent ownership of the voting stock.

- The business must be managed independently, meaning its board cannot be controlled by family members of the foundation’s founder or substantial donors to the foundation.

- All profits of the business must be distributed to the foundation.

So, the good news is that the Newman’s Own Foundation can continue using profits of the food conglomerate to fund charitable organizations and causes around the world. Congratulations.

But what happens now? The Newman’s Own Exemption isn’t just Newman’s own. Other foundations can now take advantage of the sweeping change brought by this new bill. (It should be noted that donor-advised funds are not allowed to take advantage of the new law.)

The original law was intended to ensure that the wealthy could not hide some profits from taxation by giving ownership of the business to their private foundation. That is now possible under the circumstances defined above. So, the question is if we will see a rise in the number of private foundations taking complete ownership of a business, and how this might change the philanthropic model.

If it were to happen, the role of the foundation and its relation to the source of its funds changes quite a bit. Although the day-to-day operations and management of the private business must remain separate from the foundation, the foundation has the right to appoint the board of the business. As one analyst has pointed out, it also means the foundation, in some states, might have the right to approve mergers, acquisitions, and in other ways oversee some key decisions. This analyst also points out that there are some circumstances in which the income shared with the nonprofit from the business, especially if it is a pass-through LLC, may initiate unrelated business income tax.

The people at the Newman’s Own Foundation have won their battle and can remain active using the model that has worked so well for 35 years. Now we have to wait and see what the implications are for the rest of the philanthropic community and the nonprofits they fund. This law has opened the door for a new model to be used and, potentially, abused. Time will tell.—Rob Meiksins