Who really benefits from the estate tax?

For over a century, the estate tax has been put to use with the intention to reduce the concentration of wealth and offer some tax burden relief to individuals, households, and corporations, using the revenue it brings in to allow other sources of income to be taxed at a lower rate than they otherwise would. Arguably, the effect of this tax on either the distribution of wealth or on federal government revenues has been minimal; however, that may be attributable to a number of possible causes: the personal exemptions may be too high, the tax rates too low, or the loopholes and deductions too vast.

In addition to the notion of pure wealth and power being too concentrated, one argument made on behalf of the estate tax is that, whether legally or illegally, some income and wealth have gone untaxed or undertaxed during life, so it should be taxed at death to make things fairer to those who have paid taxes proportionately during their lifetimes. One study by the Federal Reserve Board found that 55 percent of the assets in estates had not been taxed at the time of death. Examples include both untaxed capital gains and wealth accumulated in black or grey markets that escaped taxation during life.

Charites benefit from the estate tax because bequest gifts are not subject to it, creating an even stronger reason to leave a charitable bequest gift. Of course, individuals leave bequest gifts for many reasons, even if they are not subject to the estate tax. For example, one might be able to donate more at death to honor a cause or a charity one supported in life. Some people prefer to leave a bequest gift out of fear of running out of money while alive. Others fear leaving too much money to children or other heirs. Finally, some fear (or oppose) paying too much (or anything) to the IRS from their estate and would prefer to give their wealth to their favorite charities than to pay estate taxes.

Bequest gifts allow lots of flexibility for families in the estate planning. One can donate a fixed dollar amount, a fixed percentage of their estate, or residual amounts after leaving fixed dollar amounts to heirs. We all know we are going to die—indeed, it’s the only thing we know with certainty—yet most don’t plan for it. Two exceptions are my Mom, who has prepaid her funeral expenses, and David Rockefeller, who left an estimated $700 million in valuables to be auctioned at Christie’s, with the proceeds going to charities.

David Rockefeller’s estate gift is unusually large: According to the Chronicle on Philanthropy’s top 50 largest gifts in 2016, the largest bequest gift last year was approximately $400 million; the second-largest was $108 million and the third-largest was $35 million—one-twentieth of Rockefeller’s gift. We estimated total bequest giving last year to be $30.36 billion (Giving USA 2017), or eight percent of total giving.

Why do some individuals and groups oppose the estate tax?

Some people oppose the estate tax (which these folks often call the “death tax”) because they feel that having paid their share of taxes during life, they should be able to allocate that which they have accumulated, independent of the government. Some economists oppose the estate tax because it generates a relatively small share of total federal tax revenue (only about 1 percent of total tax revenues) yet causes lots of anxiety and concern for many—and that’s not to mention the administrative burden created for the IRS’s implementation of the tax as well as the time and money spent on tax planning to minimize or avoid estate tax liabilities. Still others oppose the estate tax as a potential disincentive to save; saving is important to capital investments, which are important to productivity, which is important to growth in real, inflation-adjusted wages.

Finally, some people oppose the estate tax because of fears that children inheriting the family business or the family farm would have to sell these entities in order to pay the estate taxes. On September 27, 2017, in Indianapolis, the president himself recently stated, “To protect millions of small businesses and the American farmer, we are finally ending the crushing, the horrible, the unfair estate tax, or as it is often referred to, the death tax.”

However, there are some misleading factors—or “fake news”—here.

- First, the current exemption levels allow couples to transfer almost $11 million without any estate taxes. Most people would not consider somebody inheriting more than $11 million as “poor.”

- Second, as a result of the huge increase in the exemption levels, according to the Joint Committee on Taxation, only the wealthiest 0.2 percent of estates would pay any estate tax.

- Third, as per the Tax Policy Center (TPC), while the top statutory rate is 40 percent, the effective (average) rate is only 17 percent.

- Fourth, TPC estimated that only 50 small farms or business face any estate tax with an expected average tax liability of 6 percent of their value.

- Fifth, family businesses and farms are allowed to pay their estate taxes over many years. For example, an operating family farm has 15 years to pay off any tax liabilities. During the last major effort to repeal the estate tax, American Farm Bureau, one of the chief critics of the estate tax, intentionally searched for examples of family farms that had been sold because of estate taxes, but they failed to find even one farm lost this way (Johnston, 2001).

How the tax changed through the years

In the United States, wealth taxes go back to 1789, and the modern estate tax was started over a century ago to help fund World War I in 1916. The top marginal tax rate started at 10 percent, grew quickly to 25 percent, and continued higher, maxing out at 77 percent from 1941 to 1976. It remained at or above 65 percent until 1982. It has only been since 2003 that the top marginal tax rate has been less than 50 percent (Jacobson, Raub, Johnson, 2017). While the estate tax once generated 10 percent of the federal government’s tax revenues (1936), it has declined to one percent today (Joulfaian, 2016) and has been a small share for many years.

Does the estate tax matter to philanthropy?

In theory, a reduction in or the elimination of the estate tax would have two potential effects. Estates paying less taxes could use these newfound after-tax resources to give either to heirs or to charities (or some combination). Economists call this allocation of extra wealth from a tax cut “the wealth effect.” On the other hand, lowering the tax rate effectively raises the price of donating an estate gift (aka “the price effect”). Like any price increase, this would tend to reduce charitable bequest giving. Increases in exemption levels would operate in much the same way as a reduction in the tax rate.

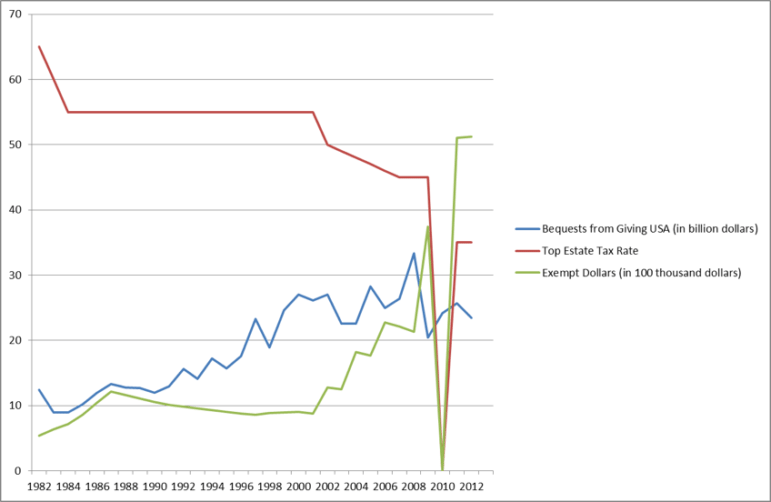

First, it should be acknowledged that bequest giving has more than tripled in inflation-adjusted dollars over the last 40 years from $9.7 billion in 1976 to $30.36 billion in 2016 (Giving USA 2017). Second, it is fair to say that bequest giving has gone up and down on a year-to-year basis that is not entirely driven by the changes in tax policies. As can be seen in the graph below, in some years, tax rates have gone down or exemptions have gone up, yet bequest giving has gone down, and vice versa. In other words, sometimes the actual bequest giving has moved in the direction theory would predict, and other times the opposite has happened.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Second, my own research using aggregate data for charitable bequest giving (from the IRS and Giving USA) from 1954 until 2012 shows that after controlling for many measures of income and wealth, as well as general macroeconomic factors, increasing the top marginal tax rate has a highly statistical significant and positive effect on bequest giving. Controlling for other factors, a 10 percent increase in the estate tax rate is associated with a statistically significant increase in charitable bequest giving of almost 7 percent. Conversely, increases in the exemption level are statistically significantly associated with decreases in bequest giving, especially when the exemption level bumped over $3 million dollars or more. So, as more people were exempted from the estate tax altogether, fewer left charitable gifts at all, or they left smaller gifts than when the exemption levels were lower.

Third, several scholars have estimated the impact of the repeal of the estate tax. These range from 12 percent (Joulfaian, 2000) to between 22 and 37 percent (Bakija and Gale (2003). McClelland (2000) re-estimated these models using more recent data and better measures of wealth and found results in the range of 20 percent and 30 percent. He thought the best single estimate was approximately 22 percent reduction in bequest giving. The Congressional Budget Office (CBO, 2004) came up with a much smaller estimated range of between 6 percent and 12 percent.

It’s important to acknowledge that all of this research is fairly old and that lots of things have changed since then, so they may significantly underestimate or overestimate the effects of a repeal of the estate tax today. It may be the case that they are underestimating the effects of repeal because extrapolating to what would happen with a repeal is trickier than what would happen with more modest changes in tax rates or exemption levels. When there are modest changes in policies, it is easier and more reasonable to state what the likely responses would be because we have historical evidence. Pre-2010, we did not have evidence of what might happen with a complete repeal, and given that the 2010 case was an oddity in many ways—it was stipulated in advance as a possibility but was not expected to happen, and it was always a short-term phenomenon—it may not tell us what would happen if the estate tax were “permanently” repealed. However, it does provide a case study for the effects of a repeal.

Let’s briefly look at the decade before and the years after the repeal in 2010. One can look at individual years, but let’s group some of them to simplify. From 1997 through 2001, the top marginal tax rate was 55 percent and the exemption level ranged from $600,000 to $675,000. During that period, charitable bequest giving ranged from $13 billion to $20 billion, trending up by over 50 percent. (Note these giving figures are not adjusted for inflation, as the exemptions are not. [IRS and Giving USA 2017]) From 2002 through 2008, the top marginal tax rate fell to 50 percent, then down a percentage point per year until it settled at 45 percent in 2007. The exemption levels grew to $1 million, then $1.5 million (2004-05) before hitting $2 million (2006-2998). In that timeframe, bequest giving was pretty stable in the $18 billion to $24 billion range—except in 2008, when it jumped back up to just over $31 billion. In 2009, two things happened to drive down bequest giving: The exemption level jumped from $2 million to $3.5 million, and the Great Recession drove down asset values dramatically across the board (stocks, bonds, real estate, etc.). Not surprisingly, bequest giving fell to $19 billion.

In 2010, the Great Recession had ended, but its effects lingered and there was a public policy “limbo.” Estates that year had two options: Take a $5 million exemption and a 35 percent top marginal tax rate, or a $0 exemption and a 0 percent top marginal tax rate. Most took the zero tax rate, but for technical reasons some rationally elected for the other option. Bequest giving grew by 22 percent to $23 billion from 2009 to 2010—even with a zero top marginal tax rate. The following year, the exemption returned to $5 million, the top marginal tax rate returned to 35 percent, and giving grew 7.6 percent to $25 billion. Since then, the exemption has been adjusted for inflation; the tax rate remained at 35 percent in 2012, but has been 40 percent since then. Bequest giving remained in the mid-$20 billion range for 2012 and 2013, but has been in the low $30 billion range since then.

Clearly, there is no simple and clear pattern here, and the elimination of the estate tax did not eliminate bequest giving in 2010. However, it is hard to draw firm conclusions from this episode, as most people expected policymakers to reach a resolution that did not lead to the repeal of the estate tax for one year—and, it was just in place for one year! Given the uncertainty created by this policy gap before and during 2010, this was a bad way to address public policy, and it was rumored at the time that many high-net-worth households had prepared multiple wills to be deployed in case different estate tax policies were enacted.

Again, it’s important to remember that people give for many different motivations and that bequest gifts are different than gifts during life—it is truly their last chance to donate to support a charity or cause. People usually don’t give just because of a tax deduction, but the research suggests that the existence of an estate tax makes it more likely for people to make an estate gift at all and then to make a larger gift than they would have absent the tax. Finally, the presence of an estate tax encourages donors to give more during their lives as well. Several estimates suggest that eliminating the estate tax would be associated with a decline of giving during life in the 6 percent to 12 percent range (Auten and Joulfaian, 1996; Joulfaian, 2016; and Greene and McClelland, 2001). Therefore, for those concerned about philanthropy, the repeal of the estate would have a deleterious effect on giving both during life and at death.

Conclusion

Most people die without a will, and most of those with wills write them at a single point in their life and don’t tend to revise them unless there is a driving force to do so: marriage, divorce, addition or loss of children or other heirs, misbehavior of said heirs, and possibly a dramatic change to the estate tax laws. However, some households have many millions or billions of dollars in play in their estates, so, understandably, they are hypervigilant about these tax policy changes and revise their wills accordingly.

We should be concerned about the repeal of the estate tax if we are concerned about philanthropy. The best estimates are that the repeal of the estate tax would considerably reduce giving, both during life and at death. We should also be concerned about the repeal of the estate tax from an equity perspective, as it provides an opportunity to tax capital gains and other forms of wealth, legal and illegal, that have escaped taxation. We should be concerned that the repeal of the estate tax inherently requires an increase in other taxes on personal or corporate income if we are to run balanced budget adjustments to the budget and tax policies—as is currently required. Finally, if we believe that wealth conveys power, then we should be concerned that the repeal of the estate tax enables further concentrations of income, wealth, and power among those whose greatest accomplishment may have been getting lucky at birth.

A shorter version of this essay appeared in The Conversation on 10/11/2017.

References

- Auten, Gerald, and David Joulfaian. 1996. “Charitable Contributions and Intergenerational Transfers.” Journal of Public Economics 59(1):55–68.

- Avery, Robert; Daniel Grodicki, and Kevin Moore (April 2013). “Estate Tax vs. Capital Gains Taxation: An Evaluation of Prospective Policies for Taxing Wealth at the Time of Death.” Divisions of Research and Statistics and Monetary Affairs, Federal Reserve Board.

- Bakija, Jon and William Gale (July 2003). “Effects of Estate Tax Reform on Charitable Giving.” Urban–Brookings Tax Policy Center: No. 6.

- Chronicle of Philanthropy (February 7, 2017). “The 2017 Philanthropy 50.”

- Congressional Budget Office (July 2004). “The Estate Tax and Charitable Giving.”

- Friedman, Milton (2017 reprint). “An Open Letter from Economists on the Estate Tax.”

- Giving USA 2017. Researched and written by the Indiana University Lilly Family School of Philanthropy. Published by the Giving USA Foundation.

- Greene, Pamela and Rob McClelland, (March 2001). “The Effects of Federal Estate Tax Policy on Charitable Contributions.” Congressional Budget Office Technical Paper Series, Paper No. 2001-2.

- Jacobson, Darien; Brian Raub; and Barry Johnson (Summer 2017). “The Estate Tax: Ninety Years and Counting.”

- Johnston, David Cay. (2001) “Talk of Lost Farms Reflects Muddle of Estate Tax Debate.” New York Times, April 8, 2001.

- Joint Committee on Taxation (March 2015). “History, Present Law, and Analysis of the Federal Wealth Transfer Tax System.” As cited in Chye-Ching Huang and Chloe Cho (May 2017), “Ten Facts You Should Know About the Federal Estate Tax.” Center on Budget and Policy Priorities

- Joulfaian, David (2000). “Estate Taxes and Charitable Bequests by the Wealthy.” National Tax Journal 53(3): 743-63.

- Joulfaian, David (2016). “What do we know about the behavioral effects of the estate tax?” Boston College Law Review, Vol 57, 843-58.

- McClelland, Robert. (July 2004) “Charitable Bequests and the Repeal of the Estate Tax,” Technical Working Paper 2004-8, Congressional Budget Office.

- Rooney, Patrick; Amir Hayat; Michael Kramarek; Xiaoyun Wang (2014). “Charitable Bequest Giving in the USA.” Working paper.

- Rooney, Patrick M., and Eugene R. Tempel. 2001. “Repeal of the Estate Tax and Its Impact on Philanthropy.” Nonprofit Management and Leadership 12(2):193–211.

- Tax Policy Center Table T16-0277. As Cited in Chye-Ching Huang and Chloe Cho (May 2017), “Ten Facts You Should Know About the Federal Estate Tax.” Center on Budget and Policy Priorities

- Trump, Donald (9/27/2017). As quoted by Glenn Kessler and Michelle Ye Hee Lee (9/28/2017), “Fact-Checking President Trump’s tax speech in Indianapolis.” The Washington Post.