April 25, 2018; The Day (New London, CT)

Every now and again, we see reports of incidents like what’s currently occurring in Norwich, Connecticut, where Assessor Donna Ralston has announced her intent to tax nearly three dozen nonprofits within that city, either through denying them tax-exempt status or, for 18 of them, through dubbing them ineligible as a result of unfiled paperwork. That paperwork, which confirms charitable status, is required to be filed only once every four years. The others, including Habitat for Humanity and the Arts Center Ralston, she says just did not meet the criteria for property tax exemption, admitting meanwhile that she took the actions as part of an effort to boost the tax base.

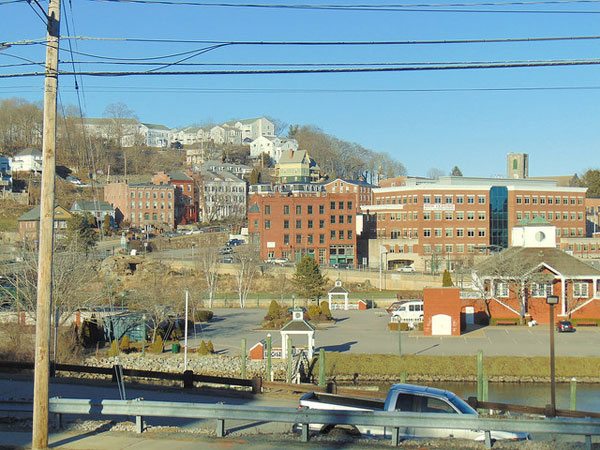

Among those organizations now being billed for taxes on the assessed value of their property are mainstays in the community like the Norwich Arts Center (NAC), Bethsaida Community Inc., Reliance Health, four lots owned by Norwich Free Academy, two Veterans of Foreign Wars posts, and an American Legion hall.

Some of those bills may be quite hefty if they are allowed to go forward. The five parcels of property owned by United Community and Family, for instance, have an assessed value of $4,370,200 and the agency faces a potential tax liability of more than $200,000.

Since the Board of Assessment Appeals has denied eight of the 10 appeals filed by the nonprofits who are affected, the next step is court.

“I find it troubling at this juncture that this kind of statement is coming from the community,” said Jack Malone, president of the board of Reliance Health, whose five properties have a combined assessed value of $1,129,400. “At a time when community-based nonprofits are beleaguered by dwindling state support, it adds insult to injury for the city to say, ‘We are denying you the tax-exempt status you have been enjoying for so long.’”

“Reliance Health was started with the single goal of helping people with mental wellness issues, who were thrust into the community with no place to go. Forty years later, this is what the community of Norwich says to them? After 40 years of work?”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

“For 30 years, Bethsaida Community Inc. has provided outreach, housing and support services to homeless women,” Bethsaida Executive Director Claire Silva said in an emailed statement. “Each year, we house about 60 women. Clobbering nonprofit agencies with taxes (agencies that have already been hit by Connecticut funding cuts) is not how you help the most vulnerable populations.”

For her part, Assessor Ralston contends, “I’m really not trying to be mean with all this tax-exempt stuff. I’m trying to be fair to the people who pay taxes.”

“These organizations] can be considered a tax-exempt use by the state and the feds, and still be a taxable use in the city,” Ralston said.

In some cases, the bills may make annual budgets untenable—in NAC’s case, for instance, their property taxes on $342,300 in assessed value would be more than $16,000, which would need to be paid out of a total annual budget of $96,000. The only way NAC has a hope of getting the assessment reversed is to work together with other organizations under the Community Nonprofit Alliance (CNA), a statewide umbrella group, to fight the denials and get the rulings reversed in court.

According to Gian-Carl Casa, president and CEO of CNA, other localities in Connecticut appear to be taking similar actions and he worries about the problem becoming a trend. This is certainly not the first time we have heard about local nonprofits suddenly being faced with tax bills and even liens. In Camden, N.J., in 2012, many nonprofits were hit with tax liens after the city adopted new standards of proof for tax exemption. The largest lien issued in that case was for $152,000 to the Camden County Office for Economic Opportunity, which had been tax exempt since 1965. The tax court eventually reversed many of the decisions, forcing the city to buy back liens they had placed on properties and then sold.

One good lesson in this may be the manifest usefulness of nonprofit state associations in responding to common threats. If you do not yet belong to one, maybe you should make joining one something you do today.—Ruth McCambridge