This is the last of four parts in a management series for nonprofits on platforms as organizational forms. The series will describe the dynamics of how platforms work and how to approach balancing, growing, and sustaining them over time.

Metrics have a complicated place in nonprofit organizations, or in any efforts seeking social change. Trends have moved from measuring inputs, to measuring outputs, to measuring outcomes, to measuring impact.

Platforms amplify value and allow for clear measurement. They sidestep some of the challenges of measuring social change with their simple focus on curating high-quality interactions, which is also a key metric for a good society.

While a platform may be designed to track various indicators, the core metric is the number of satisfying user interactions. In other words, “Platform metrics need to measure the rate of interaction success and the factors that contribute to it.”1 With platforms, we learn to capture and measure network effects.

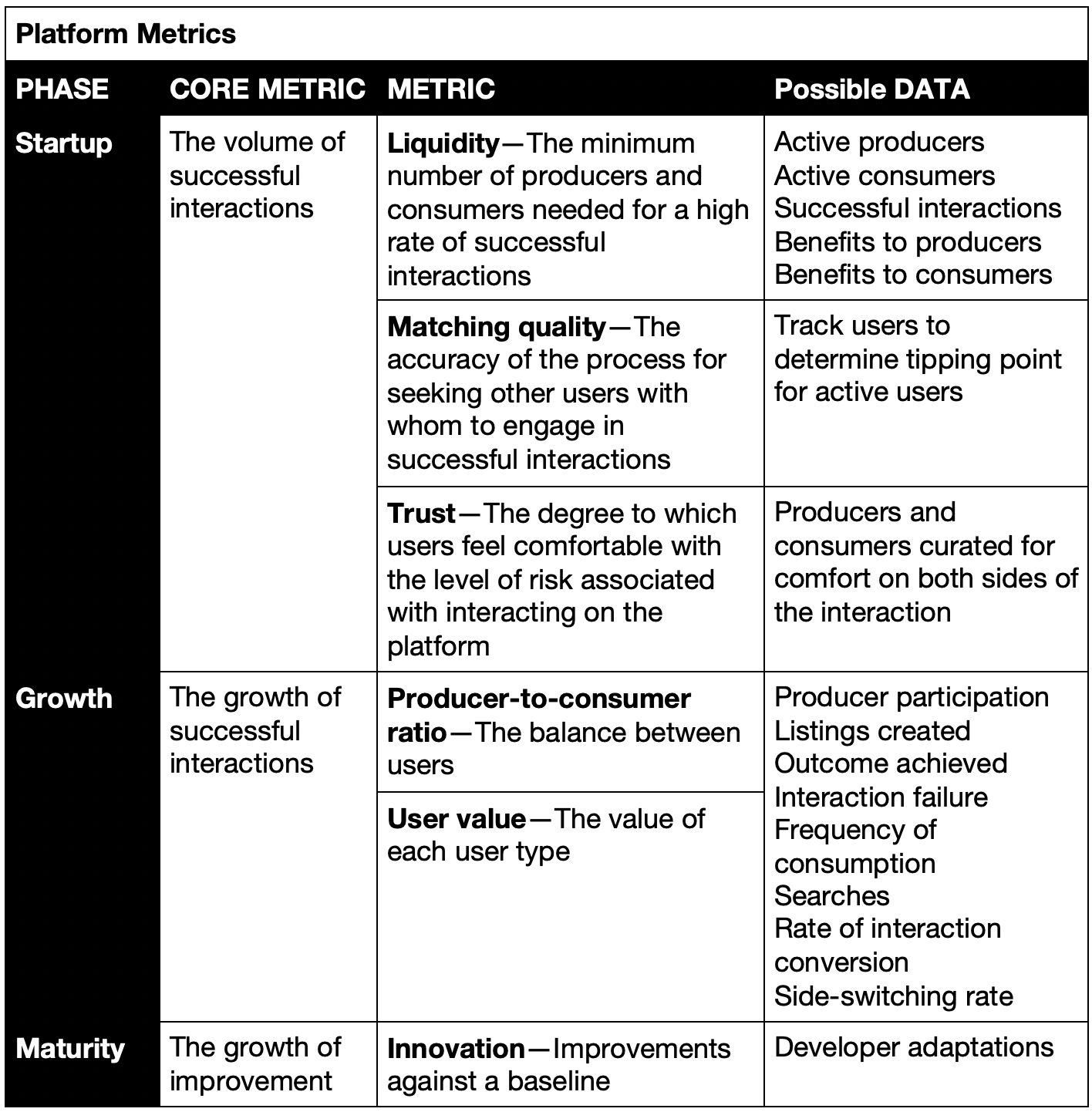

Metrics also correspond to the life cycle of the platform, or what phase of development it is in—from startup, to growth, to maturity. Platforms in the startup phase must track “the growth of their most important asset: active producers and consumers who are participating in a large volume of successful interactions.”2 Traditional metrics, such as revenues and cash flow, are not relevant in evaluating the strength of the platform in this phase.

In addition to the volume of successful interaction, platform managers should focus on the benefits that accrue to both producers and consumers. The purpose is to define success and failure, and identify how to improve the value of the platform for its users. There are three key metrics for this—liquidity, matching quality, and trust.

Platform liquidity is the state of minimum producers and consumers needed for a high percentage of successful interactions. “When liquidity is achieved, interaction failure is minimized, and the intent of users to interact is consistently satisfied within a reasonable period of time.”3 Though the formula, or the data collected to satisfy the metric, will vary from platform to platform, this is the first and most important milestone in the life cycle.

Matching quality is the accuracy of the process for seeking other users with whom to engage in successful interactions. “It is achieved through excellence in product or service curation.”4 This must be translated into a concrete quantity “with a clear operational definition.”5 One way to do this is to track users for a period of a few months to differentiate between different types and corresponding levels of activity. From this, the platform manager can determine a tipping point after which users become active. Then, the rate of users at this level can be tracked as a signal of platform strength.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The third key startup metric is trust, the degree to which users feel comfortable with the level of risk associated with interacting on the platform. As with matching quality, it is achieved through curation. “A well-run platform is one in which participants on both sides have been successfully curated so that users are comfortable with the level of risk involved in engaging.”6

Platforms that focus on content creation may require additional metrics. These include some measure for co-creation—“the percentage of listings that are consumed by users”— and consumer relevance—“the percentage of listings that receive some minimum level of positive response from potential consumers.”

In the growth phase, platform managers must ensure the vibrancy of the platform’s core interaction, and that the inflow of new users is greater than the outflow of users, so that the platform grows. This relies on a balance of users, or the producer-to-consumer ratio. Any efforts to balance focus on active users (“those who’ve engaged in interactions on the platform at a specific minimum rate of frequency that you consider appropriate”7). One way to do this is to measure the value of each user type.

Producer value can be measured by monitoring frequency of producer participation, listings created, outcomes achieved, and interaction failure—the percentage of interactions that are initiated but not completed. “These models capture the mechanisms by which repeat producers provide recurring platform [value] without incurring additional acquisition costs.”8 On the flipside, “because repeat producers are especially [valuable] to a platform, well-managed platform[s]…work hard to create active repeat producers.”9

Consumer value is tracked by monitoring frequency of consumption, searches, and rate of conversion—the percentage of searches that result in interactions. An additional metric is the side switching rate, or the rate of conversion from one user type to another, as in from consumer to producer.

In maturity, platforms focus on innovation, or the growth of improvement. One way to identify necessary innovation is to look at the adaptations that users are creating on the platform and determine which are used widely enough such that they should be incorporated into the core interaction somehow. In this way, the platform expands on its core interaction.

Notes

- Parker, Geoffrey G., Marshall W. Van Alstyne, Sangeet Paul Choudary. Platform Revolution. New York, London: W.W. Norton & Company, 2016. 186.

- Ibid, 187–188.

- Ibid, 190.

- Ibid, 191.

- Ibid.

- Ibid, 192.

- Ibid, 195.

- Ibid, 197.

- Ibid.