May 1, 2020; Colorlines and NPR

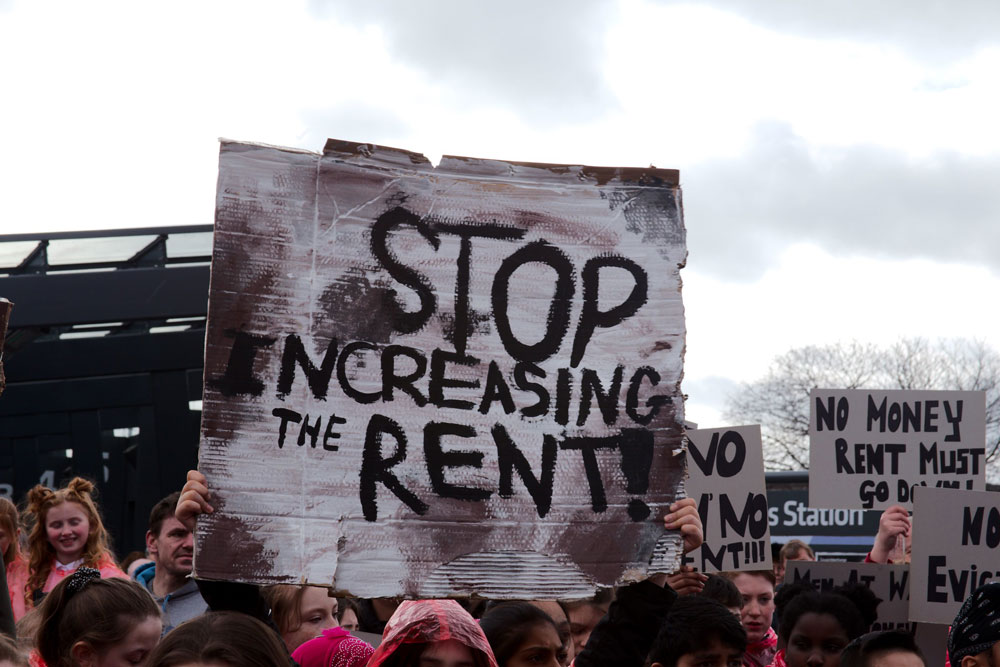

The COVID-19 pandemic has brought the housing crisis to a breaking point, but it is not what prompted it. Much like other systemic problems, housing injustice has plagued the country’s biggest cities with a cycle of poverty that affects students, low-income, and communities of color the hardest.

“Housing was already unaffordable for tens of millions of low wage essential workers—from grocery clerks to delivery drivers to hospital custodians—before COVID-19 hit. Now, those workers are risking their lives to keep their homes,” writes Maurice BP-Weeks, co-executive director at Action Center on Race and the Economy (ACRE).

Together with the Alliance of Californians for Community Empowerment, Alliance for Housing Justice, Housing Justice for All, Bargaining for the Common Good, the Center for Popular Democracy, Jobs with Justice, Partnership for Working Families, and People’s Action, ACRE created a housing justice coalition to call for rent and mortgage strikes as a response to a pandemic stimulus package that leaves the underserved behind. Their website, WeStrikeTogether.org, is tracking rent strikes by zip code with nationwide heat map. So far, close to 200,000 people have taken the pledge to rent strike, out of whom 31 percent said they didn’t pay rent in April.

Their website also provides a bank of resources and research, including reports like “Wall Street Landlords Turn American Dream into American Nightmare” by MIT graduate Maya Abood, which shows how real estate speculators have perpetuated the practice of bundling rentals into bonds, driving an inflation of property values similar to that which caused the market crash of 2008. The report explains that global equity firms like Blackstone Group and Colony Capital have been buying tens of thousands of homes for years to turn them into “competitive” rental properties. Predatory lending and evictions have become the “solution” to minimize market “losses.”

These national organizations have seen firsthand the immediate impact of these practices, which disproportionately affect moderate to low-income families, mainly communities of color. It also has created a housing crisis among college students, who are increasingly living in crowded spaces, forced to hold several jobs just to pay rent, and accruing student debt that will further decrease their ability to perhaps become homeowners themselves one day. The lack of housing security and evictions thus become an endless cycle of poverty for most.

At Princeton University’s Eviction Lab, researchers under the guidance of Professor of Sociology Matthew Desmond have meticulously tracked evictions by state since 2017, thanks to funding from the Gates, JPB, and Ford Foundations, among others. Their goal is to show that “eviction functions as a cause, not a condition of poverty” in a world where most families spend over half of their income to pay rent or a mortgage. According to The Atlantic, even during good times, “three in five renters could not have come up with $400 in an emergency.”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The pain and fear of personal economic woes is felt through the #CancelRent movement, a more loosely created alliance of over 70 organizations. They are seeking to “fight for a future free from debt” as millions are turning to their credit cards to pay for rent.

“This moment is really terrifying, but it’s also quite inspiring,” Cea Weaver, coordinator of Housing Justice for All, told Curbed New York. “It’s in moments of crisis that we’re able to win big things from the first rent control laws in New York state’s history about 100 years ago to public housing and more. It’s in moments like these when we can really push the envelope to envision a totally different world.”

Their demands include an immediate moratorium of rent, mortgage, and utility payments during the pandemic for renters, homeowners, and small businesses, plus a three-month recovery period. They are also calling for the immediate release of immigrant detainees.

Representatives in the House, including Ilhan Omar (D-MN) and Alexandra Ocasio-Cortez (D-NY), are co-sponsoring a bill calling for temporarily suspending rent and mortgage payments. The bill includes a Landlord Relief Fund to reimburse property owner and lenders for payments lost. Distributed through HUD, the stimulus bill would give preference to nonprofit owners and small landlords and requires a set of stipulations to applicants, such as a five-year rent freeze, just-cause evictions, and non-discrimination rules to protect tenants. Some local initiatives have already taken place.

The Eviction Lab recently added a section with COVID-19 scorecards to track policy driven by local governments to ameliorate the housing crisis in their state. Massachusetts rates the highest, with policies such as freezing evictions for nonpayment, suspending eviction court orders, and passing foreclosure moratoriums that extend past the emergency declaration. California, on the other hand, has one of the lowest scores at 1.80/5.00, teetering on measures that barely hold back a wave of homelessness, a crisis that has already surpassed basic human rights standards in one of the richest states in the country. States like North Dakota have not enacted any policies to help people with their precarious living situation.

The truth is the housing crisis preceded the health crisis, with housing and rental prices skyrocketing year after year, placing the most vulnerable a month’s pay away from losing their right to adequate housing.

“We are all supposed to stay home, but that’s not possible in a society structured to make it impossible to keep a roof over our heads,” writes B-P Weeks.—Sofia Jarrin-Thomas