June 18, 2020; Common Dreams

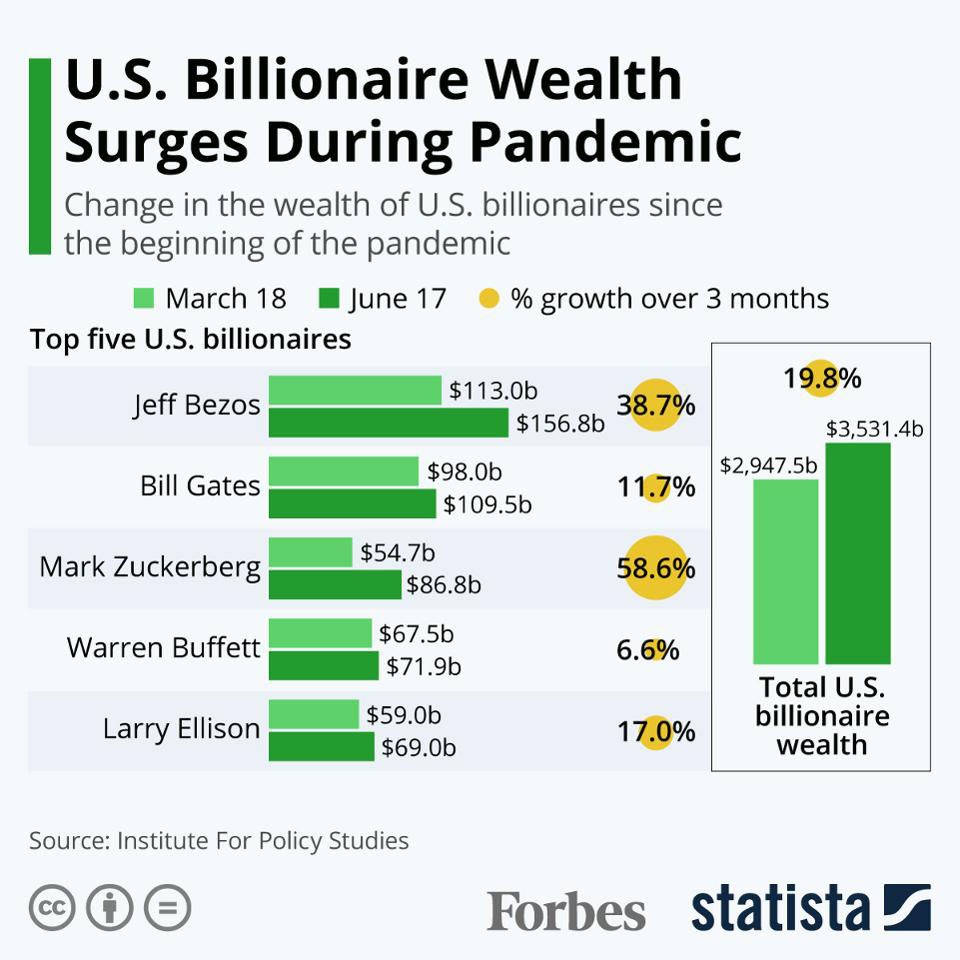

Earlier this month, the Institute for Policy Studies and Americans for Tax Fairness (ATF) published an analysis that lays out crimes against the collective well-being of this country. US billionaire wealth has increased by at least $584 billion, even as 45.5 million people have filed for unemployment.

That constitutes a 20 percent increase in billionaire wealth in the three months ending June 17, 2020. Over the same period, 29 additional people became first-time billionaires as millions stare down the barrel of hunger, eviction, and enormous debt.

Looking at the chart below, it is clear that Jeff Bezos of Amazon is the hands-down master of profiteering off of the suffering of others, having accumulated another $43.7 billion, or 38.7 percent growth, in the three-month period. Meanwhile, of course, Amazon was congratulating itself for taking down posts of those who were price gouging for personal protective equipment on its site. Let’s remind ourselves that Amazon’s effective federal income tax rate in 2018 was negative one percent—and it was zero the year before—so to date they have not paid into relief of the disaster out of which billions were extracted.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Frank Clemente, ATF’s executive director, says “This orgy of wealth shows how fundamentally flawed our economic system is.” He adds, “If this pandemic reveals anything, it’s how unequal our society has become and how drastically it must change.”

In reviewing the chart above, it is worth noting that University of California at Berkeley economists Emmanuel Saez and Gabriel Zucman found that 2018 marked the first year since the Forbes 400 existed in which the Forbes billionaires paid a lower effective tax rate than the bottom half of US households (23 percent v. 24.2 percent). Back in 1980, the effective tax rate paid by Forbes 400 billionaires was 47 percent, and it was even higher—56 percent—back in 1960. Clearly US tax policy is out of whack, and, not surprisingly, Americans of color and of low incomes are most affected.—Ruth McCambridge