This article comes from the summer 2004 edition of the Nonprofit Quarterly. It was first published online on June 21, 2004.

It’s beautifully wrapped and from your favorite store. It’s what you always wanted! But wait. It’s too big, or too small. It’s mohair, not linen. Or you really needed something else. How do you tell Aunt Bea? Or do you?

A happy giver and a content receiver, to paraphrase Tolstoy, are happy for similar reasons, while unhappy givers and receivers are each uniquely unhappy. Happy gifts are memorable, well-timed, and appropriate to the occasion; and they make everyone feel great. Unhappy gifts don’t work for familiar reasons: they don’t fit, or are ill-timed, age-inappropriate, too expensive to own, or just not interesting to the recipient.

In the nonprofit economy gifts are a significant, influential form of currency. And here, too, givers and receivers alike have difficulty describing—much less producing—the right gift. A shared set of rules of “gift physics” that predict some of the intended and unintended effects of large gifts can help guide both sides. Conventional wisdom might prescribe that we avoid looking a gift horse in the mouth, but experience—from Troy to today—teaches us that a quick look into the gift horse’s mouth, helps givers and receivers alike avoid common pitfalls. Here are some familiar gift horses, along with stories about their breeds, sample physicals, suggestions on their care and feeding, and a financial floor plan of the stable, which shows how they compare.

Framework for a Physical: The Triangle and the Rules of Gift Physics

For all nonprofits, sustainability means keeping the balance between mission, capacity, and capital. If one changes, the others must change to maintain balance within the enterprise. These fixed relationships in a dynamic system might be described as “the laws of gift physics,” where the impact of matter (gifts of varying kinds) introduced into an existing system (an organization) gives rise to certain predictable results. To some extent, in a gift system, every action has an equal—and opposite—reaction. Under these rules, each gift to an organization has an impact that exerts pressure on other parts, forcing the others to adjust to the impact of the first. Here is our familiar triangle where mission, capacity and capital exist in equilibrium.

If any one side of the triangle changes, the other two must change. This takes place whether it is planned or not, whether the giver intends it or predicts it or not and, above all, whether anyone wants it to happen or not! In that the recipient is often more anxious to receive than the giver is to give, the momentum of the transaction is from the giver to the receiver. Therefore, the giver has more power to carefully consider and potentially re-steer what might be a dangerous course.

What might be some other laws of gift physics?

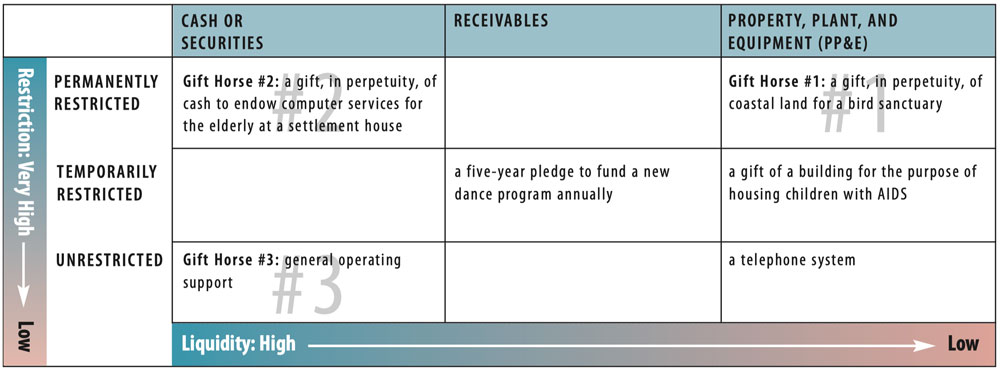

- The more restricted a gift, the lower the net positive financial impact, and therefore the higher the draw, most immediately on capacity and eventually on capital and mission.

- The more illiquid a gift (the farther from “folding green,” e.g., cash, on the chart below), the greater the draw on the rest of the organization’s resources.

- The more liquid the gift of an asset (cash is the most liquid; land is one of the least liquid), the more power management has to balance the three points of the triangle while fulfilling overall program goals and meeting the giver’s overall wishes.

- If a gift is both liquid and unrestricted (e.g., general operating support), it provides the greatest flexibility and presents the lowest risk and cost, and hence the most predictable boost to mission.

Here are some examples of how various “gift horses” compare within this framework:

Restriction and Liquidity

Gift Horse #1: The Thoroughbred: Fabulous, high-profile…and high maintenance; Gift of a Permanently Restricted Fixed Asset.

Titmouse Unlimited of South Beach, Inc., a small, locally based, open-space preservation and advocacy organization has received a large bequest of coastal land. It’s a gem. The preserve will protect a key migratory bird habitat, and guide development away from valuable wetlands. For Titmouse, Inc. this is a huge coup. The single full-time staff person immediately agrees to accept the gift, embracing the donor in tears. It is indeed an exceptionally generous gift; a very large tract, the land is worth millions.

The donor’s conditions provide that the land must remain pristine, and may not be sold or developed. In other (accounting) words, it’s a permanently restricted fixed asset. On the continuum of financial liquidity, it is permafrost, with the consistency of glacial ice! It can’t be sold or used for any typical money-producing purpose. Moreover, it will probably require funds to care for and protect it. The green eyeshade equivalent of a cold black hole—and Titmouse is so excited to own it!

Despite the positive bounce, the trend is for expenses to increase faster than revenue. And because Titmouse, Inc. was small, it had no reason to build infrastructure for management. This rapid growth didn’t leave time for such investment. By ’06, despite the fact that a second full-timer has been hired (or possibly because of it), the increase in expenses outpaces the increase in grant revenue. As growth—in the form of increases in gross revenue—is proceeding, net revenue is declining, or not keeping pace with the size of the whole enterprise.

Why the sharp increases in expenses? Well, the new land needed to be insured, and there were legal bills. Birdwatchers who were Titmouse’s long-time supporters wanted access to the land, but they had nowhere to park. The topless bar adjoining Titmouse’s southern border didn’t want to share its parking lot. Also, there weren’t really any trails. Both the donor’s heirs and a group of people with disabilities are contemplating legal action against the donor or Titmouse, Inc. for different reasons. And while the director is looking for ways to develop earned revenue, and diversify fundraising, each is a new business venture (or an expansion) that takes investment of its own. Titmouse has neither a development department (to raise the money) nor experience operating a “social enterprise” business. No wonder its sole staffer cried on the donor’s shoulder when the gift was announced.

All in all, however, if we looked only at the income statement, the change wouldn’t seem huge. If this were a growth path with the original balance sheet, minor changes (beefing up fundraising a little; going from full- to half-time for one position) would carry the day. The flexibility of a small organization allows for these adjustments. The dramatic change that is driving this pressure on capacity, although an irresistible windfall from the point of view of mission, is manifest on the balance sheet where “capital” resides. What happened, and what is likely to happen?

One unintended effect is that the gift induced Titmouse to take on a completely new business without any capitalization, staffing, or for that matter, consciousness of a major change! While this alone would have been a colossal challenge, the effect on the existing environmental advocacy business is daunting as well. Who would organize and lead the annual bird count? What about the large contingent that Titmouse leads to the state capital at budget time, for the annual Financial Flap? And who would program and host the “Titmouse Twitter”—highlighting migratory birds that stop by on preserved habitat—on local public access TV? They had a bevy of fans. Would they lose the base they had so carefully built?

Driving the directors’ shock was the tangible change in the balance sheet. It was truly dramatic: With the gift of land, Property, Plant and Equipment (PP&E) grew from 20 percent to 99.9 percent of the balance sheet: appraised at market, the land was estimated at $10 million. Formerly, Titmouse, Inc. had been essentially a single-proprietor advocacy and education organization.

By taking the gift, Titmouse became dominated by its property management business. And nobody—not the donor, nor the Director of Titmouse, Inc., nor the board—realized that the gift would require a major change (addition) to the core business of education and advocacy. Accordingly, neither the donors nor the recipient had prepared for the business implications of the huge change. If others’ experience is any indication, ’06 will be just the tip of the iceberg! What did the physical for this gift horse conclude?

Mission: A+ This is such a fantastic gift; its “mission impact” outweighs practical considerations at the outset. Everyone invariably plays catch-up as a result—and it’s to be expected.

Capacity: D- With this gift, the donor has “bet the farm” on an excellent, community-based organization that has a dedicated, charismatic leader with no track record in management (beyond managing advocacy volunteers) and no formal knowledge of land management. But such expansions can, in fact, “hollow out” an organization and overextend an excellent leader of a small organization. This can lead sometimes to the loss of the very “stuff” that originally attracted the donor.

Capital: D- With this gift, the nonprofit has experienced a major change of business with no provision for the capitalization of, or source of revenue for, that business.

“I have been here for 23 years, and I have never had a more engaged program officer,” the director of Pewabic Settlement House confided over lunch to the president of the Abenaki Foundation. She wanted to say, “Jane, the program officer at Abenaki is obviously smart, but she’s never managed a nonprofit. She needs to listen! She requires $10,000 of conversation for $15,000 of gift; the result is a carefully crafted, very specific program, which may be great—but I feel bullied!”

But Jane was a skillful and determined advocate within the foundation, and Pewabic would benefit. Jane had crafted a large challenge grant to create an endowment whose proceeds would be used to fund programs for the homebound elderly at Pewabic. The income from the endowment would be further “targeted” so elderly people, especially women, would get training and other supports to access the Internet. Jane’s mother, a fun and formidable lady of 68, surfed the Web, kept in touch with her family, and generally fought loneliness and isolation by using the Internet. Jane wanted this for more elderly people, and hoped that a demonstration at Pewabic—a multi-ethnic, multi-class center—would help spread the word broadly and give rise to other such efforts.

Jane and her foundation didn’t stint. They produced a $5 million challenge grant—to be matched one to one. The director of Pewabic developed a campaign with the help of some engaged board members, and they met the challenge and more. The settlement house had a long-standing group of givers, and this had actually pushed the director to reach out into previously untapped individual donors. The program appealed perfectly to the well-off 50-somethings who had parents who were living alone. It was an idea they embraced; the demographics were good, and the program looked like a gem.

The first year of the program was wildly successful. Pewabic expanded its staff: recruiting computer instructors; adding computer terminals, training staff and participants; and instituting an on-line newsletter and listserv. As the program expanded more terminals were added, requiring more space, another Internet connection, and work tying the system to Pewabic’s existing computer network. With the growth of the network, more time was needed to maintain communications with the growing group of participants. People from all over the city—and country—were now part of Pewabic’s “extended family.” But what was taking place on the balance sheet? What capitalization questions were arising?

Well, programmatically, to the delight of everyone, all hell broke loose. While certainly suited to the mission, the neatly conceived program’s popularity has exceeded all expectations. Within the first year, Pewabic discarded all its original plans! To the disappointment of all, a bitter lesson proved once again to be true: runaway mission-related success for a nonprofit is almost always a qualified financial success, if not an outright disaster. In this case, the success would be confined to one program area among many, and would serve a geographic area that would extend far beyond traditional geographic boundaries. Pewabic, predictably, needed to institute planning time and investment to catch up to this innovative program.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

From the green eyeshade perspective, the growth of the program and the demands of the continuing capital, capacity building, and program needs pushed Pewabic to the limit. By 2009, the program will have exhausted its own self-generated working capital and will be pulling capacity out of the organization if it doesn’t restructure. As a settlement house, Pewabic’s strength is in its connection to all of the people and families that live in that neighborhood, but now the needs and excitement of this one program have grabbed every spare moment. The result? Now there is intense competition for planning, fundraising and general leadership between this program and homeless housing, intervention with young people, vaccinations and meals, elderly day programs and everyday infrastructure. Contrary to type as an entrepreneurial executive, the director now longs for planning—and a process that will acknowledge the many difficulties she has encountered.

What is the diagnosis for the gift and for the parties?

Mission: C+ This is a very winning program, somewhat off-kilter for the settlement house because it focuses so strongly on only one part of its constituency (elderly people) and takes them outside of their geographic boundaries. The executive is engaged, and understands the program potential. What she doesn’t understand: why a wildly successful program seems so draining.

Capacity: C+ Pewabic has sound management, but it’s pretty spare, and focused on a traditional settlement house model. The parties have chosen to use cash to fund a complex fixed asset (computers), which depreciates rapidly, requires extensive management and training, and needs to be integrated into the rest of the operation via intensive and repetitive training, hiring of additional personnel, and more. Essentially, this grant will make a substantial increase in the fixed cost of operation without any increase in pricing, revenue from subsidy or other sources of funding. It’s probably well worth it, but the hardware itself is probably one-fourth to one-third of the total cost of change in operations. Yikes!

Capital: C If there is an overall scarcity of resources (especially cash) when an organization makes a decision to use cash to purchase a fixed asset, it will reduce operating and financial flexibility to the extent it invests in that asset. The asset—in this case, rapidly depreciating technology—vaults the organization into a cycle of replenishment (PCs need replacement every three years), training, and technology infrastructure, which goes far beyond anyone’s plans. While it may be a wonderful move programatically, to do it right involves a change to capitalization, capital structure, and its maintenance, which is completely new for the entity.

The phone was ringing off the hook (or it seemed to be; in reality there were no more hooks, only buzzes and a really bad voicemail system) at Judgement Day, Inc., a nonprofit that provided treatment to heroin-addicted teens. “This phone system is the pits,” said Slade Golspie, the program director. “Let’s try to get someone to give us a new one. How about that trader from Wall Street we rescued back when he was a kid and on coke? He was grateful, and now he’s rich! And clean.”

Slade’s call was successful. The trader wanted to help, and listened to Slade’s pitch for the telephone system. “Just give us the system,” said Slade. “That’s it, and you guys must have more out-of-date telephones than anyone.” The trader was puzzled. Was it possible that a nonprofit with a hotline of ten extensions could really want a slightly outmoded telephone system from a Wall Street trading company with 65 traders? Could they really make it work? Why wouldn’t Slade just buy the most appropriate and up-to-date system and ask him for money?

The trader had a knack for trading, sensing the market and making instant buy/sell decisions, and he’d been successful—but he had not had management experience. Nonetheless, some of his classmates (back before he dropped out as a junior math major in the business curriculum) were in management jobs now. He knew the patter, and some of the basics, and this was against all assumptions.

But the executive director of Judgement Day, Inc. was implacable. “Look, our funders don’t like to see any overhead. If we get the system donated, we can just bury it in our financials.” The trader relented. “OK, I’ll see what I can do.”

Sara Tate, Slade’s assistant (cum office manager and operations director) was irritated. “Why didn’t you just ask him for cash? He’s not all nuts about trust: he expects it, and we don’t want some outmoded too-big phone system from someone who nobody dared clue in. The technology’s moving too fast for that—we’re much better off with the $3K new improved version than the $25K old version. Who came up with the idea that a busy hotline is better off with donated equipment! Telephone service is our core business, for heaven’s sake! Grrrrrrr.”

Slade Golspie relented. He picked up the phone, fearing the worst. “He’s going to think I’m dippy! But Sara’s right. We need it.”

The cell phone played “Yakety Yak” electronically. The trader picked up immediately, laughing. “Sorry, can’t hear very well now; I’m on my cell at a cigar bar with some buddies. What’s up?”

Slade’s mouth was dry and he felt nerdy. “What a riot! Listen, I was thinking. What would you say to just giving us cash instead of the phone system? I mean, it’s not what we started with, and I know that you pushed back a little then and I didn’t listen but cash for a new system would really be the most helpful thing.” He steeled himself. The response was instantaneous.

“I was wondering why you didn’t ask for that. Sure. I mean, of course, it makes perfect sense. You guys do important work! I should know, huh? I’m sure that this is going to be a better investment. You people saved my life. Let me know how much you need; I’ll do the best I can. Ya know, I can bring in some of my pals to cover you on any hits to your budget; I can testify to how great your program is, whatever. Just let me know.” Sara was thrilled. “You pulled it off! Thank heavens! You have no idea what a pain it is to try to reprogram and refit an outmoded system. It would have cost us $5,000 to take the damn thing, and now for $3,000 we can get a new, state-of-the-art system. Let me write the thank you!”

Would a generous patron want to give a gift that creates cost? Of course not. It’s most commonly poor communication and lack of understanding on both sides of the transaction that lead to gifts that distort capital structure, change business, spur adventitious growth and sap operating strength as growth occurs.

Mission: A This equipment is aligned with the core business and mission of Judgement Day. They knew what they needed and clearly stated it.

Capacity: B+ A gift to purchase phone equipment probably merits some conversation about what kind is needed, the provision for training, the size, and other planning aspects. Sara seems equal to the task of researching for the right fit.

Capital: A Here’s a donor with business brains who would like to do the right thing! And, just in the nick of time, the nonprofit manager is not going to insist on a self-destructive course. If the generous trader alumnus gives cash in excess of the exact purchase price, which will get the state of the art, right-sized system in and the staff trained, he will deserve the title of “angel.”

What to Remember about Horses and Physics and Such

We can do better in the art of receiving large gifts so they don’t inadvertently rear up and hurt us. In fact, we all (givers and receivers) have some power to use the laws of financial physics to our advantage field-wide. Here are some insights and recommendations.

Nonprofits exist to take on causes that for one reason or another are not commercially viable (their missions are the reason they stay in a commercially non-viable business). Among such businesses are discovering a vaccine for AIDS, creating an accessible dance notation system, providing health care to indigent World War II veterans, or helping workers whose small business markets disappeared after 9/11 rebuild, to name a tiny few. This requires much financial discipline, but the notion that most nonprofits can grow themselves out of contributions is largely unrealistic. (Harvard University, a leading nonprofit, hasn’t done it in over 300 years.) Planning by givers and recipients should acknowledge this and not create unrealistic expectations for profitability or achieving scale, and therefore profitability.

The more restricted a gift, the easier, generally speaking, it is to raise. When they are confident and management savvy, grantees confidently negotiate with donors to invest sensibly. Sophisticated donors—like knowledgeable investors—find people and programs they care about and have faith in, check out the plans to see if they are reasonable, and then back them with unrestricted cash, trusting management to pull it off.

Plan for success. Many nonprofit executives are inured to hardship, so success and growth don’t really enter the planning picture. When they do succeed—and need to embrace the business realities of growth, replication, and change—they may hesitate and fail to understand the degree of adaptation needed to make this new thing work. The wise donor in this situation focuses on ends rather than means, encouraging constant vigilance but giving operating flexibility to the manager.

Program growth almost always means business weakness, at least in the near term. Unfortunately, grantmakers and nonprofit directors alike almost always anticipate that program success—more coverage, more clients, etc.—will mean financial success. It’s almost always the opposite, and more grants are required before stability is achieved.

Keep alert to new business opportunities, but don’t think the nonprofit necessarily has to run them. While the Pewabic example describes an organization with computer skills and market savvy, the reality of actually running a computer-based training and networking business is completely new. The endowment grant created an opportunity to enter such a business, but the larger question is, what’s the best way to enter a new business? They may be in a good position to contract for, rather than immediately enter, the business themselves. Outsourcing for non-core business functions is a real possibility for many such business shifts until core capacity can be built internally (or forever). The key is to focus investment on cradling the core competency of the organization, not scaling a business that is dependent on technology where draws on capital will be continual and scale elusive.

Focus resources on the core skills the nonprofit brings to the enterprise. In the case of Pewabic, it’s convening, organizing, communicating, and creating community, as well as, sometimes, educational programming. It may not, however, include operating a technology center.

Gaze into the mouth of a gift horse while looking for the hidden problems. Of course we must acknowledge that from a mission point of view there will be opportunities that, however dire the business consequences seem, should be grabbed nonetheless and sorted out later. However, understand that you may be betting the farm! Prepare for significant change.

Grantmakers, board members, and executives alike: Above all, do no harm. For an organization with a strong track record; good vibes; reasonable financials; a compelling case statement that aligns with philanthropic intentions, mission, and growth objectives; charge ahead concentrating as much as possible on unrestricted operating support.