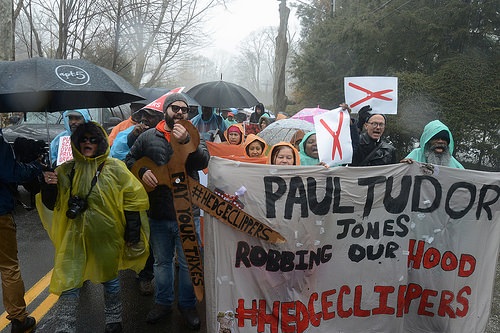

May 11, 2015; Hedge Clippers

A project of the Strong Economy for All Coalition in New York, the Hedge Clippers group is unsparing in its criticism of the hedge fund billionaires who the Clippers feel have outsized influence with government and politics. Even when the hedge fund moguls operate under the whimsical notion of being “Robin Hoods” aiming to eliminate poverty, hedge funds leaders use their political contributions, business operations, and even philanthropic instruments to “expand their wealth, influence and power.”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

That’s clearly the point of the scathing new report the Hedge Clippers issued about the Robin Hood Foundation, a high profile public charity founded by hedge fund tycoon Paul Tudor Jones. Annually, the Robin Hood Foundation holds a gala fund-raising dinner that generates some $50 million for its anti-poverty programs. But the Clippers have an analysis that makes the $50 million look cheap compared to what the hedge fund leaders take, they say, from the economy:

- Two of Jones’s deputies at the Foundation, the Clippers say, oversee the Managed Funds Association, the hedge funds’ lobbying arm.

- The foundation demands that nonprofits do a great deal of data collection, what it calls “relentless monetization,” but the transparency that the foundation demands of its grantees is met by an opaqueness bout its own metrics and impacts.

- An analysis of the foundation’s performance against the core of its mission would suggest that it has fallen short: Though committing to end poverty in New York City, the poverty rate has increased in New York City from 20 percent in 1990 to 21.2 percent in 2012, roughly the two decades that the Robin Hood Foundation has been in existence.

- The cumulative wealth of the Robin Hood Foundation’s hedge fund billionaires increased from $85.3 billion in 2008 to $164.36 billion in 2012, an increase of 93 percent, though hedge fund manager David Tepper saw his wealth increase from $1.8 billion to $10.4 billion, a mere 478 percent increase.

- Jones and other hedge fund moguls, the Hedge Clippers say, have vigorously advocated on tax policies, particularly to protect the “carried interest tax loophole,” meaning that hedge fund managers’ income is treated in tax terms as capital gains (taxed at 20 percent) rather than as ordinary income (which would have been taxed at 39.6 percent.

- Although the foundation makes grants to support safety net programs, the foundation’s board members and key funders are actively involved with groups trying to cut back on the safety net, such as three Robin Hood people on the Manhattan Institute board of directors,

Overall, the report is not a critique on the Robin Hood Foundation but an examination of the burgeoning wealth of Jones and other hedge fund managers who founded or run the philanthropic institution. The Foundation could have used a tough analysis of its grantmaking strategies, particularly how its “relentless monetization” strategy affects the kinds of groups that apply and the kinds of grants it makes. Or perhaps it might show the multiple nonprofit connections of the Robin Hood hedge fund backers, to reveal the specific kinds of anti-poverty work they think does the trick.

It may be very much a characteristic of New York, where the hedge fund industry is firmly ensconced. Create a public charity, and the hedge fund players will show up. But it is what they do with, for, and to their grantees and the concept of fighting poverty that a tough-minded report on Robin Hood and other hedge-fund dominated funders ought to examine.—Rick Cohen