December 18, 2018; Connecticut Mirror

“Inequality is one of the reasons the world’s falling apart,” notes University of Connecticut economist Fred Carstensen, who heads the Connecticut Center for Economic Analysis. As Keith Phaneuf and Clarice Silber in the Connecticut Mirror report,

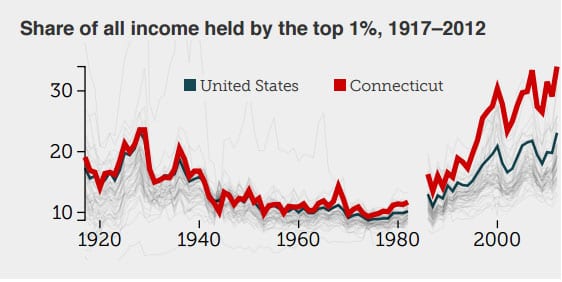

The top one percent of earners in Connecticut captured all of the post-recession income growth between 2009 and 2013, according to a 2016 analysis by the Economic Policy Institute of Washington, DC…while the remaining 99 percent watched their earnings fall nearly two percent.

This is even worse than national figures, where the top one percent received “only” 85 percent of all gains during that period.

And there are consequences: As Phaneuf and Silber write, “When adequate investment in human capital—higher education, adequate health care and decent housing—are impossible because of debt or under-employment, inequality becomes a significant drag on economic growth.” Connecticut, they add, “is the only state not to have recovered all jobs lost in the last recession, having regained just over 90 percent; and child poverty levels have increased by 50 percent since 2000.”

Carstensen, the economist, adds: “If you don’t have wealth, if you don’t have assets against which you can draw so you can balance things out over a longer time period…you are living literally paycheck to paycheck.”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

In response, Carstensen suggests two primary strategies for remedying Connecticut’s rapidly expanding class divide.

One strategy is to direct public policy to “focus on drawing people out of poverty, and keeping the middle class from falling backward.” The Organization for Cooperation and Economic Development (OECD) – described by the Economist as “a club of mostly rich countries”—acknowledges, Phaneuf and Silber note, that “Some degree of tax hikes, by raising top marginal rates and closing deductions, ‘which tend to benefit high earners disproportionally’ may well be necessary” to achieve this objective.

The second strategy that Carstensen advises, write Phaneuf and Silber, involves using tax revenues collected to increase “access to public services, including high-quality education, job training, transportation and health care.”

For some, new and fairer tax systems are the answer. Salvatore Luciano, the new head of the Connecticut AFL-CIO, tells CT Mirror that his first step toward generating the needed funding “would be to raise taxes on wealthy households and major corporations.”

“I don’t think people realize how huge the wealth disparity is in Connecticut,” Luciano says, “I think that’s a big part of the problem.”

Needless to say, the view of folks like Carstensen and Luciano is not universally shared. Peter Gioia, economist for the Connecticut Business and Industry Association, for instance, opposes raising taxes, arguing that, “If you raise taxes at this point in time, you will have a flood of people leaving the state….There’s a whole cottage industry of financial advisors that are talking to people about this [tax trend], and showing them where else they can go.” Of course, Giola’s argument may be taken another way: illustrating why building a more democratic economy where business ownership is much more widely shared is so important to stave off this threat of capital moving away and realize the just social and economic outcomes that the nonprofit sector seeks to achieve.—Martin Levine and Steve Dubb