November 9, 2017; Wisconsin Gazette

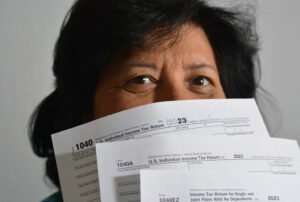

Jeff Bezos, Warren Buffett, and Bill Gates possess more wealth than the poorest half of US, according to the Institute for Policy Studies. The $264.1 billion in known holdings by these three men surpasses the combined net worth of an estimated 160 million people, or 53 million US households. Analyzing two major datasets made available by the latest Forbes 400 list (their calculations started in 1982) and the Federal Reserve’s 2016 Survey of Consumer Finances, the Institute for Policy Studies’ 18-page report, “Billionaire Bonanza,” examines America’s “deeply unbalanced economy.” The report’s authors warn of a “moral crisis” and assert that the Trump administration tax proposals will only exacerbate disparities as 80 percent of the proposed tax benefits benefit the wealthiest one percent of households.

This assessment represents merely a cursory glance at what can ultimately be known about the extent of the inequality in America. It is impossible for Forbes and the Federal Reserve to take into account offshore tax havens recently laid bare—again, only in part—by the Paradise Papers, or the convoluted trusts involving private corporate accounts and family members. Even in our world of philanthropy, vast sums are wielded through donor-advised funds. Who can guess how much wealth escapes any degree of oversight and accountability?

NPQ often examines this disturbing subject, from “The Culture of Inequality” to “Economic Inequality and the Future of Democracy: Tracking the Conversation.” But familiarity does not make these new statistics any easier to absorb. The report’s authors, Chuck Collins and Josh Hoxie, speak to the speed with which extreme inequality is reaching ever-new heights, saying our society is becoming “a hereditary aristocracy of wealth and power.” The authors note that since the publication of the latest Forbes 400 list on October 17, 2017, Jeff Bezos increased his wealth by an estimated $7 billion. They also observe that the top 25 members of the Forbes 400 are white.

Among the report’s key findings are:

- The three wealthiest people in the United States—Bill Gates, Jeff Bezos, and Warren Buffett—now own more wealth than the entire bottom half of the American population combined, a total of 160 million people or 63 million households.

- The median American family has a net worth of $80,000, excluding the family car. The Forbes 400 own more wealth than 33 million of these typical American families.

- One in five U.S households, over 19 percent, have zero or negative net worth. “Underwater households” make up an even higher share of households of color. Over 30 percent of black households and 27 percent of Latinx households have zero or negative net worth to fall back on.

In the report’s section on the racial asset divide, the authors speak to inequality as a societal issue that embraces us all.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The typical—median—white household holds $151,800 in wealth. Black and [Latinx] households own just $4,300 and $6,200. White median household wealth now runs 35 times greater than median black household wealth and 25 times greater than [Latinx households].

The report’s final section offers solutions to the “billionaire bonanza.” They reference how, in times of national emergency, the US government has “conscripted wealth” to help make the nation whole. The authors offer recommendations for federal and state tax policies that might mitigate the accelerating growth of extreme inequality.

Inequality is, of course, a global problem. The 2017 Credit Suisse Research Institute’s Global Wealth Report was just released. This is, according to Credit Suisse, the most comprehensive source of global household wealth information, an analysis of the wealth held by 4.8 billion adults. Reporting for the Guardian, Rupert Neate summarizes the Swiss bank’s data having to do with the world’s richest owning half the world’s wealth.

These millionaires—who account for 0.7 percent of the world’s adult population—control 46 percent of total global wealth that now stands at $280tn.

At the other end of the spectrum, the world’s 3.5 billion poorest adults each have assets of less than $10,000 (£7,600). Collectively these people, who account for 70 percent of the world’s working age population, account for just 2.7 percent of global wealth.

Louis Brandeis, who as a US Supreme Court justice sought to be a social reformer, legal innovator, and labor champion, said this about inequality that still resonates today. “We can have democracy in this country, or we can have great wealth concentrated in the hands of a few, but we can’t have both.”—Jim Schaffer