September 30, 2019; Forbes

Netflix’s most-watched show is the prison drama Orange is the New Black. In its last season, the show—like the industry that provides its setting—took a twist, and began focusing on the plight of undocumented immigrants being used as cash generators by private corporations. Imprisoning undocumented (and sometimes documented) immigrants is a large and growing business for the private sector. According to Clyde Haberman at the New York Times, last year, private companies incarcerated about nine percent of the total US prison population, but 73 percent of immigrant detainees.

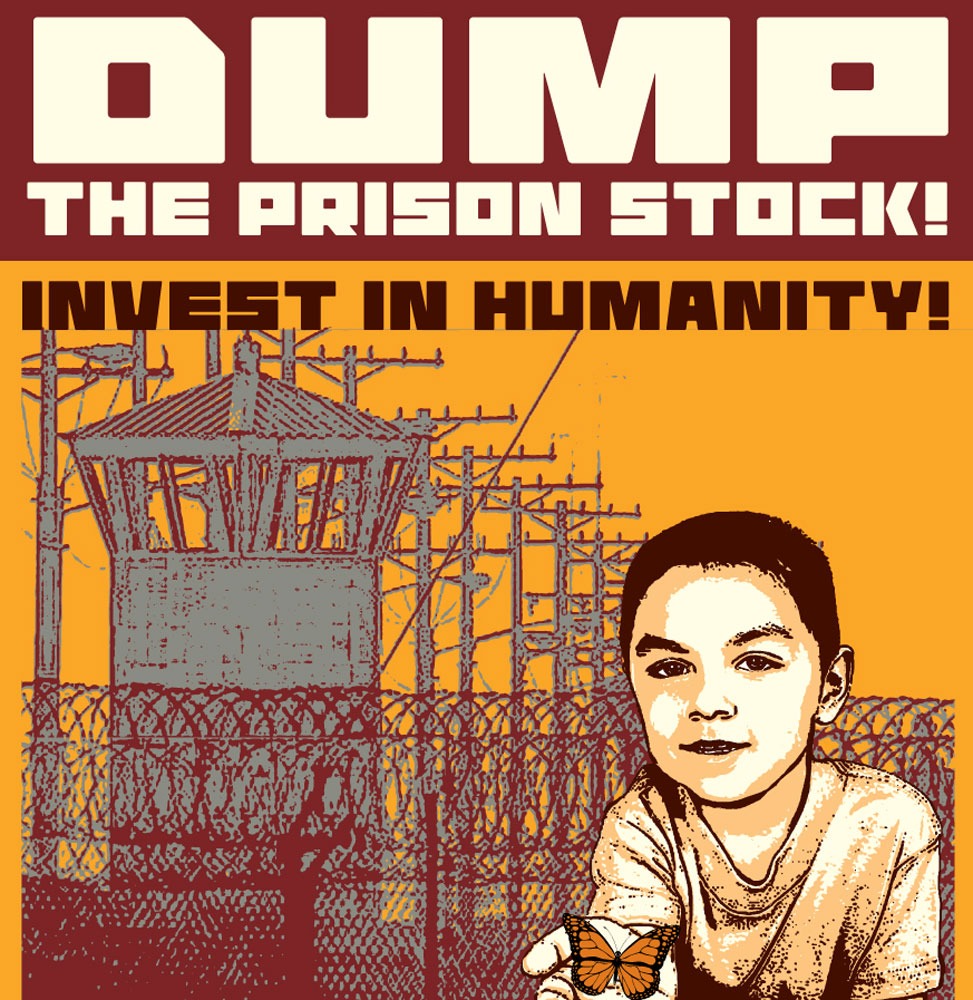

Obviously, private prisons are one aspect of the larger issue of mass incarceration, especially of immigrants. A number of campaigns have become prominent in the last couple of years fighting the incarceration of people crossing the US border. One of the largest is Families Belong Together, a coalition which operates in all 50 states and includes the National Domestic Workers Alliance, Women’s Refugee Commission, MomsRising, United We Dream, People’s Action, ACLU, Leadership Conference on Civil and Human Rights, MoveOn and over 200 others. Among other goals, they seek to end family separation and detention.

Direct pressure on the government and its contractors to behave in ethical ways hasn’t done much for families at the border, so Families Belong Together fought smart. They went after the lifeblood of for-profit corporations: money and credit. They pressured the banks who finance private prison companies like CoreCivic and GEO Group to divest and end those relationships. Using the hashtags #FamiliesBelongTogether, #BackersOfHate, and #RealMoneyMoves, supporters held protests, wrote petitions, and shared resources. And this week, they reached a milestone: every existing bank partner to GEO Group has officially committed to breaking ties.

Social movements have a record of successful divestment campaigns. In his book Decolonizing Wealth, Edgar Villanueva writes that they “put pressure on investors to get rid of stocks, bonds, or investment funds that are supporting that unhealthy, unethical, or downright evil activity.” From the famous campaign to financially starve South Africa’s apartheid regime, to the current pressure on nonprofits and universities to divest from fossil fuels, this tactic has served as a lever of direct financial and social pressure.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

That’s what GEO Group and its peers face now. According to Gin Armstrong at Truthout, JPMorgan Chase, Wells Fargo, Bank of America, SunTrust, BNP Paribas, Fifth Third Bancorp, Barclays, and PNC represented $2.35 billion, or 87.4 percent, of credit lines and loans for private prisons. Armstrong writes that since private prisons have classified themselves as Real Estate Investment Trusts (which keeps their taxes low), the loss of this credit will “materially impact their ability to do business as usual.”

That’s a good thing. Christopher Petrella, a lecturer at Bates College and member of Grassroots Leadership, said, “It actually kind of forces these companies to admit that they’re kind of prison companies only incidentally—what they really are is real-estate companies. That’s a major, major problem. Because when we’re talking about incarcerating human bodies, the language of real estate is just so grievously inappropriate.”

Private prison groups aren’t out of options. Though all those banks committed to ending their relationships, funding doesn’t dry up immediately; Bank of America agreed to lend $90 million to GEO Group right before it committed to divestment. They won’t lend any money in the future, but “fulfilling [their] contractual obligations” could keep them tied to GEO for another five years. Plus, five banks (Regions, Citizens, First Tennessee, Pinnacle, and Synovus) have not committed to stop extending credit lines and loans to CoreCivic.

Though pushing financial levers is a smart move for a movement, this victory is one to only very cautiously celebrate. The Families Belong Together Corporate Accountability Committee issued a statement calling divestment “a monumental win for millions of people.” But this industry has managed to pivot before when it saw its revenue streams threatened.—Erin Rubin