March 18, 2020; CityLab and Washington Post

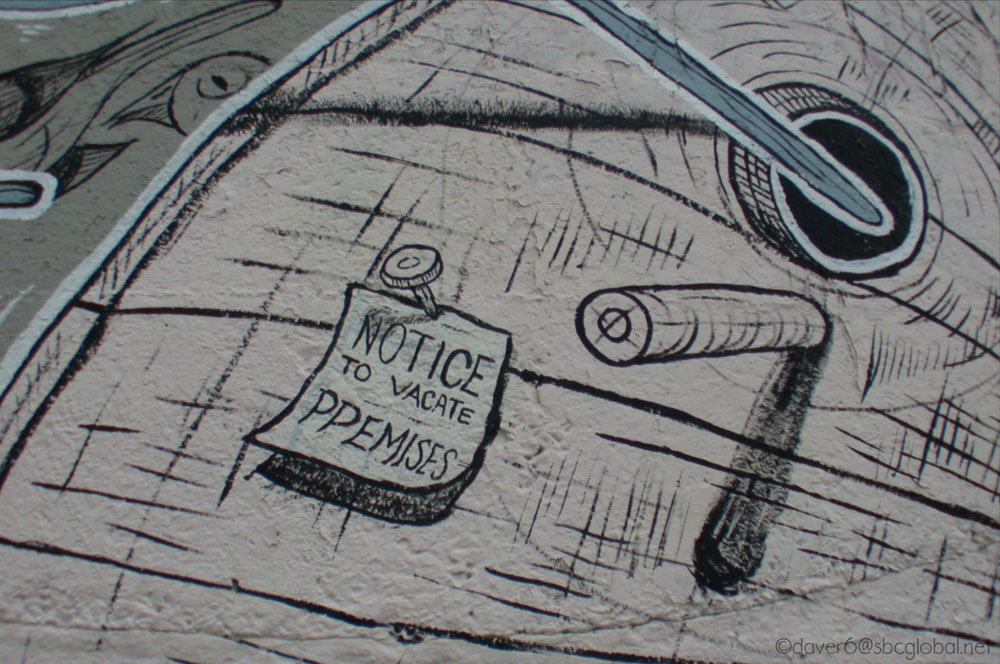

On Wednesday, March 18th, President Donald Trump followed the lead of grassroots activists in announcing a national moratorium on some kinds of evictions and foreclosures through the end of April. Jeff Andrews in Curbed calls this a “a good start” but observes:

The moratorium on evictions of public housing residents, the majority of whom are elderly and/or disabled, applies to more than a million households. The moratorium does not apply to housing voucher holders. HUD Secretary Ben Carson told the Los Angeles Times that a moratorium on FHA-backed multifamily housing could be coming, but housing voucher recipients may need Congressional action.

Sarah Holder, writing in Next City, observes that a push for local moratoriums on eviction (and foreclosure and utility shutoffs, while we’re at it) has been underway for weeks, having arisen spontaneously among local officials, housing advocates, and grassroots activists. In NPQ earlier this month, Ruth McCambridge noted that the city of Detroit decided to expedite water reconnections in light of the COVID-19 pandemic. McCambridge makes clear that nonprofits will have a role to play in making these moratoriums work for distressed households.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

But along with officials, advocates, and activists, even creditors are concerned that their livelihoods are in jeopardy. Millions of citizens who are suddenly unemployed pose an existential threat. Eviction is costly, foreclosure is time-consuming, and withholding utility services is no longer tenable. Any expected cash infusion from the federal government may be weeks or months away.

Here’s where nonprofits can help. A moratorium provides time to negotiate and educate. Negotiation means that tenants can be in touch with their landlords to reassure them that rent is on the way. Assisting tenants in setting up repayment plans could be helpful so that owners have some cash flow and tenants have some flexibility in how they use the emergency funds they will eventually receive. Education means helping households set up spending priorities so that emergency funds are sensibly apportioned among all of a family’s liabilities. After all, a check for a few thousand dollars won’t cover all obligations to creditors, especially if joblessness extends for months. A little planning now can help forestall a recurrent crisis.

Will creditor moratoriums have a lasting impact? Besides being a teachable moment for low-income households, advocates hope that the crisis underscores the economic fragility of many low- and moderate households and leads to longer-term policy changes. Local officials can counsel 2020 candidates to add consumer protections to their platforms. Advocates can promote their pet projects. Activists can find an anchor point for a broad-based grassroots movement to protect the low-income consumers who have lost protections over the last decade. The interplay of public officials, advocates, and activists with ordinary Americans should become the new paradigm to preserve the lessons that we’re learning in this time of crisis.—Spencer Wells