May 16, 2018; Shelterforce

The promise and potential peril of the newly created Opportunity Zones initiative is something that community and economic development nonprofits are following closely. While the IRS has stated that it will issue further guidance later this year, there are already some instances where this new policy is curious. In guidance issued last month, the IRS stated that it would permit individual taxpayers to self-certify as Opportunity Funds, meaning that there would be no action required by the IRS.

For some community and economic development groups, paving a pathway for Opportunity Funds to be established at the taxpayer level by streamlining the process is a surprise, given the federal government’s historical investment in building a national infrastructure of over 1,000 community development financial institutions (CDFIs) that manage over $120 billion in assets and provide a wide array of financial services and investments in distressed communities. It remains to be seen what role, if any, CDFIs will play in the rollout and implementation of the Opportunity Zone program.

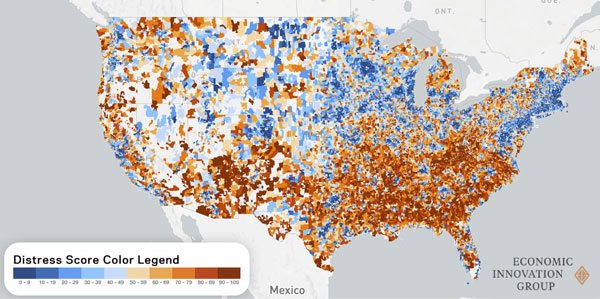

As NPQ has previously reported, Opportunity Zones emerged from the 2017 tax bill as a development mechanism that incentivizes investments in qualified low-income areas through cutting taxes on capital gains that are invested in those areas. The tax bill set a timeline of 90 days for governors to designate Opportunity Zones, which could be up to 25 percent of all eligible low-income census tracts in their states, a limitation that stimulated a wide range of public engagement in the designation process from cities, counties, and economic development groups.

The deadline for submitting designations has now passed, and the Department of the Treasury’s CDFI Fund is working in tandem with the IRS on designating Qualified Opportunity Zones, while the IRS has the authority to implement the parts of the bill that deal with Opportunity Funds, which are specific funds that facilitate investment in Opportunity Zones.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

A current updated list of Qualified Opportunity Zones as of May 18th can be found on the CDFI Fund’s website, along with some general information on the program. Once these institutions release their final list of Qualified Opportunity Zones, which should be in the next couple weeks, these designations will last for the next 10 years.

Considering the length of this designation, as well as the estimated $6 trillion in unrealized capital gains throughout the country that is eligible to be invested in Opportunity Zones, it is critical that nonprofits and communities that are impacted by the new policy become familiar with its components, and identify ways to utilize this program to address social need, stimulate economic growth, and ensure that equity issues are interwoven into economic development efforts locally.

In addition to the program specifics, there have also been questions raised in terms of Opportunity Zone designation. In Portland, Oregon, for example, a recent article noted the designation of an Opportunity Zone in one of the hottest real estate markets in the area. This is troubling because real estate is one of the qualified asset classes that capital gains can be invested in through the Opportunity Zone program. In Cleveland and the greater Cuyahoga County, which has 64 census tracts designated as Opportunity Zones, similar concerns have been raised. Questions about designations and the program intention have surfaced in larger contexts, where some wonder if the program will actually assist distressed communities or if it is a veiled attempt to give tax cuts for those investing in gentrifying neighborhoods.

While it remains to be seen whether these early examples are outliers or if they reflect how the overall program will unfold, it is important to consider some best practices in community and economic development to guide fundable projects in Opportunity Zones, since the program will be fully fleshed out later this year. A recent webinar hosted by PolicyMap on Guiding Principles for Opportunity Zones—featuring author Jeremy Nowak, who currently is affiliated with Drexel University’s Lindy Institute for Urban Innovation and who previously directed the Reinvestment Fund, a leading CDFI—showcased four principles to consider. These principles focus on developing integrated community and economic development strategies that leverage existing programs, balance market forces with social need, and ensure that data is a central feature in assessing effectiveness.

In addition to learning how to take advantage of the program, now is the time to provide feedback and input as Opportunity Zones are formally being defined, as Laurel Blatchford in Shelterforce suggests. Specifically, nonprofit advocates can help ensure that community needs are addressed through annual reporting of investments in Opportunity Zones, as well as in defining abuse to protect communities and residents. For nonprofits dedicated to improving the economic conditions in distressed communities, it is important to follow the program as it develops.—Derrick Rhayn