Editors’ note: This article from the winter 2017 edition of the Nonprofit Quarterly, “Advancing Critical Conversations: How to Get There from Here,” was adapted from “Examining the Role and Diversity of Fiscal Sponsors in the Nonprofit Sector” (Nonprofit and Voluntary Sector Quarterly 46, no. 3, 2017). With this article, the Nonprofit Quarterly is proud to launch a new, more formal partnership with Nonprofit and Voluntary Sector Quarterly (NVSQ). NVSQ is a peer-reviewed, multidisciplinary academic journal focused on nonprofit sector research, and NPQ has adapted many of its articles for practical use over the years. This has created a rich, two-way conversation via a research-to-practice and practice-to-research bridge involving nonprofit leaders, academics, and “pracademics.” The formalization of this practice on the part of both journals is a reflection of our joint dedication to keeping the traffic on this bridge moving freely.

While there are many nonprofit entrepreneurs with plenty of energy and fresh perspectives eager to enter the nonprofit sector, the start-up stage can be an immensely challenging and vulnerable time for an emerging organization. The precariousness of this stage demonstrates the need and value of an accommodating infrastructure that can assist and nourish emerging nonprofits as they attempt to create greater stability. In this article, we focus on one such supporting infrastructure: fiscal sponsorship.

The presence and work of fiscal sponsors in the nonprofit sector are not new, yet fiscal sponsorship remains a seldom-discussed topic in the mainstream nonprofit practitioner or research literature. Below, we look at the variety of organizations and relationships encompassed within the field of fiscal sponsorship, and discuss some of the practical considerations and trade-offs that groups may experience when they contract with a fiscal sponsor.

The Challenge of Starting and Operating a New Nonprofit

The United States’ nonprofit sector has long engaged the activities of millions of individuals—and every year, a multitude of new nonprofit groups and organizations are being formed and launched. However, the exact number of new nonprofits is difficult to pin down. The steady flow of new entrants clearly suggests that the nonprofit sector is both attractive and accessible to individuals wanting to initiate the process of starting new nonprofit activity, usually by founding a new nonprofit organization. As noted by nonprofit management and philanthropy expert Peter Frumkin, the nonprofit sector represents a highly appealing place for people wanting to take a chance to make a difference: “Almost anyone with an idea or vision can found a nonprofit or voluntary organization quickly,” because of the sector’s low entry barriers. However, Frumkin adds, moving from the idea stage to actually operating and maintaining a new nonprofit venture is a much more challenging endeavor.1 Consequently, as Susan Kenny Stevens has commented, the earliest stage of new nonprofit ventures is not just highly time-consuming and demanding of ample commitment from the nonprofit entrepreneur but also the most fragile stage in a nonprofit’s life.2

Organizational researchers have long recognized this fragility by pointing to the problems associated with newness as well as smallness, and the vital importance for new and emerging ventures to attain a certain degree of stability—for example, securing an input of vital resources and building an ability to manage and utilize such resources in order to overcome the vulnerabilities emanating from these liabilities.3 In his seminal essay “Social structure and organizations,” Arthur Stinchcombe painted a highly compelling picture of the steep challenges facing emerging organizations.4 He particularly underscored the vulnerability facing such organizations, which starts from the point at which individuals attempt to explore and implement ideas and to search for resources to propel the idea forward. Stinchcombe’s essay especially emphasized how new organizations suffer a heightened risk of failure because entrepreneurs must engage in so many vital activities more or less simultaneously, which often ends up being an overwhelming task.

As a consequence and as a general rule, anyone trying to create a new organization must find ways to handle what Stinchcombe refers to as the “liability of newness.”5 In this context, fiscal sponsors appear to represent a potentially vital capacity for fledgling nonprofits by offering a support infrastructure to handle some of the burden associated with being a start-up.

What Is a Fiscal Sponsor?

One available option for tackling some of the challenges of newness is to use a fiscal sponsor. A fiscal sponsor is an already existing nonprofit organization with 501(c)(3) status that has agreed to provide a legal home and support for currently non-tax-exempt entities. Some in the nonprofit community refer to fiscal sponsors as fiscal agents, but as noted by Gregory Colvin, the term fiscal agent implies that the project or charity being sponsored controls the charitable organization providing the fiscal sponsorship (i.e., the sponsor is an agent of the sponsored).6 However, this is the reverse of the actual relationship allowed by law. The law allows for a 501(c)(3) organization to sponsor a project or nonexempt organization. Thus, the term that appropriately defines the sponsor is fiscal sponsor.

Although there is no one commonly agreed-upon definition of a fiscal sponsorship, the principle is essentially understood to be the same across the board. The National Network of Fiscal Sponsors defines fiscal sponsors as “…nonprofits that advance the public benefit by facilitating the development and growth of charitable, mission-driven activities;”7 from the perspective of the nonprofit entrepreneur, a fiscal sponsor offers an opportunity to have a formal legal home without having to spend significant time and resources to incorporate a new public charity. In other words, fiscal sponsorship is a way for individuals to launch and test new ideas without having to obtain tax-exempt status or build a full-fledged organization. The fiscal sponsor not only helps to provide administrative services and oversight but also assumes some or all of the legal and financial responsibility for the activities of the nonprofit entrepreneur.

Benefits, Costs, and Types of Fiscal Sponsorship

From a theoretical perspective, fiscal sponsors help establish the stabilizing conditions essential for emerging nonprofits to evolve. However, fiscal sponsorship is not just beneficial to the emerging entity but is also viewed as having broader and more long-term advantages. As noted by Jonathan Spack, “…fiscal sponsorships can be a real boon to the fluidity, innovative capacity, and diversity of the community-development and nonprofit sector.”8 Moreover, due to the concerted nature of fiscal sponsorship, it can serve as a valuable collaborative learning mechanism among nonprofits, and potentially as a mechanism to pool and coordinate scarce resources in a more efficient manner. Still, using a fiscal sponsor is not without cost. For example, many fiscal sponsors expect to be compensated financially for their services. Also, although the nonprofit entrepreneur may be officially in charge, he or she never retains full autonomy and agency of the program/project as long as the relationship with the fiscal sponsor remains. In addition, being a fiscal sponsor generates transaction as well as administrative costs, and depending on how many new and emerging entities are being housed by the sponsor, the demand for attention and support could potentially become a distraction and perhaps even induce mission creep.

The notion of fiscal sponsorship does not refer to a single mechanism; instead, it entails a number of relationship options that can exist between the nonprofit entrepreneur and the sponsor organization. Perhaps the most coherent—and commonly used—depiction and explanation of the various fiscal sponsorship options can be found in the work of Greg Colvin, who differentiates among six fiscal sponsorship models.9 As noted by Colvin, although each model has certain specific characteristics, they are not mutually exclusive. In other words, the different models can be combined into various hybrid types and/or serve as the basis for alternative models. Some of the key distinguishing features among the different models include the degree of financial independence enjoyed by the nonprofit entrepreneur, to what extent the activity of the nonprofit entrepreneur is a separate legal entity, the liability of the fiscal sponsor to third-party stakeholders, and how and where the economic transactions between the sponsor and nonprofit entrepreneur are reported. It is important to note that the regulations guiding fiscal sponsorship require mission alignment, and this, in the long run, may be a very wise first screen to use when looking for a fiscal sponsor.

We now briefly outline the different models, based on a summary provided by Colvin:

- The first model is labeled direct projects, and reflects situations in which fiscal sponsors fully integrate the nonprofit entrepreneur’s activity into the program portfolio of the sponsoring organization. In other words, the fiscal sponsor has maximum control of the activity, and the sponsor and the nonprofit entrepreneur have an employer–employee relationship. As noted by Colvin, the direct project is likely the most frequent model for fiscal sponsorship but also one with a potential for tension and conflict, as the nonprofit entrepreneur does not have legal control of the activity should he or she decide (for example) to launch his or her own independent nonprofit.

- The second model is labeled independent contractor projects, which changes the relationship between the sponsor and the nonprofit entrepreneur from an employer–employee relationship to a project–contract relationship. In this scenario, the activity still has its principal home in the sponsor organization, but the undertaking of the activity is contracted out to the nonprofit entrepreneur. Colvin comments that this arrangement still allows the fiscal sponsor to have certain control over the project’s results.

- The third model is the preapproved grant model, where the fiscal sponsor accepts and transfers external funding to the nonprofit entrepreneur as such funds are obtained. This can involve, for example, a one-time grant from a foundation or continuous transfers from multiple donors.

- The final three models—group exemption, supporting organization, and technical assistance—all involve relationships in which the nonprofit entrepreneur has obtained 501(c)(3) tax status for his or her activity. For the group exemption and supporting organization, the nonprofit entrepreneur can directly solicit and obtain donations from external funders, and gains a tax benefit from being in a relationship with the fiscal sponsor. In the final model, the relationship is focused on the fiscal sponsor providing financial and administrative technical assistance—for example, filing tax returns or bookkeeping.10

The Fiscal Sponsor Landscape

When we decided to investigate the basic questions of who and how with regard to fiscal sponsorship, we were surprised to find that fiscal sponsors have so far received very little attention from the nonprofit research community.

As noted by Spack, “Because fiscal sponsorship is by definition a behind-the-scenes service, it is often under the public and philanthropic radar.”11 There is certainly some awareness of fiscal sponsorship in the research community. For example, Kirsten Grønbjerg, Helen Liu, and Thomas Pollak highlight how fiscal sponsors are one source contributing to the “dark matter” of non-IRS-registered nonprofit entities.12 Joanne Carman describes the promise of community foundations as fiscal sponsors for community development.13 And Nancy Kinney and Mary Carver discuss urban congregations as potential—if limited—incubators of emerging new service organizations.14 However, no research has directly addressed the characteristics of fiscal sponsor organizations—which in turn has likely contributed to the impression that although fiscal sponsors exist, currently operate, and thus have an impact on the nonprofit sector, they are not well recognized or understood.

The most determined attempt to get a grasp on organizations serving as fiscal sponsors is a report commissioned by the Tides Center, based on a survey of 111 fiscal sponsors identified via Internet search engines.15 The report does provide some basic information, but the key purpose of the survey was to gather data on the types of practices and the key challenges facing fiscal sponsor organizations. The report finds that the policies and practices employed by fiscal sponsors vary significantly, and that there is no distinctive type of fiscal sponsor. Furthermore, “…there is a growing number of organizations involved in fiscal sponsorship with increasing project loads.”16 Given the scarcity of empirical research focusing on fiscal sponsors, we sought to provide a first glance at the fiscal sponsor industry and answer a number of basic yet important questions, including: What typifies nonprofit organizations serving as fiscal sponsors? How many projects do they sponsor, what types of projects do they sponsor, and what types of support do they offer to the nonprofit entrepreneur? What does the fiscal sponsor receive in return, if anything, for its services?

To answer these questions, we accessed a sample of fiscal sponsors identified in the Fiscal Sponsor Directory.17 The Fiscal Sponsor Directory is produced and maintained by San Francisco Study Center Inc., and contains more than two hundred fiscal sponsors. Our sample begins with two hundred and eighteen fiscal sponsors with identification information. We then merged this list with the National Center for Charitable Statistics (NCCS) CORE 2013 File and CORE 2013 Full File, resulting in a final sample of 184 501(c)(3) fiscal sponsors with financial data.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

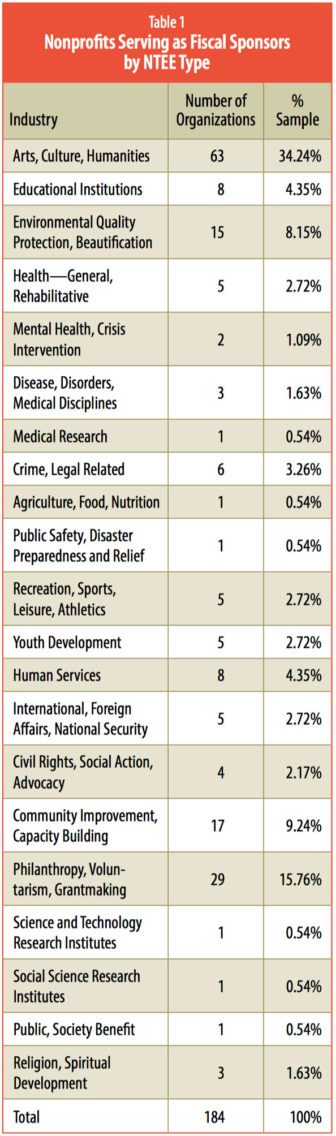

Table 1 shows what types of nonprofit organizations serve as fiscal sponsors. The largest sector represented by our sample—arts, culture, humanities—makes up 34 percent of the total sample. Philanthropy, voluntarism, grantmaking makes up 16 percent of the sample. Community improvement, capacity building makes up 9 percent of the sample. The remaining 41 percent of the sample is disbursed across eighteen major groups in the National Taxonomy of Exempt Entities (NTEE). In all, the sample is sector diverse, with twenty-one of twenty-six NTEE Core Codes (NTEE-CC) represented.

In terms of geographic dispersion, 38 percent of the sample is located in California, while 14 percent of the sample is located in New York. California and New York combine for more than half the sample. The remaining portion of the sample is scattered across twenty-eight states and the District of Columbia. In all, the sample is geographically diverse, with the majority of states represented. Financial characteristics of the sample reveal that fiscal sponsors tend to be medium- to large-sized organizations. The mean total revenues were approximately $11 million (the median approximately $1 million) and mean total expenses are close to $10 million (the median $930,000). Organizations serving as fiscal sponsors receive the majority of their revenue in contributions and engage in multiple sponsored projects. The average fiscal sponsor was involved with fifty-eight projects and the median was sixteen projects, with a roughly even split between charging a fixed fee for service (48 percent of the sample) and having a scaled fee structure (49 percent of the sample), with the remaining 3 percent of the sample not charging a fee or not disclosing a fee structure.

In addressing what types of projects they sponsor and what types of support they offer to the nonprofit entrepreneur, we reviewed eligibility criteria used by the fiscal sponsor as well as projects they are willing to sponsor and services offered to the projects.

Ninety percent of the sample report having an aligned mission and aligned values as criteria for fiscally sponsoring a project. Just over half of fiscal sponsors cite geographic location as a criterion. Interestingly, type of service, having an advisory group, and minimum budget size are cited as criteria by less than 30 percent. Comparing eligibility criteria by the size of fiscal sponsor, the largest quartile of fiscal sponsors are less likely to have geographic restrictions and more likely to require the sponsored organization to have an advisory group. Conversely, the smallest quartile of fiscal sponsors are less likely to have a minimum budget requirement and more likely to restrict eligibility to specific services. Overall, it appears that most fiscal sponsors have flexible eligibility requirements, assuming that core mission and values align and that the project is geographically close. Fiscal sponsors were most willing to take on projects relating to arts and culture (68 percent), followed by education projects (55 percent), and children, youth, and families projects (53 percent). In comparing size quartiles, it becomes clear that the largest quartile of fiscal sponsors is more willing to sponsor projects across most (eighteen of twenty) project types. Interestingly, for two project types (arts and culture, and festivals and events), the smallest quartile of fiscal sponsors expressed the most willingness to sponsor projects. Overall, sponsors appear willing to take on a variety of projects (nineteen project areas were cited.)

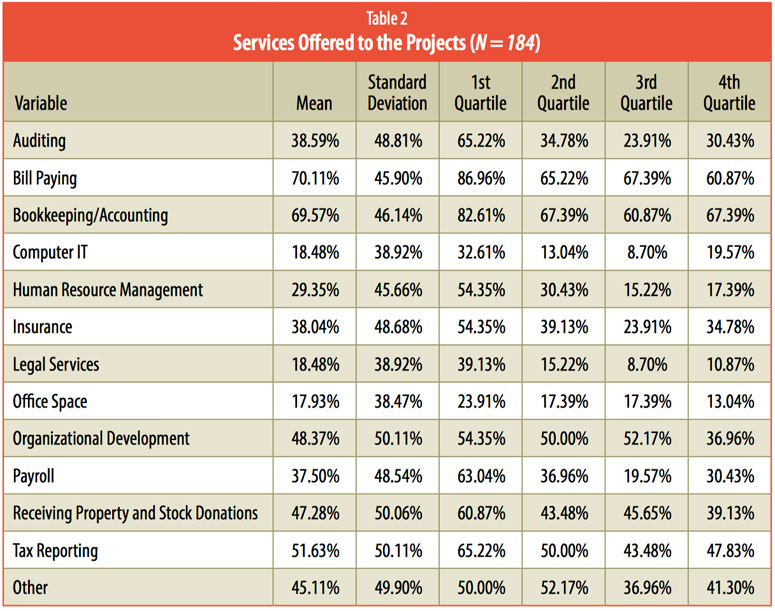

Although the types of projects fiscal sponsors are willing to take on are diverse, the services they provide to projects cluster around financial services. Table 2 details the services offered by fiscal sponsors.

Bill paying (70 percent) and bookkeeping/accounting (70 percent) are cited as the top two most-often-provided services. Tax reporting (52 percent) is also cited more than 50 percent of the time. In reviewing the services offered, five of the top ten (auditing, bill paying, bookkeeping/accounting, payroll, and tax reporting) are accounting-related services, consistent with the notion that a primary function of fiscal sponsors is to provide these to projects. Perhaps not surprisingly, the largest fiscal sponsors are more likely to offer the greatest range of services to projects.

Conclusion and Implications

Overall, we identify the following takeaways with implications for the nonprofit sector:

- Voluntary groups need not incorporate to test whether or not they have the mission, vision, and followers to warrant a corporate structure of their own.

- Fiscal sponsors do not follow a standardized model, so it becomes important to do due diligence to compare and contrast what one sponsor versus another might offer and at what cost, level of convenience, risk, and match to your group’s need.

- Having a fiscal sponsor may buffer you from many of the administrative demands of being a start-up, but it likely will not address any of the larger entrepreneurial concerns of mission and vision development, strategy, recruitment, and momentum. On the other hand, it does leave you more time for such core concerns, if all goes well.

- The fiscal sponsor model is not just a viable model for nascent nonprofits. Organizations at any stage of maturity could benefit from such an umbrella function. Indeed, organizations might find that the most efficient use of resources is to engage a fiscal sponsor for the duration of their existence.

INTERVIEW

The Nonprofit Quarterly (NPQ): If fiscal sponsorship is the answer, what is the question?

Dan Neely and Fredrik Andersson: A frequent complaint coming from the nonprofit community—funders in particular—is that there are too many new nonprofits. Notwithstanding the merit or lack thereof of this claim, should an eager budding nonprofit entrepreneur always and swiftly obtain 501(c)(3) status for his or her nonprofit venture? While fiscal sponsorship does not offer a definitive answer, it illuminates a viable and valuable option. The problem is not too many new nonprofit ideas; the problem is how to carry them forward in a way that increases the chance for new ideas to take root and transform into innovations that add real value.

NPQ: Can you talk a bit about what might disqualify an organization from being a fiscal sponsor?

Neely and Andersson: Not being legal scholars, we are not in a position to say anything about what might legally disqualify an organization from being a fiscal sponsor. That said, taking on the responsibility of being a fiscal sponsor is not something that an organization should do haphazardly. First, when making the decision to serve as a fiscal sponsor, consider the opportunity costs. If you are going to devote capacity toward helping fledgling nonprofits, you are going to be forgoing capacity that could be used elsewhere. Ask yourself what, if anything, you are expecting to get out of taking on the role of fiscal sponsor. If the answer is “I don’t know,” then perhaps fiscal sponsorship is not for you and your organization. Even if the answer is “Nothing,” remember that you are not the only one who gets to make the call regarding what is best for your organization. If external stakeholders view your attempt to serve as fiscal sponsor as unrelated to your organization’s mission or as unwarranted, you can certainly do some harm to the reputation or brand of your organization. Again, this is not to say an organization should not become a fiscal sponsor—but it is advisable to make sure that there is at least some basic alignment and understanding among your key stakeholders that this is a path worth pursuing.

NPQ: Can you be too big or too small, or too old or too young, for fiscal sponsorship?

Neely and Andersson: The humdrum answer is “It depends.” If one goal of fiscal sponsorship is to provide capacity to fledgling nonprofit entrepreneurs, then possessing such capacity ought to be a key criterion for deciding to become a fiscal sponsor. Whether you are big, small, young, or old are variables likely to impact what type of capacity can be offered, but this does not necessarily mean being young and/or small puts you on the sideline as a potentially excellent fiscal sponsor. Fiscal sponsors are represented by a range of ages and sizes. Indeed, one size does not fit all for organizations wishing to become fiscal sponsors.

Notes

- Peter Frumkin, On Being Nonprofit: A Conceptual and Policy Primer (Cambridge, MA: Harvard University Press, 2002), 129.

- Susan Kenny Stevens, Nonprofit Lifecycles: Stage-Based Wisdom for Nonprofit Capacity (Wayzata, MN: Stagewise Enterprises, 2002).

- Howard Aldrich and Ellen R. Auster, “Even Dwarfs Started Small: Liabilities of Age and Size and Their Strategic Implications,” ed. Barry M. Staw and L.L. Cummings, Research in Organizational Behavior 8 (January 1986): 165–98; Arthur L. Stinchcombe, “Social Structure and Organizations,” in Handbook of Organizations, ed. James G. March (Chicago: Rand McNally, 1965), 260–90; and Alan A. Gibb and Michael Scott, “Understanding small firms growth,” in Small Firms: Growth and Development, ed. Michael Scott, Alan A. Gibb, John Lewis, and Terry Faulkner (London: Gower, 1986), 81–104.

- Stinchcombe, “Social Structure and Organizations.”

- Ibid.

- Gregory L. Colvin, Fiscal Sponsorship: 6 Ways to Do It Right, 2nd ed. (San Francisco: Study Center Press, 2005).

- “What is a fiscal sponsor?” National Network of Fiscal Sponsors, June 15, 2015.

- Jonathan Spack, “How Fiscal Sponsorship Nurtures Nonprofits,” Communities & Banking 16, no. 4 (Fall 2005): 22–24.

- Colvin, Fiscal Sponsorship.

- Gregory L. Colvin, “Fiscal Sponsorship” (paper presented at the Western Conference on Tax Exempt Organizations, Los Angeles, CA, November 17, 2006).

- Spack, “How Fiscal Sponsorship Nurtures Nonprofits.”

- Kirsten A. Grønbjerg, Helen K. Liu, and Thomas H. Pollak, “Incorporated but Not IRS-Registered: Exploring the (Dark) Grey Fringes of the Nonprofit Universe,” Nonprofit and Voluntary Sector Quarterly 39, no. 5 (October 2010): 925–45.

- Joanne G. Carman, “Community Foundations: A Growing Resource for Community Development,” Nonprofit Management & Leadership 12, no. 1 (Fall 2001): 7–24.

- Nancy T. Kinney and Mary L. Carver, “Urban congregations as incubators of service organizations,” Nonprofit Management & Leadership 18, no. 2 (Winter 2007): 193–214.

- Rick Green, Jaclyn Kvaternik, and India Alarcon, Fiscal Sponsorship Field Scan: Understanding Current Needs and Practices (San Francisco: Tides Center, 2006).

- Ibid., 29.

- “FiscalSponsorDirectory.org: A directory of fiscal sponsors nationwide,” National Network of Fiscal Sponsors.