July 7, 2017; Oregonian and USA Today

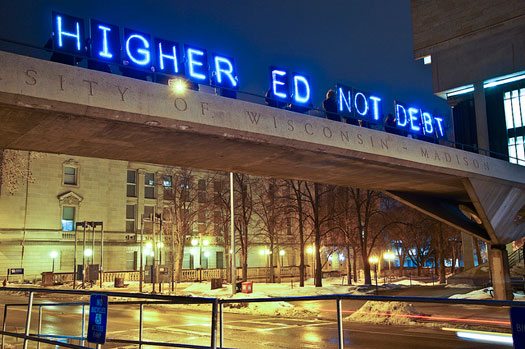

Overall, 44 million Americans hold $1.34 trillion in student debt. Few college aid students understand the ramifications of their student loans on their future ability to buy a home or start a family. A student receiving their undergraduate degree in 2016 left owing an average of $37,173 of debt, an increase of 6 percent from the year before and approximately an 85 percent increase in the last ten years. Debt for graduate study and other advanced education has quadrupled since 1989, growing from slightly less than $10,000 to more than $40,000, while debt from bachelor’s degrees increased from $6,000 to $16,000.

Student debt is often young adults’ first encounter with large, long-term debt. Many sign the dotted line with little education or understanding of the ramifications. This debt can force these students into specialties or employment opportunities they would not choose if it were not for the extra income. This debt is also a drain on the country’s economy; many believe it’s one reason the growth rate is so low.

Clearly, students are struggling to navigate and evaluate financial aid deadlines, applications, and opportunities. The state of Oregon recently passed legislation, to take effect in January 2018, requiring state colleges, universities, trade schools, and other post-secondary programs to provide students with financial aid information that is “straightforward” and “easy to understand,” assisting students in comprehending the amount of debt they are taking on and the amount they will be responsible for once the loan payments begin.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Specifically, each year, schools must provide:

- The total the school is charging in tuition and fees,

- The total amount of federal education loans the student is assuming,

- An estimate of the repayment cost, or a range including principal and interest,

- The anticipated monthly payment, and

- The borrowing limit percentage the student has reached on each loan.

The law doesn’t apply to privately held loans.

Legislators hope this additional information will relieve the growing student loan delinquency rate, which reached 11.2 percent last year. However, awareness of student loan debt is just part of the solution. What we really need is to rethink why students nowadays have to become heavily indebted in order to have a chance at a job that pays a decent wage.—Gayle Nelson