This article is, with publisher permission, adapted from a more extensive journal article, “Reckoning with Slavery: How Revisiting Management’s Uncomfortable Past Can Help Us Create Better Futures,” published earlier this year by the Academy of Management Learning & Education.

In 1750—over a century before most modern business schools were founded—Malachy Postlethwayt described a school of strikingly modern design. Postlethwayt, a British pamphleteer, was planning to establish a “Merchant’s Public Counting House” where young men would be “bred to Trade” with “great advantage.” For a period of two years, students would study an array of topics ranging from arbitrage to rates of exchange, the stock market, foreign languages, and written and spoken business communication.

Merchants and bookkeeping instructors often taught short commercial courses, but Postlethwayt’s proposal stands out because it sounds strikingly like the modern MBA. Though it is unclear whether his vision materialized, Postlethwayt’s plans did describe the “gentlemen” who he expected to attend. Prominent on the list were “the sons of American planters”—the children of enslavers in North America and the Caribbean (Postlethwayt 1750).

Many enslavers were keenly interested in pursuing commercial education. Some kept extraordinarily complex business records, and several even published manuals and textbooks on plantation accounting and management. Plantations even participated in the equivalent of early-modern internships: while cotton and sugar planters sent their sons north to New England and across the Atlantic to Europe to be educated, other merchants and tradesmen sent their sons to the West Indies for practical experience working as bookkeepers and agents on large slave plantations. As we would say today, they sharpened their data science skills and expanded their networks.

Yet these early consumers of business education—many of whom went on to own plantations and be enslavers themselves—aren’t widely covered by modern business schools. Business schools largely omit this history from their courses, even though many enslavers had built large and complex organizations, developed standardized reporting forms, and used appreciation and depreciation to value their (human) capital assets. Cotton planters tracked the number of pounds of cotton picked by every man, woman, and child, devising all kinds of strategies for accelerating the pace of labor.

Business schools and students pitch themselves as change-makers. But too often the heady assumption is that change will be good—that doing good and doing well align naturally. Or, worse, that bigger change will be better change. Businesses can, of course, do lots of good, but it is neither universal nor inevitable, and the business history of slavery offers a powerful antidote to such assumptions. Planters’ brutal practices show just how much it is possible to overlook in the pursuit of profit.

Big Lessons from Old Data

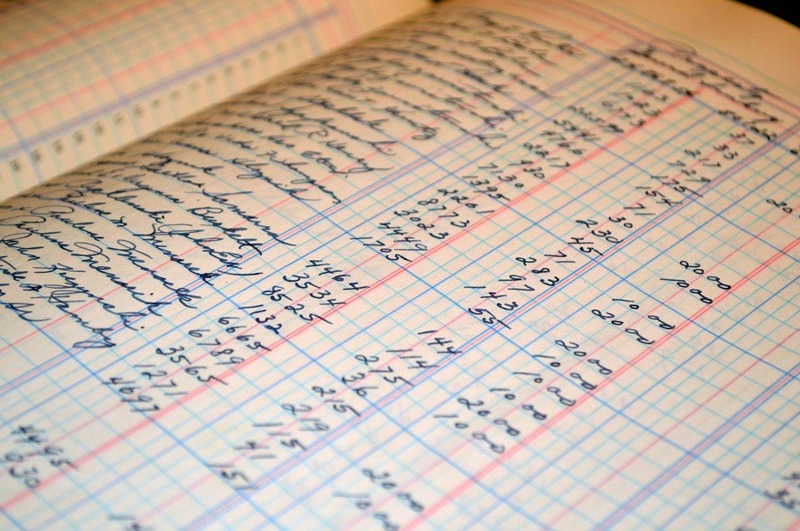

Today, the history of slavery offers more than a general cautionary tale. The calculations of enslavers—made clear in their account books—provide detailed paper spreadsheets of output, valuations, and lives. These documents offer insights about how numbers and balance sheets can erase some things even as they make others visible.

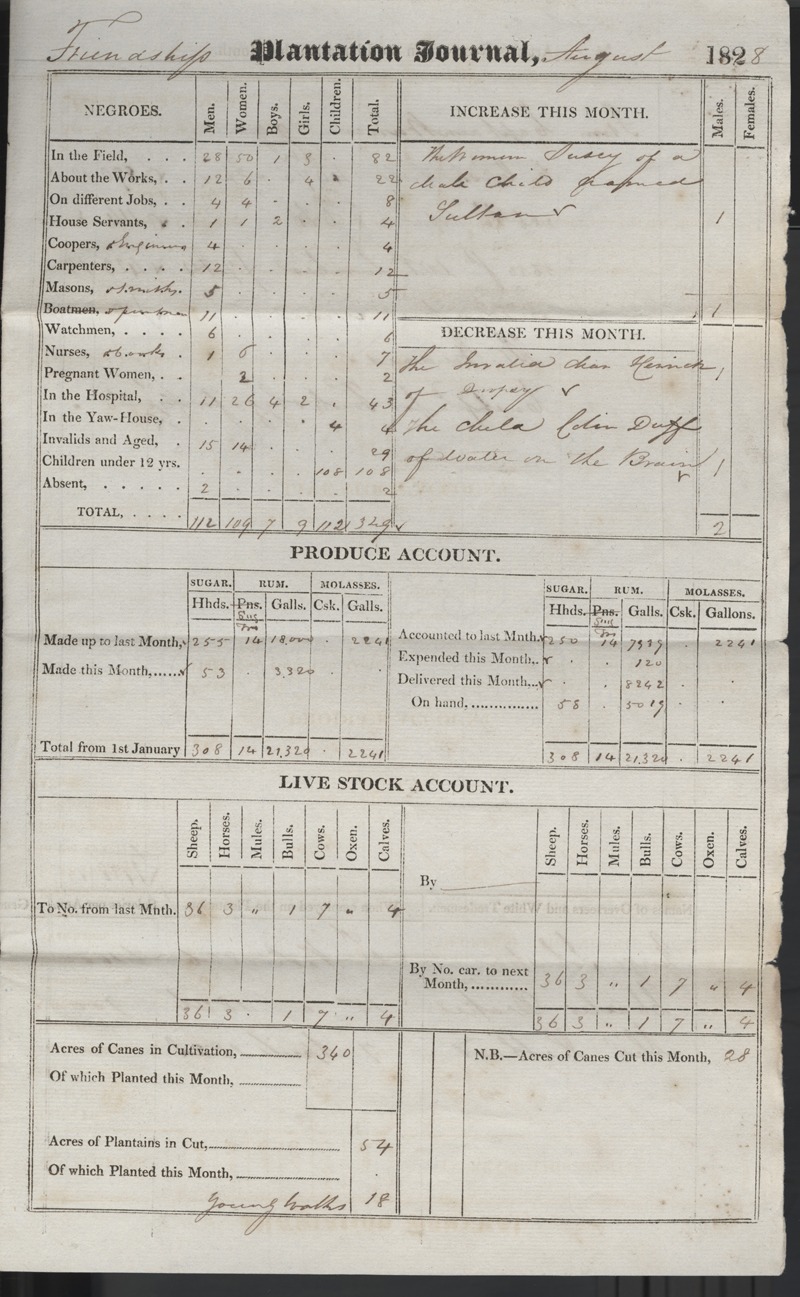

Take this example from Friendship Plantation (Figure 1), a sugar estate in British Guiana where a community of 329 enslaved people lived and worked in August 1828. The plantation used a pre-printed form—a kind of dashboard—to track key performance indicators. This form would have been completed using data gathered from other account books used on the plantation and then sent across the Atlantic so that the proprietor could manage business from afar.

At the top of the form is a summary account of the enslaved people toiling on the plantation. Each person is listed in two ways—first by occupation or activity, and again by age and sex. Down the left-hand side, the form listed the many categories of labor required to run a plantation.

The overseer or bookkeeper who filled out this form made additional notations, for example penciling in “Smiths” next to “Masons” and “Cooks” next to “Nurses.” At the bottom, the bookkeeper categorized those who could not work full-time, including any who were “In the Hospital,” “Invalids and Aged,” and “Children under 12 years.” Across the top enslaved people were classified again by age and sex, as Men, Women, Boys, Girls, and Children. Both row and column summed to 329, reassuring the proprietor that all had been accounted for.

The report, in short, gave the absentee owner an instant “read-out” of his human property. Below the account of enslaved people, the bookkeeper filled in key details on the production of sugar and livestock. At bottom, he summarized the progress of the planting and the availability of plantains for food.

Of course, reading this chart today, we are acutely aware of what is missing: nothing of the lives of the 329 men, women, and children; nothing of the brutal violence and dislocation that these individuals endured. The immense human costs of plantation slavery can only be read from between the lines.

Learning from Discomfort

When I use plantation account books to reconstruct planters’ reasoning, the process makes me uncomfortable. Part of it is the horror of the system: though few forms tallied up punishments like whippings, we know they were common. We also know that the threat of sale was used to terrorize individuals who would be separated from their homes and loved ones.

What also makes me uneasy is how easily this brutality is hidden from view. Data offered planters distance. It helped them to treat enslaved laborers as inputs of production rather than as people. Modern data can function in similar ways, offering decision-makers distance from human considerations: executives reviewing the numbers rarely know the people the numbers represent.

We can use this history to critique our own data practices. What costs do calculations highlight, and which do they overlook? And what kinds of behavior are normalized when numbers make exploitation easier to ignore? Parallel questions about what data misses might include: What do managers miss when user well-being goes unmeasured? What kinds of organizations result from focusing too narrowly on a particular metric like labor cost? Considering enslavers’ data reveals just how much it is possible to overlook in the pursuit of profit (Rosenthal 2019, 2021).

The businesspeople who relied on plantation records knew slavery was immoral but chose to look away. The slave trade was abolished more than two decades before 1828, the date of the Friendship dashboard. Slavery itself would soon be banned and gradually eliminated from the British Empire. As Sven Beckert (2017) has reflected:

When you read the letters of businessmen of the 1840s and 1850s, you see numerous efforts to separate business and morality into distinct realms. Merchants and manufacturers in the past did know that slavery was a moral problem, but then they tried to say that such moral considerations were extraneous to the concerns of business.

Starting Conversations for Truth and Reparations

Many resources are available for teaching about the history of slavery in business education. For example, a course on financial innovation—or any class covering the 2008 financial crisis—might draw on Edward Baptist’s short provocative piece (2010), “Toxic Debt, Liar Loans, and Securitized Human Beings.” A course on valuation practices might draw on Daina Ramey Berry’s work on the way enslaved people were valued across their lifecycle: from before birth to after death, when bodies were sometimes sold in the cadaver trade (2017).

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Even more powerful are original documents. Gridded account books constitute the spreadsheets of the 18th and 19th centuries. Students can examine how enslavers tracked how much cotton enslaved people picked each day and kept lists stating the financial value of each person’s body. Students studying commoditization can see traders callously sorting enslaved people into standard categories, pricing children by height and describing them as they would bushels of wheat and bales of cotton. They can consider the implications of using people as collateral for mortgages. Communities of every age and ability were reduced to fractions of people—a practice both radically different from yet parallel to the modern practice of accounting for employees as a percentage of an FTE [full-time employee]. Such documents can foster broader conversations about how businesspeople can, should, and do behave when the most profitable decisions are clearly unethical.

In many cases, the lessons drawn can go beyond analogy. Online databases make it easy to connect history to the present day by following the money. When slavery was abolished in the British Empire, enslavers received financial compensation. The “Legacies of British Slave Ownership” project, hosted by University College London, lets readers track these payouts easily, seeing who was compensated and the many commercial firms funded in part by those payouts, including leading railroads and banks.

Similar connections can be seen through Michael Ralph and Bill Rankin’s work (2017) on insurance of enslavers’ human property, which documents and maps their importance to companies like New York Life, Aetna, and AIG. Recent research by Mehrsa Baradaran (2014) and Destin Jenkins (2021) shows how banks and other financial intermediaries have helped maintain structural racism to the present day.

While the US receives the most attention, scholars have also examined how slavery shaped many other countries—for example, Pepjin Brandon and Ulbe Bosma (2019) have analyzed the importance of trading of enslaved people to the 18th century Dutch republic.

These resources offer opportunities for us to think about connections and complicity, then and now. What are the responsibilities of businesses beyond their own present-day operations? How should businesspeople think about the practices of their suppliers and contractors? What about the sources of their funding?

Rethinking Business Education

When history makes it into business classrooms, the focus is often on successes and the investors, managers, and entrepreneurs that students should emulate. But cautionary tales, such as those outlined from the history of slavery here, can be at least as valuable.

The dangers of not thinking critically about conventional business practices should be clear. Inspired by historical cases like this, we should ask ourselves, and encourage our students to interrogate, how the practices promoted in business school classrooms today might be viewed in 10—or 250—years.

References

Baptist, E. 2010. “Toxic debt, liar loans, and securitized human beings.” Common-Place 10(3).

Baradaran, M. 2017. The Color of Money: Black Banks and the Racial Wealth Gap. Harvard University Press.

Beckert, S. 2017. “The clear connection between slavery and American capitalism.” Interview by Dina Gerdeman. HBS Working Knowledge, May 3.

Berry, D. R. 2017. The Price for Their Pound of Flesh: The Value of the Enslaved from Womb to Grave in the Building of a Nation. Boston: Beacon Press.

Brandon, P., & Bosma, U. 2019. “Slavery was of major importance to the Dutch economy.” (Trans. Asbury, A.) The Low Countries, October 25.

Friendship Plantation Journal, August 1828, Wilberforce House, Hull, City Museums and Art Galleries, UK.

Jenkins, D. 2021. The Bonds of Inequality: Debt and the Making of the American City. Chicago: The University of Chicago Press.

Postlethwayt, M. 1750. The Merchant’s Public Counting-House; or New Mercantile Institution. (London: John and Paul Knapton)

Ralph, M., & Rankin, B. 2017. “The slave insurance market.” Foreign Policy.

Rosenthal, C. 2018. Accounting for slavery: Masters and management. Cambridge, MA: Harvard University Press.

Rosenthal, C. 2021. “Lessons From the ‘Data Exhaust’ of Plantation Slavery.” Harvard Data Science Review.

Rosenthal, C. 2019. “The perils of big data: how crunching numbers can lead to moral blunders.” Washington Post, February 18.