When the Giving USA Foundation and the Center on Philanthropy at Indiana University released their annual tabulation of charitable giving in the United States last Wednesday the numbers raised as many questions as they answered—and felt to us counterintuitive in many ways.

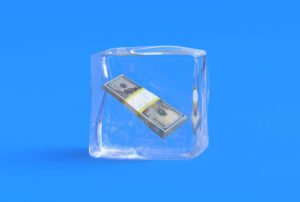

No statistic was more surprising from the Giving USA report than the finding that corporate charitable giving actually rose in a year of economic recession when many corporations were missing in action. How and where did corporations increase their charitable giving in a year when many were not showing big positives on their profit margins and in fact many where shedding employees (and payrolls) far faster than any corporation has ever cut checks for donations?

Why was corporate giving up 5.5 percent in 2009 just as corporations were taking their damaged P&Ls into federal bailout swan dives, hostile acquisitions, and chapter 11 bankruptcies?

SUBSCRIBE | Click Here to subscribe to THE NONPROFIT QUARTERLY for just $49 >>

With the release of The Committee Encouraging Corporate Philanthropy’s preliminary findings on corporate charity in 2009 some of our questions were answered. CECP is one of Giving USA’s information sources and the release of its preliminary findings on corporate giving, also last Wednesday, clarified the story behind purported increase in corporate grantmaking.

Somehow, despite the majority of surveyed corporations cutting back on charitable giving, both Giving USA and CECP reported that aggregate corporate giving rose

According to CECP, within a matched-set analysis of corporate givers conducted by the group, 60 percent gave less in 2009 than in 2008, and a majority cut back their grantmaking by 10 percent or more. Why the cutbacks? CECP didn’t proportionally disaggregate the reasons cited by proportions of corporations for their philanthropic retrenchment, but noted “company-wide spending constraints instituted on account of the economic pressures” as a frequent reason, a euphemism for the impact of the recession on corporate bottom lines. If there was another good reason for corporate reductions, it was the end of corporate commitments for disasters in 2008; 2009 was a relatively low-disaster year, and the Haitian earthquake didn’t happen until 2010.

Somehow, despite the majority of surveyed corporations cutting back on charitable giving, both Giving USA and CECP reported that aggregate corporate giving rose. How was that possible? CECP cited “dramatic increases by a handful of companies caus(ing) aggregate total giving to rise in 2009,” which it attributed to two basic causes: non-cash contributions from pharmaceutical companies and increased corporate giving budgets due to mergers and acquisitions, most occurring in the financial and health care industries.

There’s no surprise for nonprofits in the first half of that analysis regarding non-cash contributions. CECP acknowledges that corporate cash contributions have been declining during the past four years and continued that trend in 2009. Even within corporate cash grantmaking, as two spokespersons for Giving USA, Nancy Raybin, the chairwoman of the Giving Institute, and Melissa Brown, the managing editor of Giving USA at the Center on Philanthropy at Indiana University, told Nonprofit Quarterly, many corporations have refocused their grantmaking on “strategic” giving priorities rather than supporting diverse arrays of community nonprofits.

Do mergers and acquisitions in the financial sector lead to increased giving?

Raybin and Brown weren’t surprised at all by the shift from cash to product giving, particularly by the pharmaceuticals. They suggested that product giving by the pharmaceuticals was not much effected by the economy or might even be countercyclical in charitable terms. Why? When the economy goes south, leaving the pharmaceutical companies unable perhaps to market some of their product, they can donate it, at valuations they establish, whereas in better times, they might sell rather than donate.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Set aside, for the moment, the part of the corporate giving increase attributable to in-kind services and products, the bulk of which might be the pharmaceuticals (remember, in 2007, seven of the top 50 corporate foundations ranked by total giving were affiliated with drug companies) and simply accept that even if corporate giving might be up, it’s not higher in terms of cash outflows to nonprofit budgets.

Do mergers and acquisitions in the financial sector, for example, where Wall Street firms and commercial banks have disappeared in the economic crisis, lead to increased giving? Only if you ignore the companies that went away. Assume Big Bank A acquires about-to-go-under Big Bank B and its philanthropic agenda. Maybe Big Bank A’s philanthropic portfolio increases somewhat because of the expanded footprint it has absorbed, but does it necessarily replicate the charitable giving of Big Bank B in its entirety?

Only a small number of corporations account for the bulk of corporate giving.

Hardly likely. Just ask the nonprofits that have been longtime clients of the banks and investment companies about post-merger recession-era grantmaking. The increased corporate giving budgets have to cover an even larger geography, often with grant decisions being made by corporate staff who have little or no experience with the nonprofits in those regions and are often difficult for groups to contact and access.

This raises another question about the CECP analysis. The survey sparked responses from 165 companies, but the matched-set of 2008 and 2009 respondents was only 95. Why? One guess would be that some of the 2008 companies aren’t in the philanthropy game any more—or aren’t in the corporate game all together.

What companies filed for bankruptcy protection in 2009? Try Chrysler, Eddie Bauer, Filenes, General Motors, Nortel, and Six Flags, just to name a few, plus late 2008 bankruptcies such as Circuit City, IndyMac, Hospital Partners of America, the Tribune Company, and Washington Mutual Bank. Among corporate donors in the game in 2008 that were absorbed into other companies during that year and in 2009 were Bear Stearns acquired by JP Morgan Chase (which also acquired Washington Mutual), Merrill Lynch acquired by Bank of America, Wachovia taken by Wells Fargo, National City acquired by PNC, Commercebank absorbed by TD Banknorth, and so forth. In calendar year 2009, 139 banks closed according to the FDIC; only 51 closed in the previous eight years between 2000 and the end of 2008.

The overall picture is not as rosy as Giving USA’s estimate of a 5.5 percent increase in corporate charity.

Only a small number of corporations account for the bulk of corporate giving, the big time charitable giving numbers from the business world. But some of the big ones aren’t there any more. For local nonprofits that were used to corporate gifts from local corporations at fundraising events, those local business donors might only be fond memories If some of CECP’s 2008 survey respondents were listed as matched with zeroes in 2009 instead of dropped from the list, the dramatic giving increases of the pharmaceuticals might not have been able to counter the reductions in cash and product elsewhere in the corporate world.

Corporations do a lot more than give away money, product, and people (the latter as loaned executives or paid volunteers) as charitable deductions against their corporate income taxes. They may also do cause-related marketing, which they might or might not be able to count as “charitable,” though some nonprofits rely on those resources too.

But the overall picture is not as rosy as Giving USA’s estimate of a 5.5 percent increase in corporate charity. Corporate cash grantmaking is down, corporate giving is down for most corporations in general, and some old standby donors have shrunk or even gone out of business. If you’re on the receiving end of pharmaceutical generosity, you’re a corporate philanthropy winner.

Read Giving USA and You – Cognitive Dissonance Anyone? Part I