September 12, 2018; New York Times

Ten years ago, Lehman Brothers collapsed, leading to a chain of events that, abetted by a housing bubble, helped create the Great Recession. And, as Nelson Schwartz writes in the New York Times, “the scars of the financial crisis and the ensuing Great Recession are still with us, just below the surface.”

Cui bono?—or, “Who benefits?”—is perhaps the oldest question in politics, a phrase history ascribes to the Roman senator Cicero. As Schwartz observes, those who work for a wage (labor) have lost and those who earn wealth through ownership (capital) have benefitted: “Wealth, real wealth, now comes from investment portfolios, not salaries. Fortunes are made through an initial public offering, a grant of stock options, a buyout or another form of what high-net-worth individuals call a liquidity event.”

The numbers are shocking. As NPQ wrote in July:

The federal Bureau of Labor Statistics reports that labor’s income share has fallen by six percentage points in the last decade alone—that’s about four percentage points of gross domestic product…in other words, worker income is more than $700 billion less—i.e., more than $5,000 per worker—than it would be, had labor’s share stayed the same as it was a decade ago.

Schwartz finds similar data from the Federal Reserve, data Fed Chair Jerome Powell earlier this year called “very troubling.” Schwartz reports, “Over the last decade and a half, the proportion of family income from wages has dropped from nearly 70 percent to just under 61 percent. It’s an extraordinary shift, driven largely by the investment profits of the very wealthy.” He adds, “Ten years after the financial crisis, getting ahead by going to work every day seems quaint, akin to using the phone book to find a number or renting a video at Blockbuster.”

The Federal Reserve data can be found here. The Pew Research Center published a paper that provides a few summary highlights. Among these: back in 2007, median household wealth was $139,700 in 2016 dollars. In 2016, more than six years after the recession had bottomed out, median household wealth was only $97,300. Schwartz adds, “In 2016, net worth among white middle-income families was 19 percent below 2007 levels, adjusted for inflation. But among Blacks, it was down 40 percent, and [Latinx families] saw a drop of 46 percent.”

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

Some of the shift surely may be due to larger market trends, but the federal government played a strong role. Bankers, notes Schwartz, were saved from losing their wealth through federal interventions, such as the Troubled Asset Relief Program (TARP) and quantitative easing. TARP, as the US Treasury explains on its website, provided about $424 billion for banks and corporations versus $46 billion for families.

But TARP is small potatoes compared to quantitative easing, in which the Federal Reserve purchased $4.5 trillion in bank assets to help banks stabilize their balance sheets and lend to corporations. Shareholders who owned those corporations benefitted also, of course. Additionally, the Federal Reserve also maintained near-zero interest rates for years, which facilitated corporate borrowing. The net effect, Schwartz writes, was to “put a trampoline under the stock market.” Meanwhile, that $46 billion for homeowners proved to be too little, too late, leading eight million people to lose their homes to foreclosure. As a result, the homeownership rate fell from about 69 percent of Americans to 64 percent.

Nor is the impact spread evenly across the board. In terms of age, young people suffered heavily, so much so that that a recent study by three researchers at the Federal Reserve Bank of St. Louis finds that Americans born in the 1980s risk becoming “a lost generation for wealth accumulation.” And in terms of race, Michelle Singletary in the Washington Post notes that Black homeownership today is 41.2 percent—about the same as 50 years ago, before housing discrimination was made illegal.

Fabian Pfeffer, a University of Michigan sociologist, points out, “Wealth serves as a private safety net that allows you to behave differently and plan differently.” As Schwartz elaborates, “A wealthy person who loses a job can afford to…wait for an opportunity suited to his or her skills and experience. The risk of going to an expensive college and taking on debt is lower when there is parental wealth to fall back on.”

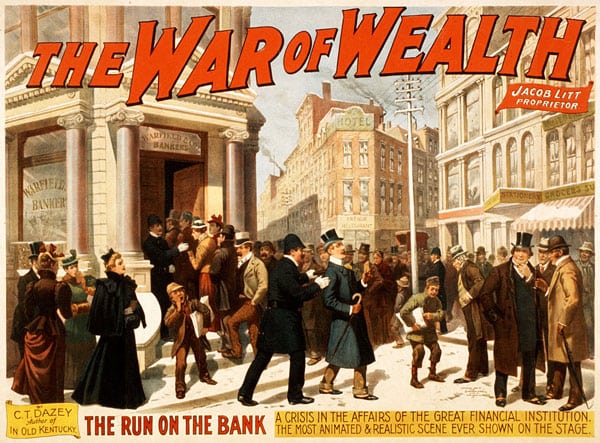

What we face, in short, is this ever-increasing concentration of wealth and division between haves and have-nots becoming normalized as the American way of life, with notions of a middle-class society rapidly fading into history. Exiting this slide into what is clearly our nation’s Second Gilded Age will not be easy, but it starts with recognizing the extent of the shift that has transpired.

Reversing course will require, as Matthew Desmond writes, a new narrative about poverty. It also means, as NPQ’s Cyndi Suarez points out, disrupting racialized narratives that have supported white supremacy. It will also require new forms of economic organizing. Fortunately, some emerging countertrends—including political organizing in communities of color, the expansion of employee ownership, and the emergence of a broader movement for a more democratic economy—give some reasons to believe that what is normal today need not stay that way.—Steve Dubb