This article comes from the Spring 2012 edition of the Nonprofit Quarterly, “Recreating Leadership: 2012.” It was first published online on May 8, 2012.

“Money often costs too much,” wrote the philosopher Ralph Waldo Emerson. Many leaders of smaller nonprofits, struggling to find the funds to grow or sustain programs, surely feel the same way. It is easy to rack up costs chasing after foundation grants, public donations, and government funds, and the wrong chase can be financially fatal.

Yet The Door, a midsize, youth-focused nonprofit based in New York, managed to zero in on the right path to growth from small to relative scale. Founded in 1972, The Door began offering youth services from a free storefront space in Greenwich Village, staffed entirely by volunteers. Today it serves eleven thousand at-risk young people from across New York City with health care, college prep, daily meals, and a range of other services—all under one roof. The Door has almost doubled in size over the last decade. Like many midsize youth organizations, it relies primarily on government funding, which makes up about three-quarters of its approximately $11.8 million budget. “Our government funding approach is now a well-oiled machine,” The Door’s executive director Julie Shapiro told us. The question—and in our experience it is the number one question for tens of thousands of smaller nonprofits—is how did they build it?

Truth be told, for most smaller nonprofits, growing revenue is more scattershot than science. Often, they can meet their budgets by inspiring a handful of donors, seizing unanticipated funding opportunities, or patching together a variety of funding sources. At the other end of the spectrum (as reported in the 2007 Nonprofit Quarterly article “In Search of Sustainable Funding: Is Diversity of Sources Really the Answer”), nonprofits that grow very large tend to be highly focused: they raise most of their money from a single type of funder (such as corporations or government) that is a good match for their mission.1

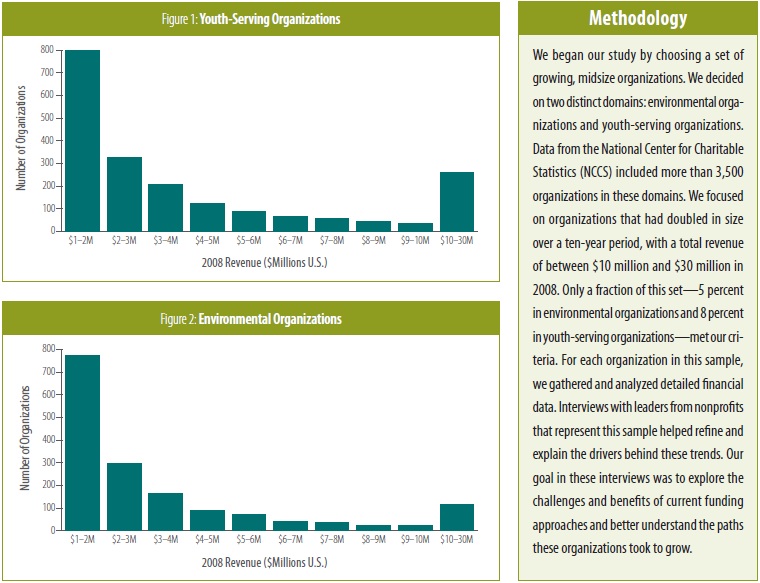

But how do you connect the dots? Is the path to growth linear, or are there distinct, required inflection points in funding strategy as a smaller or midsize organization grows? And how does a smaller nonprofit need to adapt organizationally as funding needs change over time? To begin to answer these questions, we recently studied a group of fast-growing nonprofits, including The Door. Starting with a sample of roughly 3,500 organizations in the youth-serving and environmental fields, we narrowed our focus to organizations that had doubled their budgets between 1998 and 2008 to reach $10 million to $30 million in annual revenues. Only a fraction of the organizations in our sample achieved this level of growth: 5 percent of environmental and 8 percent of youth-serving organizations. In order to understand what sets these fast-growers apart from their peers, we analyzed their funding history and conducted in-depth interviews with senior leaders from over two dozen of them.

Their stories offer guideposts for how small and midsize nonprofits with ambitious aspirations for growth can find the money to fuel that growth. While the program focus and funding mix of these organizations varied, the key message that stands out is that their leaders made a series of thoughtful trade-offs that put their organizations in a position to navigate the journey to funding their growth over time. In particular, we identified three important types of trade-offs:

- Early in their growth trajectories, generally before reaching $10 million in annual revenues, they made the decision to prioritize the cultivation of a primary type of funding aligned with their program goals, which meant de-prioritizing less-strategic funding opportunities.

- They institutionalized the roles and practices required to raise those types of funding over time, often making tough decisions about when they needed to invest in development capabilities over program priorities.

- Many recognized that their funding strategy might need to change as their growth targets grew, and proactively evolved their funding approach over time, which often required them to accept short-term uncertainty and commit to long-term investments that might not bear immediate results.

One important note: we are not arguing that growth, in itself, is a virtue. Many nonprofits may already have reached the right size for the work they are doing. But for those that believe they have a successful program model that could reach many more people or have an impact in more places, growth may be a critical path to mission fulfillment. The Door, for example, knew that there were far more at-risk youth in New York City than could be served from its original storefront. And Trout Unlimited (another one of the organizations we studied), which started in 1959 with sixteen dedicated anglers on the banks of Michigan’s Au Sable River, believed that there were fisheries across the nation that needed protection and restoration, and tens of thousands of enthusiastic anglers who could help them do it. As Trout Unlimited’s CFO Hillary Coley told us, “In thirty years, every child in the U.S. will be able to fish in their home waters. To get there, we’ll need to become a $40 million organization.”

Finding Funding Focus

Clear revenue patterns emerged in our group of high-growth nonprofits. Fairly early in their growth trajectories, generally before reaching $10 million in annual revenues, these organizations identified and cultivated a primary type of funding, such as government or individual, aligned with their program goals. We saw a pattern of revenue concentration around this source, accounting on average for 70 to 85 percent of each organization’s total revenues. What we did not see was nonprofits continuing to grow using a largely even mix of diverse sources.2

For nonprofits that funded their operations through a diverse mix of funding sources early in their history, the decision to build around a primary source instead of pursuing diversification can be difficult; the decision can feel counterintuitive since, at times, it may be necessary to forgo pursuing some seemingly promising funding opportunities. Moreover, relying primarily on a single type of funding may seem like a risky venture. But for most of the nonprofits in our data set, identifying the core source that was most likely to lead to funding success and then diversifying across many funding streams within that primary source as they grew provided the necessary risk mitigation.

Consider the experience of The Door, with its focus on government funding. Executive director Julie Shapiro told us: “We wanted to be recession proof, so we diversified across as many [government] agencies and sources as possible.” When recession-related government funding cuts threatened half of its contracts, that diversification within government funding helped The Door navigate through the downturn. Stories from others who went through difficult times reinforced this message: when funding cuts hit, those with broader funding networks were better able to weather the storm.

Like The Door, the child welfare organizations in our sample relied primarily on public funds, and achieved diversification across levels of government (local, state, federal) and/ or types of contracts and grants. The other types of youth-serving organizations, including the Posse Foundation (which focuses on youth in public high schools), and the environmental organizations, generally found greater potential in private support. For example, Trout Unlimited, which now has four hundred chapters nationwide, went after individual donations for community programs with “backyard impact,” and now receives the majority of its funding from a broad base of affluent fly fishing enthusiasts who are motivated to protect and promote trout fishing. And in the same way that The Door diversified across government sources, Trout Unlimited has sought to diversify across individual sources, focusing on multiple geographies, income levels, and strategies to engage individuals and mitigate risk. But achieving this goal required Trout Unlimited to invest disproportionately in making sure that their individual-giving strategy was particularly strong. At the same time, the organization focused far less on some of the more scattershot opportunities.

Beyond their emphasis on a primary source of funding, these organizations also prioritized one or two substantive secondary sources, which contributed on average 20 percent of total revenues. As with the primary source, secondary sources were carefully selected and cultivated to complement program focus. Their usefulness was particularly significant in three areas:

- Stabilizing rapid growth. The Methodist Home of the South Georgia Conference, a child welfare organization, supplements its primary government funding by raising 35 percent of revenues from private sources. That secondary funding comes in handy when government rules change, as they did three years ago, when a rule required the organization to move therapists to a new building off campus. Derek McAleer, the agency’s director of development, noted, “That move cost us [a considerable amount,] and there was no [government] money to cover that cost—we just had to eat it.” Similar experiences were common across many youth-serving organizations, especially those relying on direct government reimbursements.

- Supporting programs for which the primary funding source is not a suitable fit. The Children’s Bureau of Southern California, which focuses on child abuse prevention and treatment, found that while public dollars supported the treatment side of their work, this source was not well geared to their prevention programs, which Children’s Bureau views as essential to keeping more children safe. It uses money raised from individual donors to support its prevention work. The organization also used private dollars raised through a major capital campaign to construct a new community center complex to house these programs. For The Door, unrestricted foundation funds give flexibility to start new programs aligned with mission, which may not be immediately supported by government funds. In Shapiro’s words, “Government is our life, but we don’t want to be all government. You never want to be told 100 percent what you should be doing.”

- Laying the groundwork for expansion. The primary source may be vital to sustaining a site or program once it is established but maybe not readily available to fund the expansion itself. This is particularly true for government funders, who typically prefer the tried-and-true to the new. But even organizations that rely primarily on individual donors may turn to a secondary source for expansion. Trout Unlimited, which gets the bulk of its money from its fly fishing base, starts new chapters with two to three years of start-up funding raised from a local foundation or government, which gives the new local board and staff time to build membership in the region and replace these start-up dollars with sustainable revenue.

Investing in Individuals and Institutionalized Practices

Funds do not raise themselves, and executing even the most perfectly chosen funding strategy to carry a smaller organization to the $10 million to $30 million level requires building significant organizational capacity. Finding new funding opportunities, soliciting support, and deepening the relationships with existing funders needed to fuel growth required our fast-growing organizations to institutionalize roles and practices by adding key staff, defining and redefining roles, and installing practices to keep growth on track. But oftentimes, leaders had to accept new roles or make the tough decision to commit dollars to their development strategy, sometimes at the expense of programmatic priorities, to ensure that their funding engine could continue to flourish.

For the nonprofits in our study, a charismatic executive director (or small team of dedicated leaders) often shouldered the brunt of the fundraising burden in the early stages, particularly below the $3 million annual revenue mark. However, these organizations regularly reached the point where that burden became too much for the leaders to handle alongside their broader roles. The solution was often a two-pronged approach of supporting (but not replacing) the leaders’ fund development role with formal development staffers, and shifting some of their internal management responsibilities to others within the organization.

Deborah Bial, the founding executive director of the Posse Foundation, described this shift as she built the organization over the past twenty years: “In the beginning it was just me and one other person. We trained the kids, recruited, visited colleges, and raised the money. Today, my role is really external. I work with the board, meet with major donors, and speak at events and conferences.” Like many executive directors, Bial expressed a strong view that involvement in cultivating support is something that will always be part of the role. As she put it, “As an ED, you can never give that up.” And yet, as she noted, “You’re smarter as an organization if you have multiple people with power and authority raising funds.” With growth, fundraising responsibilities become too great for one person to juggle alone, and leaders must find the balance of personal time investment and delegation that enables the organization to grow.

Sign up for our free newsletters

Subscribe to NPQ's newsletters to have our top stories delivered directly to your inbox.

By signing up, you agree to our privacy policy and terms of use, and to receive messages from NPQ and our partners.

The Tejano Center for Community Concern’s founding executive director reached a similar conclusion about sharing responsibilities with a development team, and he expressed the sacrifice many executive directors make in recognizing that the best use of their time is often in supporting areas beyond their programs. Over twenty years, Richard Farias built Tejano from a five-person operation funded by barbecue plate sales to a widely recognized child welfare organization with its own charter school. “I didn’t get into this business because I wanted to raise money,” he told us. “I got into this business because I felt a burning desire to change things for children and families.” Yet, as Tejano enters its next phase of growth, Farias intends to dedicate the majority of his time to fund development. Like many executive directors, he made the difficult trade-off of delegating program responsibilities to a trusted senior staff member in order to serve most effectively as the face of the organization in the community. His primary goal is to make sure the new capital campaign is a success, and he recognizes that his role in fundraising is critical. Farias reflected on the difficulty of the transition, noting, “I’m the founder. I know where I want to take this organization. But, at the same time, this new role is what Tejano needs now.”

Difficult decisions about the roles and composition of the board may also be necessary. The Methodist Home of the South Georgia Conference attributes much of its success in maintaining and growing government funding to its board strategy. As the organization grew, it refined its strategy by clarifying board roles and being deliberate about board composition: the Methodist Home now seeks to keep at least two state legislators on the board, as well as influential county-level leaders. “They bring influence and relationships and insights,” McAleer explained. “If I was going to tell you the two keys to the success of The Home, it’s leadership and relationships. Money follows relationships.” At other organizations, the board’s role is more focused on building secondary private sources. For Larkin Street Youth Services, a Bay Area nonprofit that serves homeless, runaway, and other at-risk youth, the board provides a link to other supporters in the community. The organization worked to promote a strong board “culture of giving,” which now underpins the board’s involvement in creating and executing fundraising events. As one board member told us, “It’s compelling to have the board as part of the face of the organization, where people can see that they’re volunteering their time and putting their reputations on the line.” The organizations in our study that managed to grow to this size without such active support from the board found the path incredibly difficult. A leader from one youth-serving organization that had not evolved its board’s composition or expectations, reflected, “I wish I had been more aggressive with the board earlier,” underscoring the importance of making deliberate decisions about who should be on a board and determining what they should and should not do.

|

The Role of Foundations Very few organizations in our study broke through to $10 million to $30 million in sustained annual revenue by focusing on foundations as a primary source. The few that did, including Oceana, were fairly new organizations. Nearly every senior leader we interviewed acknowledged that foundations are generally more interested in funding catalytic new programs than ongoing operating support. These organizations planned ahead to replace foundation dollars with other forms of support before the funding ran dry. Those that continued to generate funding from foundations were generally able to pitch new programs or innovations to sustain foundation support beyond the first few years—sometimes the same set of foundations and sometimes a new set. |

A strong development staff is usually needed to support the changing roles of the executive director and the board. As development needs grew beyond what the executive director and board had capacity to execute, these organizations sought to implement structures to share responsibility for fundraising. They invested in dedicated development capabilities and strategically hired staff to home in on their primary and targeted secondary sources.

Oceana is a case in point. Established by a group of large foundations, in 2001, Oceana is the largest international organization devoted solely to protecting the world’s oceans. As the organization grew, the day came when its leader could no longer meet personally with every major donor. A development director became critical to leveraging the efforts of Oceana’s executive director and board, helping to maximize their effectiveness as the face and voice of the organization while taking on the day-to-day responsibility of meeting with the bulk of donors and potential donors. This role generally goes from “nice to have” to essential as the level of funding an organization requires grows.

Lining up funding for these new development roles was often a great challenge. Leaders we talked to faced a constant tension between investing in the professional capabilities they often desperately needed and funneling more resources toward programs. The experience of Tejano’s CEO and founder was common among this group: “We hired our first development officer as soon as we felt we could afford one. We always knew we needed one, but those funds are hard to come by.” But these leaders saw the investment as critical to success. Rare, an international conservation organization, added a senior staff role when the executive director concluded that his personal relationships couldn’t continue to drive funding and that he needed someone who could focus full-time on propelling Rare’s funding strategy.

Breaking through the Funding Wall: Committing to Evolving a Funding Strategy over Time

Building the right development team is not the only change fast-growing nonprofits make to sustain growth. The funding strategy itself may need to evolve over time. While there are myriad ways for nonprofits to raise several million dollars a year, the number of options decreases as the revenue target increases. Growing organizations reach a stage where they must evaluate the extent to which their current funding strategy will let them keep expanding. Many of the nonprofits in our study hit a funding wall—in other words, a point beyond which they could not grow significantly with the same funding strategy.3 To continue to grow, they needed to find a way to break through this wall. For many nonprofits this can be difficult, as it may mean laying the groundwork for a new development approach—potentially meaning different people and different skills—with the understanding that a new approach may not bear meaningful fruit for years. In an era of shrinking dollars, such patient, long-term investment in a development strategy can feel risky. But for those who face a funding wall, such a trade-off may be necessary in order to continue to grow to their intended size.

Circumventing a funding wall is almost certain to involve adopting a new funding model—a methodical and institutionalized approach to building a reliable revenue base that will support an organization’s core programs and services. 4 While not necessary on a small scale (where less structured approaches often work), funding models become essential to sustainability as organizations get larger. Some nonprofits design and implement their first funding model comparatively early along their growth curve. Among the organizations we studied, this was most common among youth organizations, which have only to survey the field to see that most of their large peers are getting the bulk of their revenue from government. The Children’s Bureau took this path, building on early government support with an expanding set of contracts and grants. Others are able to grow for a number of years using more idiosyncratic approaches.

A nonprofit’s first funding model may not be its last, however. Several of the organizations in our study have peered into the future and do not see their current models sustaining the growth they seek. Rare topped $10 million in annual revenue with a focus on high-net-worth individuals in several parts of the world. But experience and research told the organization’s leadership team that a funding wall was looming that would impede its programmatic ambitions to support conservation efforts in many more countries. Simply put, there were not enough international high-net-worth conservation enthusiasts out there whom they could enfranchise. In light of this assessment, Rare will pair ongoing cultivation of high-net-worth individuals with the pursuit of a new funding model rooted in public funding that is expected to become the organization’s core engine over time. The leadership team, however, has accepted that developing this new engine will take time.

Like Rare, Oceana is also pursuing a funding transition. As a relatively young organization, Oceana still depends largely on support from foundations, corporations, and high-net-worth individuals, many of whom have strong board relationships and have contributed to founding the organization. Bettina Alonso, vice president of global development, anticipates an inflection point. As she explained, “I’m concerned about hitting the ‘ceiling’ with traditional foundations. Less than 1 percent of the whole of environment funding goes to oceans. I don’t think I can get to $50 million via marine-focused foundations and corporations. Without a doubt, individuals are the source that will take us to $50 million. We plan to focus there.”

Now, it might be reasonable to ask why Rare is shifting away from a heavy reliance on high-net-worth individuals at the same time that Oceana is seeking to fund its desired growth by shifting toward individual giving. In fact, funding models are not cookie cutters—stamping out the desired result every time. A match between funding model and mission is essential. Rare has been targeting a relatively narrow niche—individuals who want to help fund conservation projects abroad; the difficulty is that the majority of U.S.-based environmental enthusiasts prefer to give to organizations that support areas that are personally connected to them. Oceana believes that its focus on the ocean, which most contributors personally connect with, and the sea turtles, sharks, dolphins, and other creatures it contains—not to mention an impressive roster of celebrity supporters— will prove appealing to a wider range of potential individual givers.

While the need to branch out from original funders at a relatively early stage is more common, those transitions can sometimes occur when the organizations are quite a bit older. CEO Earl Martin Phalen’s approach to the future of Reach Out and Read, now in its third decade, illustrates this point. The organization, which improves child (age birth through five) literacy by partnering with doctors to prescribe books and encourage families to read, has grown to $12 million by raising federal funds to purchase new books. But Phalen sees greater potential in local communities than in government, given the nature of Reach Out and Read’s work and the success of other organizations with a similar model, so he is shifting the organization’s focus. The nonprofit is transitioning to a funding model centered on community-based funding—emphasizing parental support of early education, building brand recognition, and seeding regional fundraisers in major cities throughout the United States.

The organizations that want to remain on the path to growth will experience ever-narrowing options to reach the next level. Some with highly scalable funding models will succeed by continuing to hone their current funding model. Others will need to anticipate a funding wall, identify a new funding model that will allow them to break through, and lay the groundwork to make a transition to that new model. Like Phalen’s experience, this can be a difficult and slow process that requires patience, but the trade-off may be necessary to keep an organization’s growth on a strong and realistic path.

Getting Strategic about Getting Bigger

“Don’t make money your goal,” Maya Angelou once said. “Instead, pursue the things you love doing, and then do them so well that people can’t take their eyes off you.” In the ideal world, funds would flow freely to the organizations that had done their work so well that they were having a real impact on the people and communities they served. Tejano’s Richard Farias, who got into nonprofit work because he wanted to do things for children and families, wouldn’t be devoting most of his working hours to a capital campaign. Nor would Oceana’s Bettina Alonso, who has spoken to us about “a distress that the funds are never enough for the work we would like to do.”

In this not-so-ideal world, nonprofits need a methodical funding strategy—and perhaps a good dose of good fortune—if they want to grow. Like the other organizations profiled in this article, Oceana has been among a select few that have managed to grow rapidly over the past decade. It has done the things that most of the other fast-growing nonprofits we studied have done—cultivated a primary type of funding, built the team and practices to match its funding model, and continued to evolve its strategy as it grows.

* * *

The organizations discussed here started in widely different places, and their journeys have varied considerably. What they have in common is their remarkable growth—which has carried The Door a long way from its rent-free storefront in Greenwich Village, the Tejano Center for Community Concerns a long way from barbecue plate sales, and Trout Unlimited a long way from those sixteen anglers on the banks of the Au Sable River. Moreover, they have also embraced a common set of practices for funding growth. While a nonprofit can be founded with little more than a good idea and an energetic leader, funding growth requires commitment, thoughtful planning, and the willingness to make difficult decisions along the way. Growth in the nonprofit sector is rarely smooth, but the lessons highlighted here may provide inspiration and direction for organizations with ambitious growth aspirations.

NOTES

- William Foster, Ben Dixon, and Matt Hochstetler, “In Search of Sustainable Funding: Is Diversity of Sources Really the Answer?” The Nonprofit Quarterly (Spring 2007): 26–29.

- Ibid. See also William Foster and Gail Fine [Perreault], “How Nonprofits Get Really Big,” Stanford Social Innovation Review (Spring 2007): 46. The pattern of revenue concentration resonates with lessons learned in these two studies: nearly all organizations over $50 million cultivate a single primary revenue source closely aligned with program goals, with that source typically comprising 90 percent or more of total revenue. These large nonprofits tend to benefit from a certain level of stability that comes with scale. They have developed the reputation and relationships needed to generate the vast majority of funding from their primary source, and the confidence to know that this funding is generally reliable. Many of the midsize organizations we studied were on their way, but not quite there, at this point.

- The concept of the funding wall was first introduced in Foster, Dixon, and Hochstetler, “In Search of Sustainable Funding.”

- See ibid for more on the concept of a funding wall. For more on the concept of a funding model, see William Foster, Peter Kim, and Barbara Christiansen, “Ten Nonprofit Funding Models,” Stanford Social Innovation Review (Spring 2009): 33–39.